Europe’s benchmark index will almost certainly keep swinging sharply for the foreseeable future, as signs of resilience are repeatedly undermined by interminable trade brickbats.

- For now, EU stock investors are going for their first consecutive week of upside since early July amid reports that China has again backed fiscal stimulus talk with measures to boost consumption

- European car shares are at the front of the latest advance. They’re reacting to Beijing’s fresh guidelines aimed at making it easier to buy new cars, including incentives for electric vehicles purchases

- That’s promising of course, but any hoped-for benefit won’t offset damage already done to Europe’s export-underpinned economy by trade disputes and other long-standing pressures. Such hits were underlined by data showing German shipments slumping 1.3%, the most in six years. That helped pin Europe-wide GDP in negative territory with a -0.1% print in the second quarter

- In turn, Italy’s ‘will-they-won’t-they-scenario’ is beginning to resemble the China-U.S. ‘they-probably-won’t’ situation. As such, prospects of a new coalition government excluding far-right deputy prime Minister Matteo Salvini look increasingly distant. This, along with the almost inscrutable position of what’s really going on in Washington’s negotiations with Beijing suggests buyers will not chase optimistic bounces very far

In other words, hope may spring eternal, but in the meantime, there is little chance that a recent sell-the-rip bias will switch back to a buy-the-dip one soon.

At least not before

- the White House makes measurable progress in its strategy of forcing China into making a deal, or

- accounts of talks progress become more convincing to investors.

In lieu of one of those possibilities becoming manifest, shares in Europe and indeed globally, will remain on the roller-coaster seen over the last few months.

- MSCI’s All-Country World Index traversed a range of some 45 percentage points between the end of April and the middle of this month though clings to a rise for the year of about 10%

- Likewise, the EURO STOXX 50 index is up 12.5% in 2019, after a round trip closer to 50%

- As investors dig into the final quarter of the year amid persisting uncertainty, discontent, and weakening global growth, even a price return of 10%-12% will start to look in congruous and should dwindle further

