Stock market snapshot as of [13/9/2019 5:17 PM]

- Global risk assets are close to notching a third straight week of gains and that’s going hand in hand with increasing momentum in the move to unwind August’s aggressive government bond rally. Sterling, one of the most ‘at-risk’ assets, is sharply extending its rally too as buyers seize on news hinting at a thaw in relations between Brussels and London

- An assured if not spectacular session in New York follows a slightly more assertively bullish one in Europe, reacting to a continuing stream of headlines pointing to what could be a slight dialling down of Washington’s tone over its trade conflict with China. Following Trump’s ‘out of respect’ delay of a tariff escalation initially planned for next month, Beijing confirmed on Friday it would buy a certain amount of U.S. farm products including soybeans and pork from the U.S., contrary to a recent announcement that it would cease such purchases

- Wall Street may not exactly be on a tear on Friday but there’s a strong sense of purpose in the upswing that lifted the recent U.S. laggard index the Dow Jones to its seventh straight day of gains a day ago, in step with a shift in the details of what’s driving market advances. This week as well, investors’ long-standing and deep preference for so-called ‘momentum’ shares has shown signs of transmogrifying into a penchant for ‘value’ shares. It’s early days, though along with a possible ground swell in the revolt against G10 debt, which the ‘value’ signal is linked to, investors will be alert to signs that the shift could take root

Stocks/sectors on the move

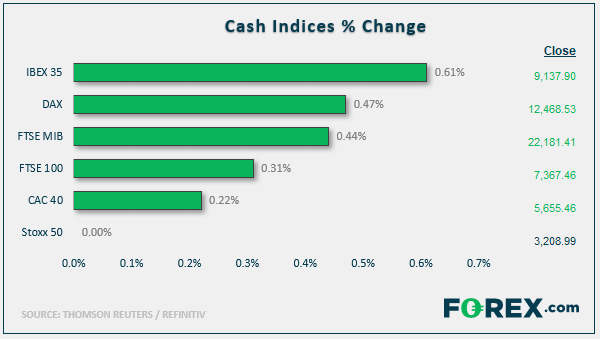

- Europe’s STOXX 600 gauge rose 0.5% with banks solidly in the lead as their sector pushed 1.9% higher. It’s been a volatile couple of days for big bank stocks. They shot higher in the minutes following the European Central Bank’s QE relaunch and deeper cut into negative rates, only to cede gains and even slump shortly afterwards. As investors absorb the details of the ‘tiered’ exemption arrangements for negative bank rates—approaching €1 trillion euros may be eligible—anxieties on the possible effects on banks over the ECB’s open-ended easing path are lifting

- The S&P 500’s Financials sector is also out near the front together with Materials, on the back of a strong lift for base metal miners’ shares, with a 5% jump by Freeport-McMoRan standing out. Its Indonesian unit said it received permission from authorities there to ship up to 700,000 tons of copper concentrate up until March 2020, far above the 198,000 tons previously announced

- Technology continues to be the broad industrial grouping that’s losing out of the stock index rebound. Apple is the leader of the downside by market weight falling 2%, somewhat correcting a benign reaction to new iPhones and other products announced earlier this week. Broadcom, the China-focused chip maker, also drops hard, losing 3% on disappointing Q3 results. The group said it’s not seeing much sign of a rebound even though “demand has bottomed out”

- The main IPO news of the day is that WeWork now looks set to have one after all. Following a strong push-back by investors on everything from the terms of its planned voting stock, valuation, and governance concerns that threatened to scupper the listing entirely, founder Adam Neumann offered concessions—for instance weaker terms for voting stock—to get the deal across the line. An outside chance remains that opposition from main investor Softbank could yet delay the fast-growing office group from coming to the market this month. WeWork’s IPO valuation has fallen as much as $34bn from initial estimates

FX snapshot as of [13/9/2019 6:00 PM]

FX markets and gold

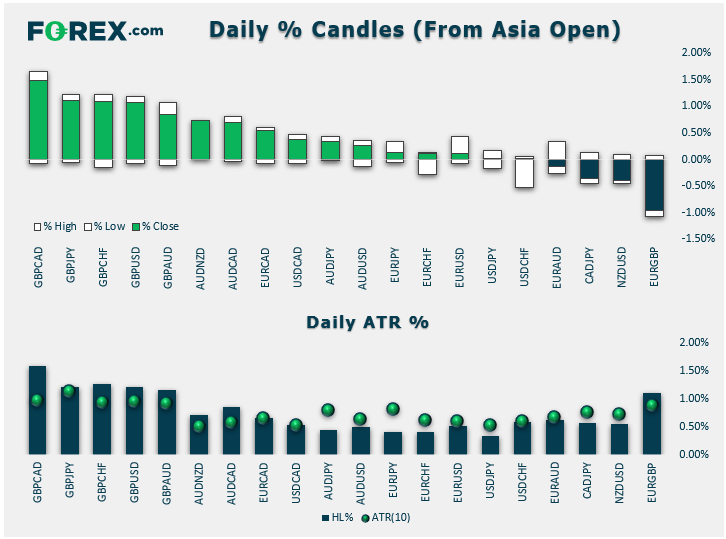

- Sterling continues to star as prospects of a hard Brexit recede, with UK Prime Minister Boris Johnson’s first meeting with European Commission President Jean-Claude Juncker arranged for Monday

- For the euro, signs of a short-term bottom continue to accumulate after a bullish outside day reversal pattern formed following Thursday’s post-ECB volatility, despite continued lower highs and lower lows

- Canada’s loon is among weak majors as the oil supply-demand outlook becomes increasingly uncertain as rising data on U.S. inventories meets OPEC warnings that deeper cuts may soon be necessary

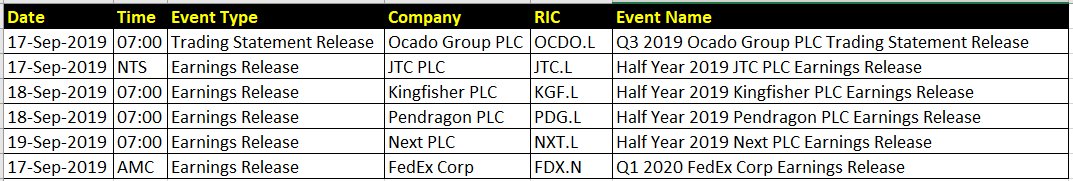

Upcoming corporate highlights

AMC: after market close NTS: no time specified

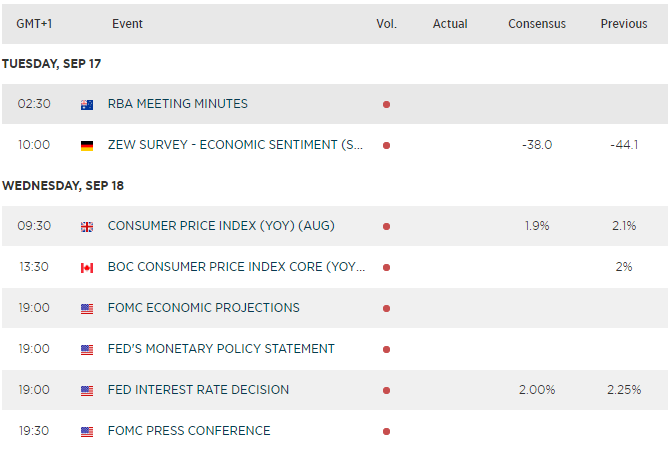

Upcoming economic highlights

Latest market news

Today 02:05 PM