Volatility indicators are creeping higher again too

A six-month high against the euro shows the pound is establishing itself around recent trend highs as markets price out ‘hard-Brexit’ risks even further. Against the dollar, sterling is also elevated, though just eyeing its best levels so far this month. Nevertheless, there’s no mistaking the bolstered confidence of market participants that:

- The outcome of Britain’s general election is becoming easier to predict

- A victory by the Conservative Party – generally regarded as the most business/market-friendly option – continues to be the likeliest outcome

- The chances of a Conservative Party majority are improving in line with the Tories’ incrementally higher poll lead

- In turn, given that MPs last month signalled moderate support for PM Boris Johnson’s Brexit deal (if not his timeline for making it law) rising chances that Parliament’s snarl-up could soon be unsnarled also boost pound sentiment

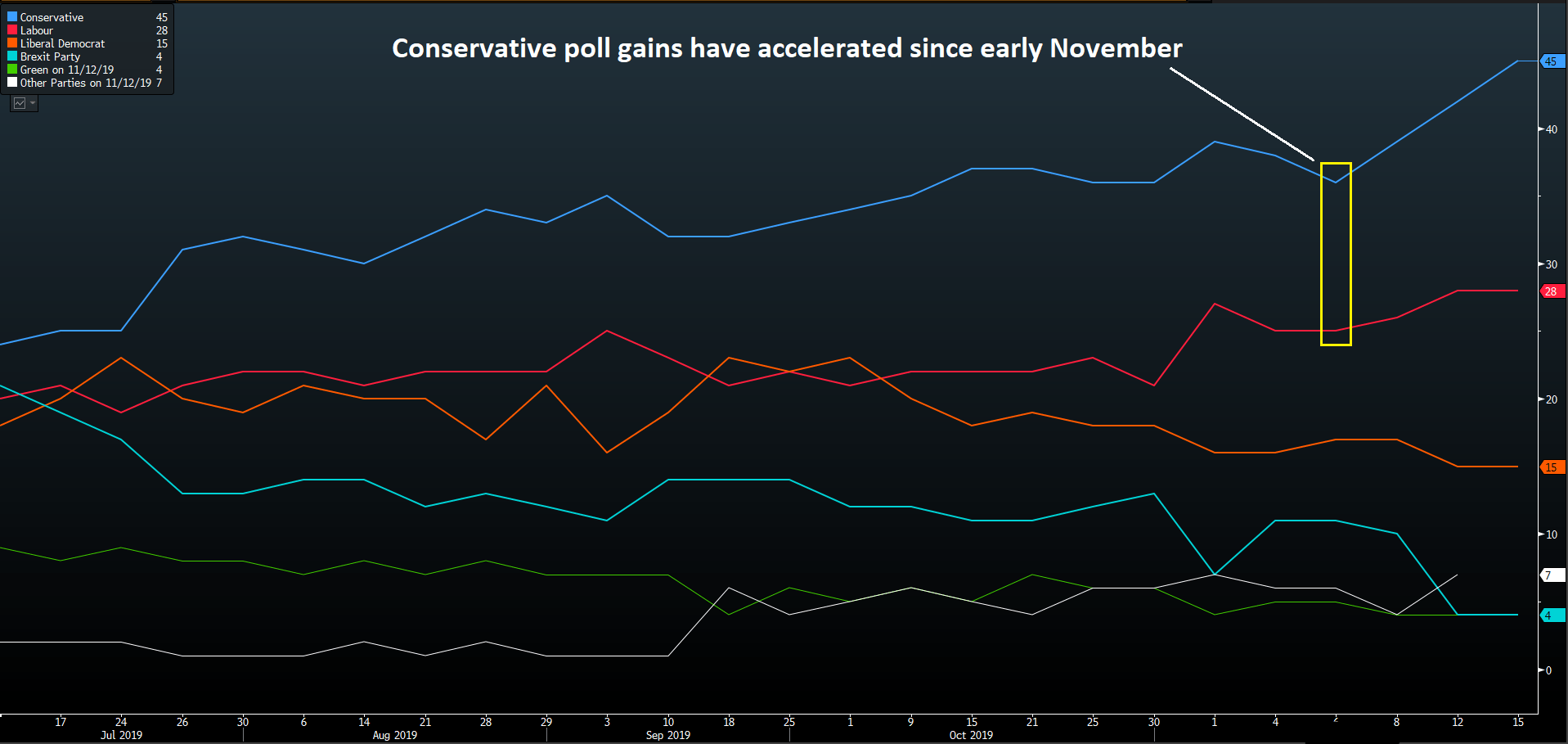

Just like its recent action against the dollar and in other crosses, the pound has stabilised vs. euro in recent weeks. It suggests that although Boris Johnson’s Conservative’s saw their lead narrow early in the month compared to a rising tally for the opposition Labour Party, markets had already begun to discount odds for outcomes other than an incumbent victory.