Chart thoughts

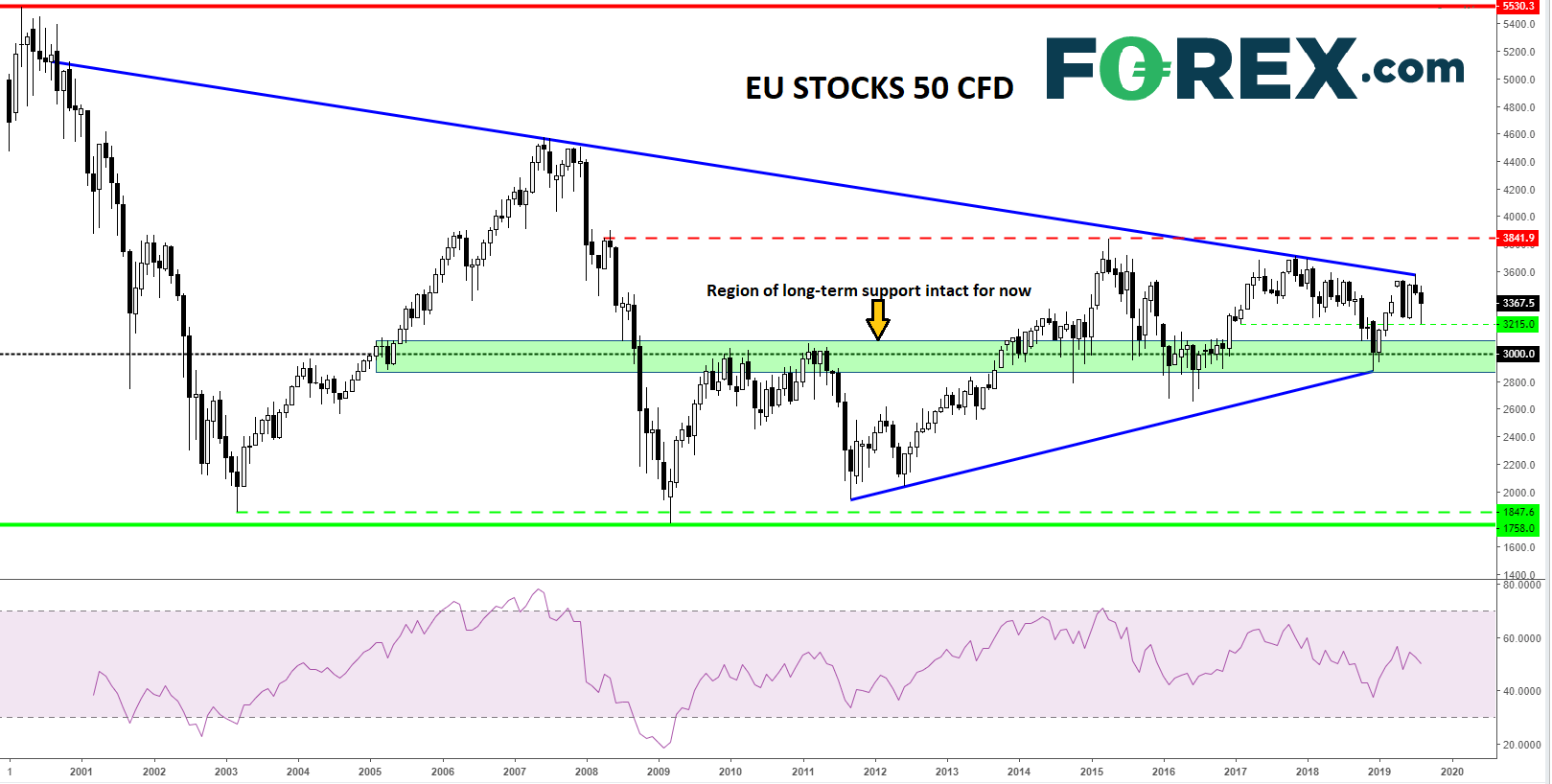

Despite the year’s acceleration of market-implied volatility, EURO STOXX 50 gyrations have remained well above of its pivotal 2875-3100 range. This is important for forward-looking sentiment: the band has been a ‘literal’ pivot for prices since the market’s recovery from the Global Financial crises of 2009 to 2012. As well, the lower bound of the region was the floor of last year’s winter correction. Just as positive, Europe’s rise from sovereign debt crisis doldrums continues, if we judge it by an unbroken rising trendline between late-2011 and late last year.

Yet key negative points include an unmistakeable down line tagged by monthly highs traceable all the way back to 2002. It was validated again in July.

EU STOCKS 50 CFD – monthly

Source: FOREX.com

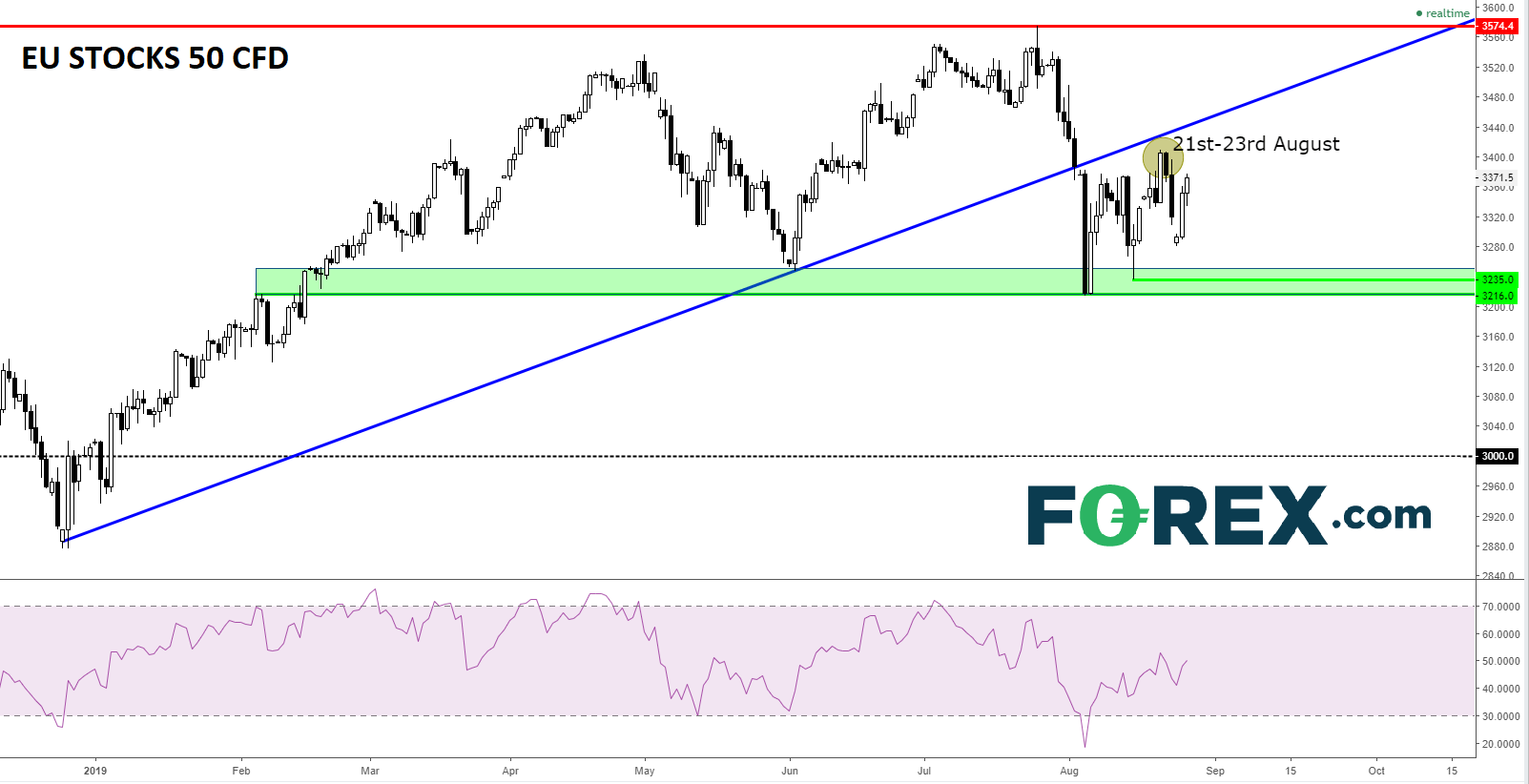

From a more here-and-now view, EU shares could also use some quick wins. The year’s main technical hope—the December/August uptrend has been toast since the beginning of the month. True, support has developed along aggressive daily tops and strongly defended lows between 3216-3225 over February, June and early this month. However, we should expect sellers to sense fresh blood if resistance implied by the loss of momentum below December/August’s trend repels buyers for a second time in coming days. At that point, attention will switch back to apparently solid 3216-3235 support with a vengeance.

EU STOCKS 50 CFD – daily

Source: FOREX.com