Compared to in the US and New Zealand, inflation expectations in Australia have remained subdued partly due to the extended lockdowns in NSW and Victoria, which have suppressed economic activity and wage inflation.

The reopening in NSW and Victoria is currently happening when energy prices are rising, and supply constraints are evident. An expectation of higher domestic inflation is a crucial reason behind the selloff in the Australian front-end rates curve in recent weeks.

To the point, the Australian interest rate market is pricing in a similar amount of RBA hikes as the Federal Reserve by the end of 2022, challenging the RBA's dovish rhetoric and its 0.1% Yield Curve Control target on the April 2024 bond.

Tomorrow's CPI data is thus shaping as a tipping point that will go a long way to justifying the rates markets shift towards earlier RBA rate hikes or prompt dovish realignment with the RBA's more cautious outlook of the economy.

For the record, the market expects headline CPI to increase by 0.8% q/q and 3.1% y/y. While the core measure, trimmed mean, is expected to increase by 0.5% q/q and 1.8% y/y.

A higher than expected inflation print would likely prompt some selling in the ASX200 due to the possibility of earlier RBA rate hikes. On the other hand, a softer number would be supportive of the ASX200’s current grind higher.

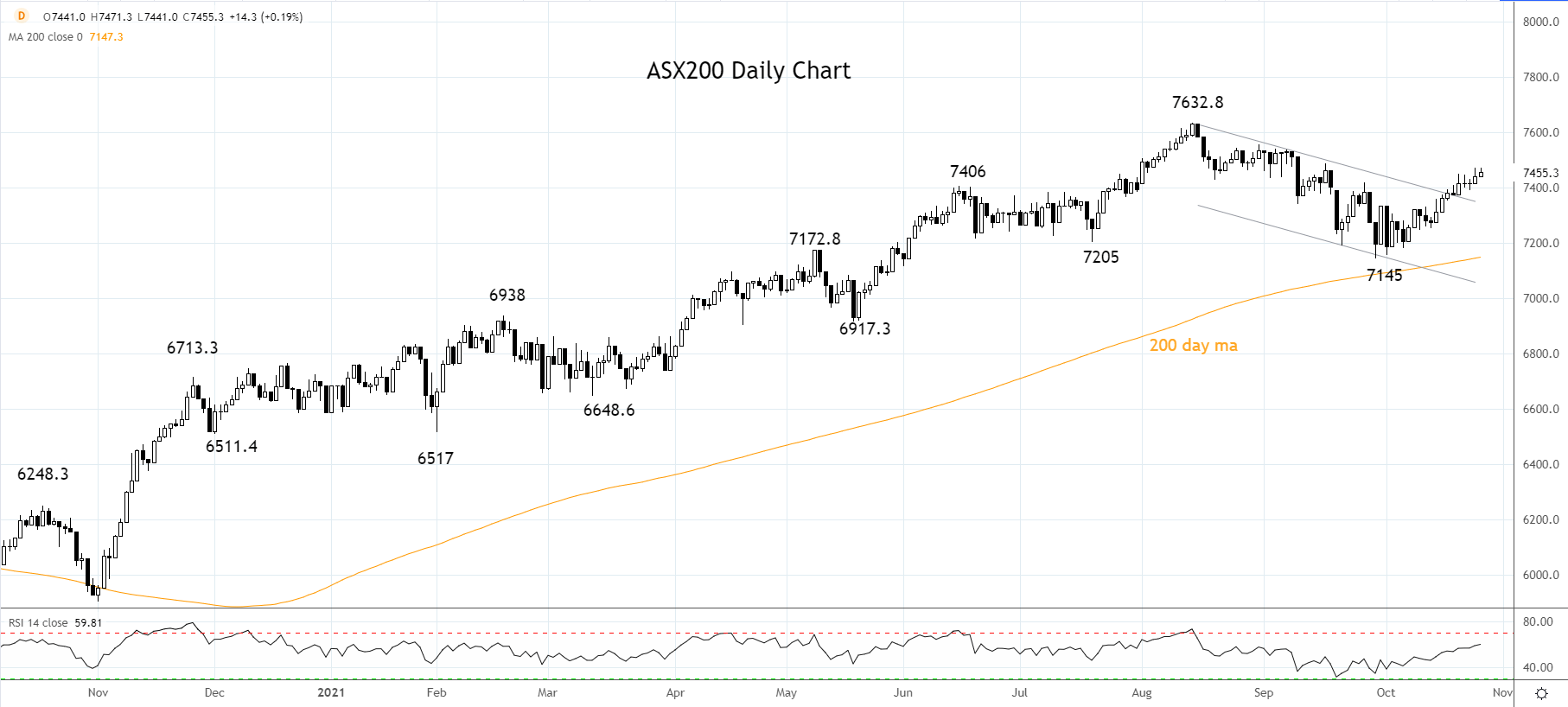

Following last week's break above trend channel resistance at 7400, the view is the correction from the August 7632.8 high is complete at the 7145 low.

Providing the ASX200 does not retrace back below short-term support at 7340/20, a bullish bias is in place, looking for a retest and break of the August 7632.8 high, with scope towards 7750 into year-end.

Source Tradingview. The figures stated areas of October 26th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.