US futures

Dow futures -0.93% at 34794

S&P futures -0.77% at 4617

Nasdaq futures -0.46% at 16318

In Europe

FTSE -0.7% at 7070

Dax -0.71% at 15181

Euro Stoxx -0.7% at 4080

Learn more about trading indices

Vaccine efficacy looks doubtful

US stocks once again set to start sharply lower amid revived Omicron fears, although the futures have picked up off their lows.

The mood in the market soured after Moderna’s chief executive Stephane Bancel warned that current COVID vaccines are unlikely to be as effective against the new Omicron variant. He added that large scale manufacturing of variant specific vaccines.

The revelation has prompted investors to take risk off the table and is in sharp contrast to the rally in risk assets yesterday. There is still a lot of unknowns regarding Omicron so we can expect the market to react strongly as new pieces of information come to light. Volatility is going to be high over the coming two weeks whilst the market pieces together the threat that Omicron poses to the global economic recovery.

Modern’s chief executive wasn’t the only one spooking the markets, Fed Chair Powell also unnerved investors with comments yesterday that Omicron poses a challenge to both of the Fed’s targets – price stability and full employment suggesting that the Fed could well hold off on tightening monetary policy further.

Powell and Treasury Secretary Janet Yellen are due to testify before the Senate Banking Committee.

Banking stocks could come under pressure as expectations of a rate hike cools, travel and tourism stocks in addition to oil majors are all likely to come under pressure.

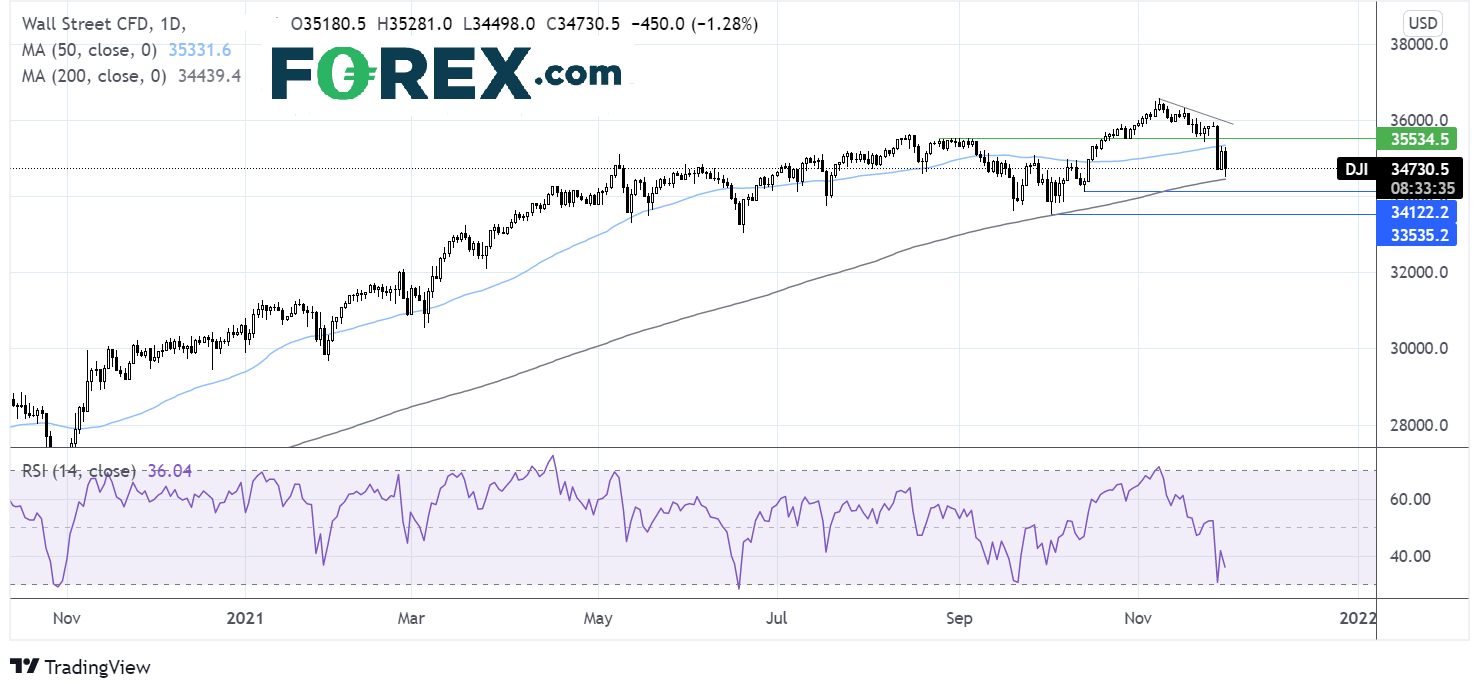

Where next for the Dow Jones?

The Dow Jones is resuming its downward trajectory. The index continues to trade below its 50 sma and found support at its 200 sma at 34430. The 200sma is a pretty key support level which hasn’t been breached since July last year. A close below here would be significant, opening the door to greater losses. It would take a move above the 50 sma at 35331 and the previous resistance at 35500to negate the near term down trend.

FX – USD falls on dovish Fed, EUR rises as CPI hits record high

The USD is falling sharply following Fed Powell’s dovish comments in the previous session which caused investors to push back on expectations of an interest rate rise given the uncertainty surrounding the outlook.

EUR/USD is charging higher thanks in part to the weaker US dollar and thanks to surging inflation in the Eurozone. Eurozone inflation jumped to 4.9% in November a record high, well above the 4.5% forecast and up from 4.1% in October. Higher energy prices and supply chain disruptions were the main contributors to rising prices. Energy is on track for its highest annual rise in November at 27.4%.

GBP/USD +0.16% at 1.3336

EUR/USD +0.56% at 1.1356

Oil resumes decline of lockdown, travel restriction fears

Oil prices are falling, paring gains from the previous session amid concerns that current vaccines won’t protect against the Omicron strain of COVID. Comments by Moderna’s chief executive raising doubts over the vaccine’s efficacy, combined with a warning from Fed Chair Powell that Omicron will slow the economic recovery has clouded oil demand outlook.

The obvious concern is more travel restrictions. However, these could be imposed by governments or quite simply people chose to travel less.

Expectations are growing the OPEC+ put on hold plans to increase oil supply give the uncertainty.

Looking ahead the release of API stock pile data could attract some attention, although Omicron headlines are likely to be the biggest driver.

WTI crude trades -2.5% at $67.94

Brent trades -2.7% at $71.09

Learn more about trading oil here.

Looking ahead

14:00 US Homes Sales

15:00 US Consumer Confidence

15:00 Fed Chair Powell Speech

21:30 API Crude Oil Stock

How to trade with FOREX.com

You can trade with FOREX.com by following these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the instrument you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade