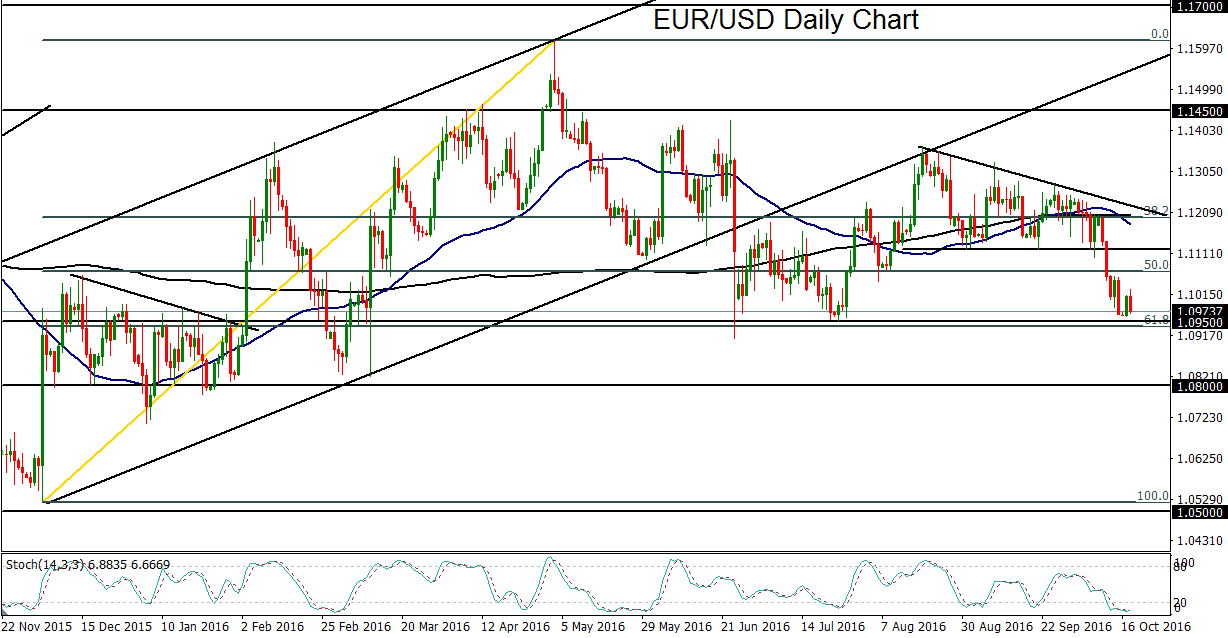

As the US dollar generally remained resilient on Tuesday after having pulled back on Monday, EUR/USD fell back towards major support around the 1.0950 level. Key US inflation data out of the US on Tuesday, in the form of the Consumer Price Index (CPI), met expectations at a +0.3% increase in prices for September, showing the highest rate of inflation growth in five months. The core CPI, however, which excludes food and energy, rose by a lower-than expected 0.1% in September, falling from the previous month’s pace of 0.3%. Despite the miss in core prices, the headline CPI data was relatively strong, suggesting that inflation could approach the Federal Reserve’s target. This data helps to back current expectations for a December Fed rate hike, which have continued to keep the US dollar well-supported in recent weeks and months. In turn, this dollar strength has helped to pressure the recently besieged currency pair, EUR/USD, back down towards its recent lows.

Shifting to the euro side of the currency pair, the European Central Bank (ECB) meets this week and will issue its eagerly awaited policy decision and press conference on Thursday. Currently in the midst of extensive quantitative easing that has weighed on the euro, the ECB will be closely watched on Thursday for any clues that the central bank may extend its asset purchase program after the current program is slated to end in March 2017. If there is any affirmative indication of such an extension, the euro may be further pressured, potentially pushing EUR/USD well below the noted 1.0950-area support. However, the ECB may simply wait until its next meeting in December before announcing its decision on further asset purchases, in which case the euro may extend its range-bound trading. Of course, any other forward-looking signs regarding monetary policy from ECB President Mario Draghi could also have a marked effect on the euro.

With any such sign of further easing measures by the ECB, coupled with continued expectations for a Fed rate hike in December, EUR/USD could be on the verge of a major breakdown below the noted 1.0950 support area. Previously, the past week has seen a sharp breakdown below a major consolidation area above 1.1100. This breakdown quickly followed through to the downside, leading to its current position just above key support. This 1.0950 support area was tested most recently in June and July, both of which resulted in strong rebounds. This time, if the noted ECB and Fed conditions are met, a support breakdown could lead to a near-term downside target around the key 1.0800 support objective.

Shifting to the euro side of the currency pair, the European Central Bank (ECB) meets this week and will issue its eagerly awaited policy decision and press conference on Thursday. Currently in the midst of extensive quantitative easing that has weighed on the euro, the ECB will be closely watched on Thursday for any clues that the central bank may extend its asset purchase program after the current program is slated to end in March 2017. If there is any affirmative indication of such an extension, the euro may be further pressured, potentially pushing EUR/USD well below the noted 1.0950-area support. However, the ECB may simply wait until its next meeting in December before announcing its decision on further asset purchases, in which case the euro may extend its range-bound trading. Of course, any other forward-looking signs regarding monetary policy from ECB President Mario Draghi could also have a marked effect on the euro.

With any such sign of further easing measures by the ECB, coupled with continued expectations for a Fed rate hike in December, EUR/USD could be on the verge of a major breakdown below the noted 1.0950 support area. Previously, the past week has seen a sharp breakdown below a major consolidation area above 1.1100. This breakdown quickly followed through to the downside, leading to its current position just above key support. This 1.0950 support area was tested most recently in June and July, both of which resulted in strong rebounds. This time, if the noted ECB and Fed conditions are met, a support breakdown could lead to a near-term downside target around the key 1.0800 support objective.

Latest market news

Today 02:05 PM

Today 11:59 AM