Source: Bloomberg/YouGov/FOREX.com

In recent days the Tories’ lead has expanded markedly, culminating with 45% of voters saying they would vote Conservative in next month’s election, according to a YouGov poll. The 17-point advantage versus Labour is the highest in the election campaign so far. There’s really no other way for the market to read the lead than ‘even better’.

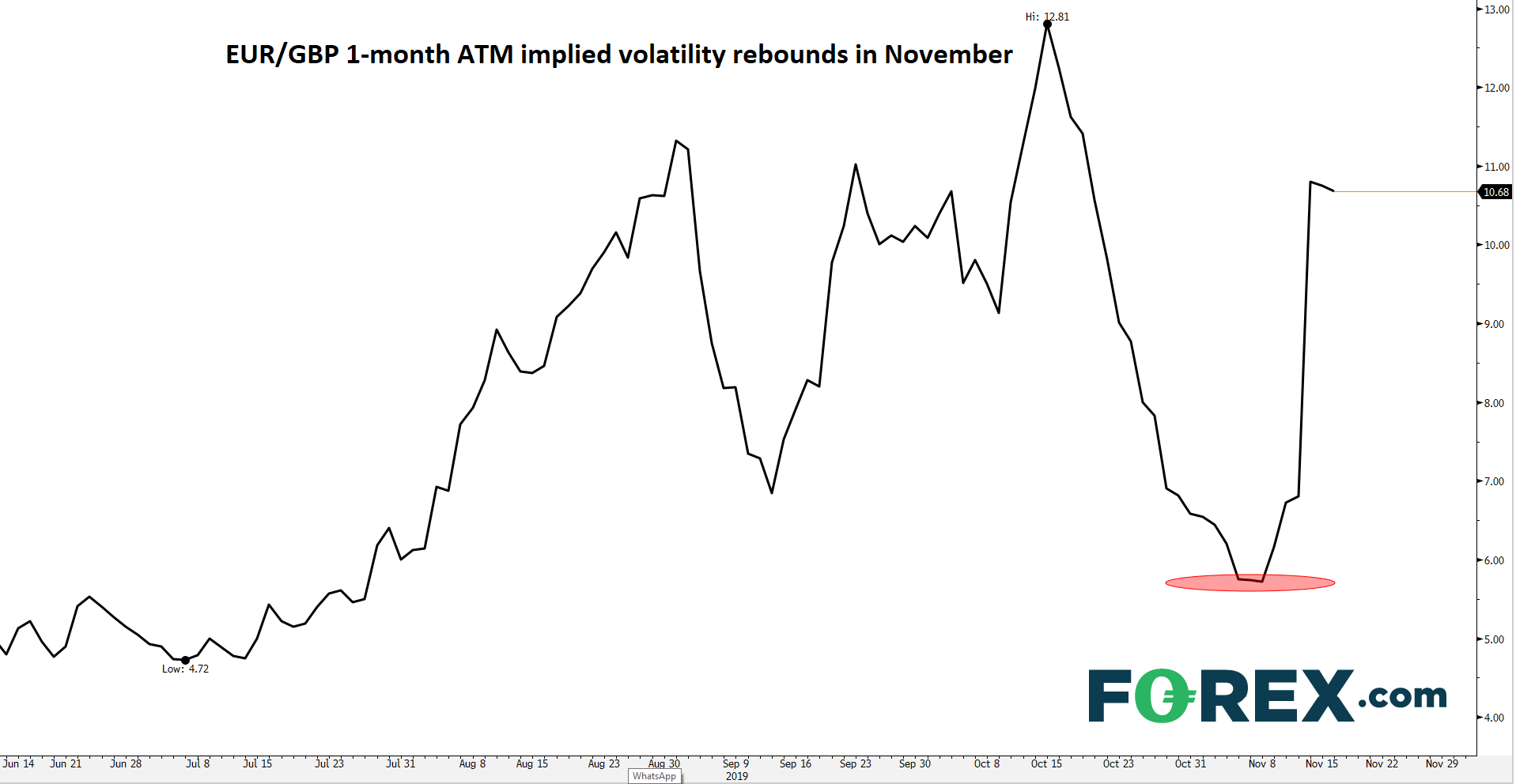

Nevertheless, an election win would not prevent further impasses with Brussels even if Parliament passes Johnson’s deal. He will also need to continue to placate Brexit-supporting Conservative MPs who tactically swung behind the deal whilst remaining keen to reduce alignment with the EU to almost nothing. Likewise, Britain’s economy shows signs of slowing further before any stabilisation, regardless of the election outcome. A ‘sell-the-rumour’ reflex is also suggested by a rebound in sterling implied volatility in trades capturing the 12th December General Election date, as shown below.

