Despite some key Australian news and economic data releases on Tuesday that should have placed increased pressure on the Australian dollar, AUD/USD climbed significantly. This was due in part to the fact that some of this news had already been expected and priced-in, as well as the overriding weakness in the US dollar.

As widely expected, the Reserve Bank of Australia (RBA) cut its cash rate by 25 basis points on Tuesday to a new record low of 1.50%. Also as expected, a primary justification for this rate cut was low inflation. The RBA’s central bank statement read: “recent data confirm that inflation remains quite low” and “given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.” Last week, the second-quarter Consumer Price Index, a key inflation measure, came out in-line with expectations at +0.4%, following the first-quarter’s highly disappointing -0.2%.

Other data was also released on Tuesday in Australia that came out worse than expected, sparking some increasing concerns over the state of the Australian economy. These data releases included the trade balance, which came out at a surprisingly large deficit of -$3.20 billion versus the -$2.00 billion deficit expected, and building approvals at -2.9% against prior forecasts of +0.9%.

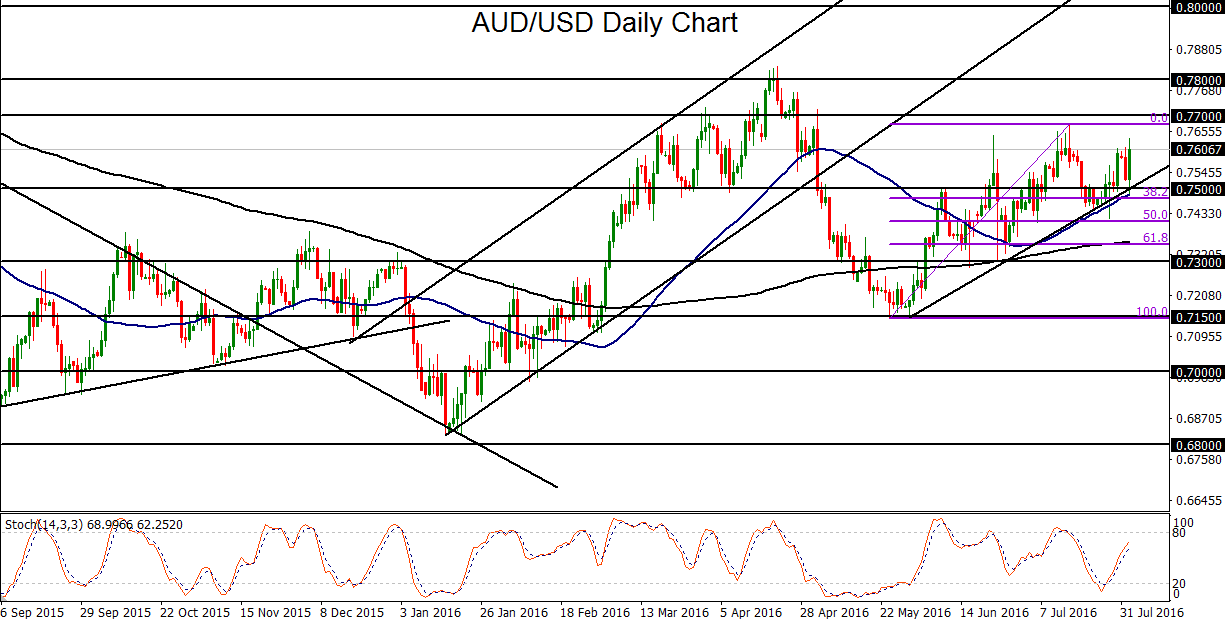

As noted, despite the RBA interest rate action and the pessimistic economic data, AUD/USD surged early on Tuesday due to the expected rate cut having been largely priced-in, as well as substantial continuing weakness in the US dollar. From a technical perspective, Tuesday’s bounce constituted a rebound off both the 50-day moving average as well as a clear uptrend support line that extends back from May’s 0.7150-area lows.

Although AUD/USD has shown some strength in the face of both Tuesday’s RBA rate cut and the specter of further potential rate cuts in the future, the currency pair’s rise could soon face some headwinds with major resistance directly to the upside. Immediately above the current price is July’s 0.7675 high, which is just under major resistance at the 0.7700 level. Further above that is the key 0.7800 resistance level, which represents April’s pivotal highs. If AUD/USD continues to trade below these major resistance levels, the key event to watch for would be a breakdown below the noted 50-day moving average and medium-term uptrend line. In the event of such a breakdown, the next major downside targets are at the 0.7300 support level followed by the noted 0.7150 level.

As widely expected, the Reserve Bank of Australia (RBA) cut its cash rate by 25 basis points on Tuesday to a new record low of 1.50%. Also as expected, a primary justification for this rate cut was low inflation. The RBA’s central bank statement read: “recent data confirm that inflation remains quite low” and “given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.” Last week, the second-quarter Consumer Price Index, a key inflation measure, came out in-line with expectations at +0.4%, following the first-quarter’s highly disappointing -0.2%.

Other data was also released on Tuesday in Australia that came out worse than expected, sparking some increasing concerns over the state of the Australian economy. These data releases included the trade balance, which came out at a surprisingly large deficit of -$3.20 billion versus the -$2.00 billion deficit expected, and building approvals at -2.9% against prior forecasts of +0.9%.

As noted, despite the RBA interest rate action and the pessimistic economic data, AUD/USD surged early on Tuesday due to the expected rate cut having been largely priced-in, as well as substantial continuing weakness in the US dollar. From a technical perspective, Tuesday’s bounce constituted a rebound off both the 50-day moving average as well as a clear uptrend support line that extends back from May’s 0.7150-area lows.

Although AUD/USD has shown some strength in the face of both Tuesday’s RBA rate cut and the specter of further potential rate cuts in the future, the currency pair’s rise could soon face some headwinds with major resistance directly to the upside. Immediately above the current price is July’s 0.7675 high, which is just under major resistance at the 0.7700 level. Further above that is the key 0.7800 resistance level, which represents April’s pivotal highs. If AUD/USD continues to trade below these major resistance levels, the key event to watch for would be a breakdown below the noted 50-day moving average and medium-term uptrend line. In the event of such a breakdown, the next major downside targets are at the 0.7300 support level followed by the noted 0.7150 level.

Latest market news

Today 02:05 PM