While most have been willing to look at higher inflation as a phenomenon of the reopening and supply and labour bottlenecks, a sharp rise in energy prices is kicking inflation higher again and prompting second thoughts.

The pain of the energy crises and rising prices is being felt most acutely in Europe. However, prices have also increased in the US and Asia as higher oil and gas prices are passed onto the consumer.

Evidence of the concern this is causing central banks in Asia, the surprise tightening of monetary policy by the Monetary Authority of Singapore (MAS) yesterday. On Monday next week, attention turns to New Zealand for the release of Q3 inflation data.

Apart from the global inflation drivers mentioned above, inflation in NZ is being fuelled by a strong labour market and rising wage inflation which indicates the risks for Monday's inflation data is to the upside.

For the record, the market is looking for prices to rise by 1.4% q/q, pushing the annual rate above 4% for the first time in a decade. All but guaranteeing the RBNZ will hike rates again in November and the reason why a 25bp hike is 95% priced.

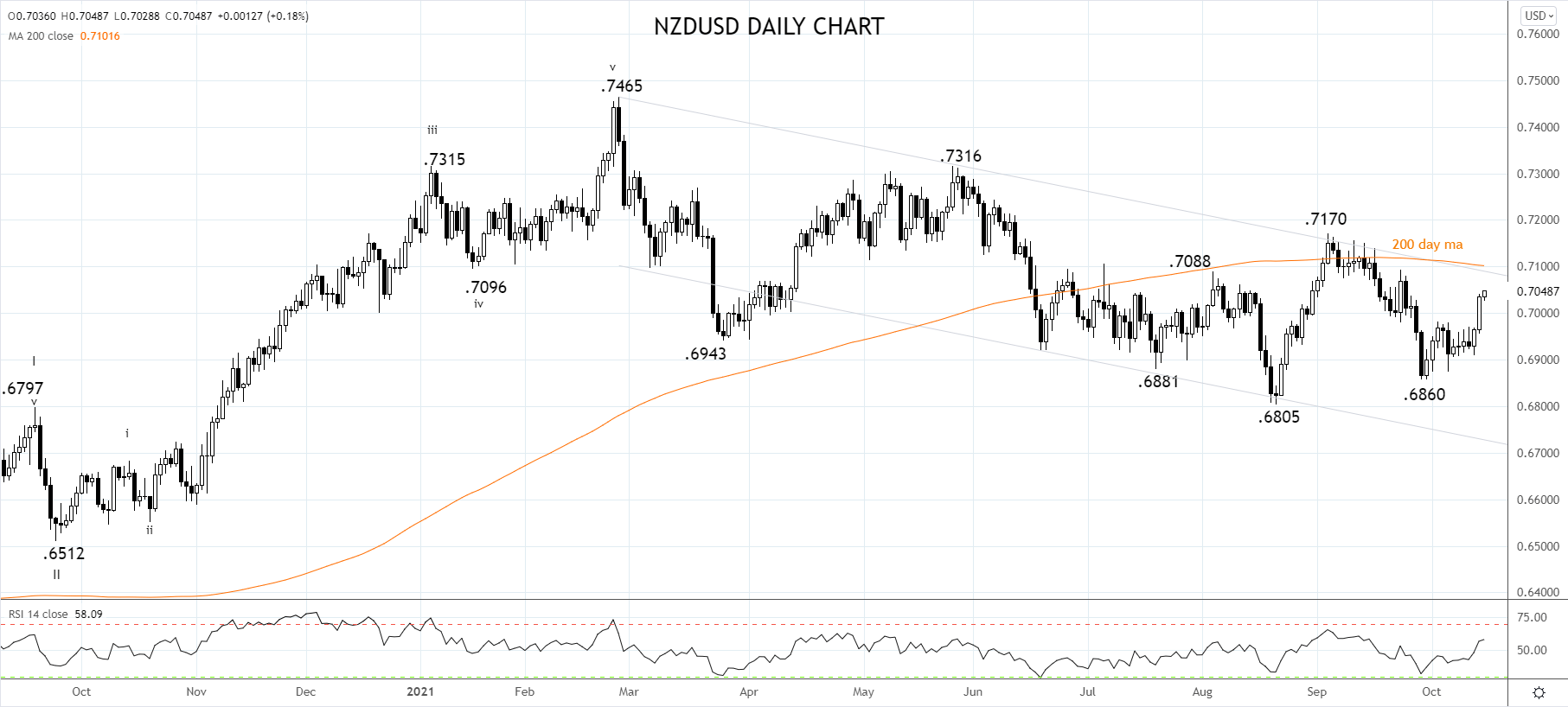

Turning now to the currency. The NZDUSD outperformed overnight, closing 1% higher near .7037. After testing and rebounding from ahead of the bottom of the range .6850/00, the bias is for the NZDUSD to test the solid medium-term resistance coming from the 200-day ma and trend channel resistance near .7100.

Should the NZDUSD break and close above .7100, it would indicate that the correction from the February .7465 high is complete, and the uptrend has resumed towards .7500c.

Source Tradingview. The figures stated areas of October 15th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.