EUR/GBP 1-month at the money implied volatility [18/11/2019 15:54:19]

Source: Bloomberg/City Index

This is still a Brexit election, after all. No matter how much more relaxed participants are about the outcome, the market is not letting down its guard entirely. As the pound extends its best run higher of the year to approaching 9% against the single currency from August lows, the need for an improved backdrop beyond the middle of December if gains are to be maintained, is also rising.

Latest key developments

- Results from a Survation poll on Monday: Conservatives – 42%, Labour – 28%, Lib Dems – 13%, Brexit Party – 5%

- Johnson backtracks on a mooted cut of corporation tax, aiming to spend more on priorities like the NHS instead

- Johnson “will keep” Chancellor of the Exchequer, Sajid Javid, if the Tories win

- Jeremy Corbyn confirmed Labour plans to nationalise Royal Mail, railways, water companies, and the electricity grid. The party surprised with a proposal to launch free broadband last week by taking BT’s Openreach unit into government control

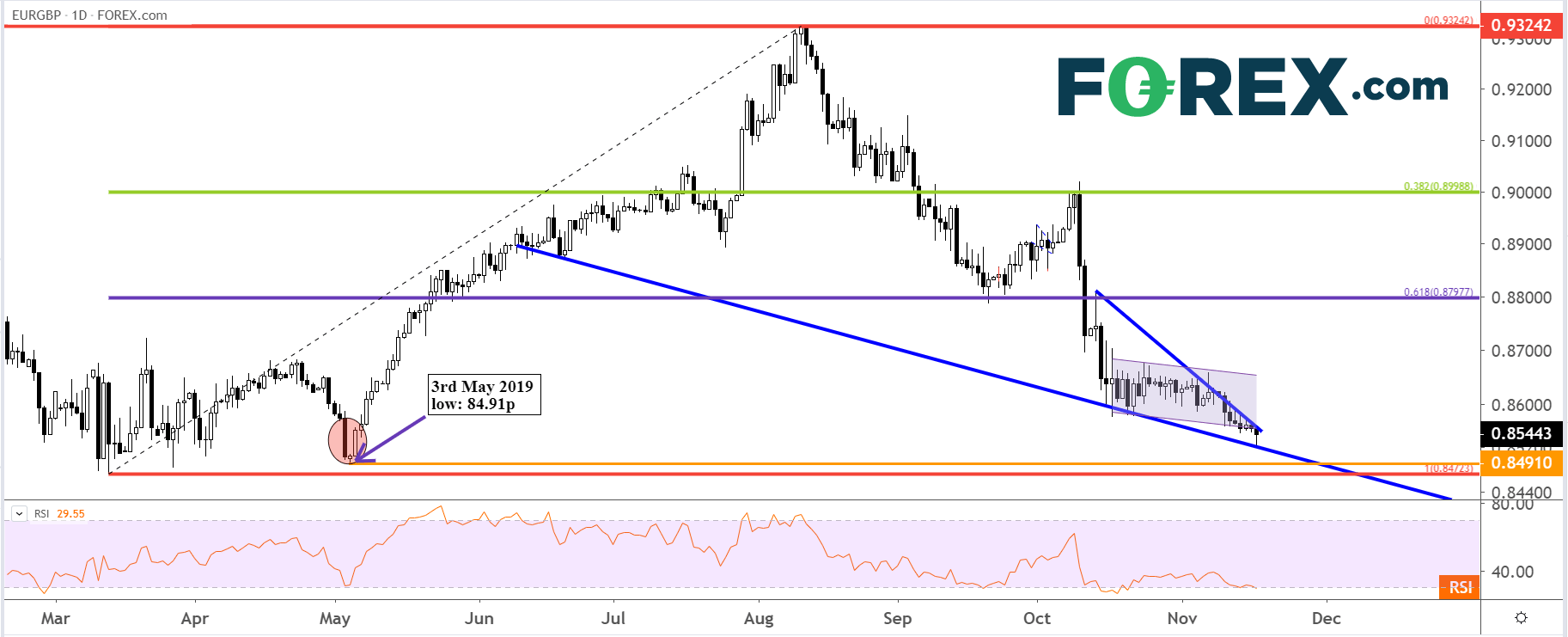

Chart points

The key interest for EUR/GBP’s chart is the break below its one-month flag to test the falling line in place since June. As well as the breach of that medium-term channel, euro is culminating near the end of what is also effectively a very tight wedge. A break out, accompanied by higher volatility is probable. But in which direction? Sellers (sterling bulls) now have the 13th March phase low of 84.72p in sight. It’s their main objective, though 84.91p, the swing low on 3rd May should also trigger a reaction given that it was the launchpad of a 3-month EUR/GBP up leg. As well, RSI momentum is bang on the borders of an ‘oversold’ reading. Given this, and well defended euro lows, right now the pound looks like it may only manage a temporary test lower before recoiling higher. Even then, sterling’s structural bull would remain in place anywhere below the 61.8% retracement of single currency’s summer hike.

EUR/GBP – Daily – [18/11/2019 17:10:48]

Source: FOREX.com