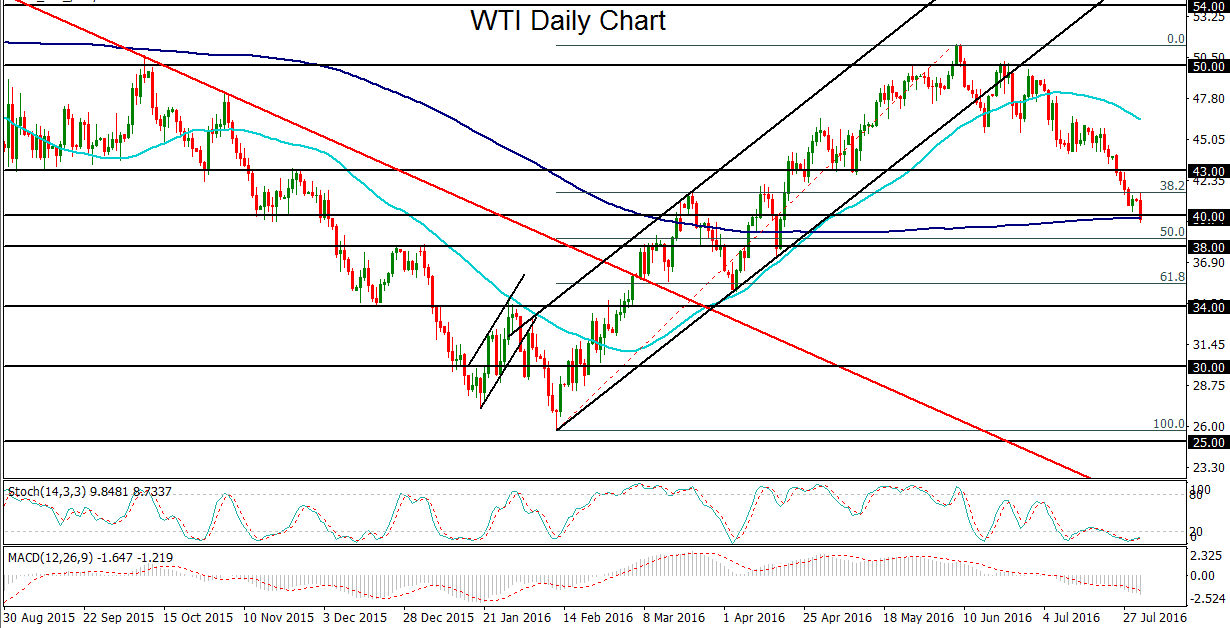

Crude oil prices continued to fall precipitously on Monday, with the West Texas Intermediate (WTI) benchmark for US crude dropping below $40 per barrel for the first time in more than three months. Monday’s fall extends the sharp downtrend that has been in place since the $51-area highs of June.

WTI extended this downtrend on Monday as persistent concerns over the crude oil oversupply situation were compounded by a survey reflecting record-high output by OPEC nations last month. Also weighing on oil prices was data that revealed the US oil rig count had climbed by 44 rigs in July, the highest monthly increase in over two years.

Having tentatively dipped below the key $40 price level on Monday, WTI has reached a critical technical juncture. A strong drop below this level could open the path to significantly further losses as major oil producers continue to raise production and compete for market share.

Also around the noted $40 level is the key 200-day moving average, which crude oil has not traded below since April. This moving average may serve as a major “line in the sand” for WTI, especially as it currently coincides with the important $40 level.

With further downside follow-through on the tentative breakdown below $40 and the 200-day moving average, the next major downside targets are at the key $38 and $34 support levels.

WTI extended this downtrend on Monday as persistent concerns over the crude oil oversupply situation were compounded by a survey reflecting record-high output by OPEC nations last month. Also weighing on oil prices was data that revealed the US oil rig count had climbed by 44 rigs in July, the highest monthly increase in over two years.

Having tentatively dipped below the key $40 price level on Monday, WTI has reached a critical technical juncture. A strong drop below this level could open the path to significantly further losses as major oil producers continue to raise production and compete for market share.

Also around the noted $40 level is the key 200-day moving average, which crude oil has not traded below since April. This moving average may serve as a major “line in the sand” for WTI, especially as it currently coincides with the important $40 level.

With further downside follow-through on the tentative breakdown below $40 and the 200-day moving average, the next major downside targets are at the key $38 and $34 support levels.

Latest market news

Today 02:05 PM