EUR/USD falls after weak German industrial production

- German industrial production falls -1.2% MoM vs -0.1% forecast

- USD recovers from a 6-week low on hawkish Fed comments

- EUR/USD rebounds lower from 1.0750

Euro USD is falling for a second straight day as the US dollar rebounds from a six-week low and after weaker-than-expected German industrial production figures.

Comments from US Federal Reserve officials, including Minneapolis Fed President Neel Kashkari, have helped to lift the USD. Kashkari said that he believed the Fed had more work to do in order to tame inflation and warned that he did not consider rate hikes to be over.

Looking ahead, the US economic calendar is relatively light, with just the balance of trade figures. Attention will be back on Federal Reserve speakers later, with a slew of speakers due to hit the airwaves, including Fed officials Barr, Logan, Williams Waller, and Jeffrey.

Meanwhile, the euro is coming under pressure after German industrial production fell by -1.2% MoM in September. This was down from a -0.2% decline in August and was a much steeper fall than the 0.1% forecast.

The data comes after the German manufacturing PMI showed a deep contraction in October and suggests that the sector remains under pressure, acting as a drag on the German economy.

Attention is now turning to eurozone PPI data which is expected to show a -12.5% YoY decline after falling -11.5% in September. A steeper decline in producer prices could signal a deteriorating demand environment, which, combined with recent weak growth data, could fuel fears of recession.

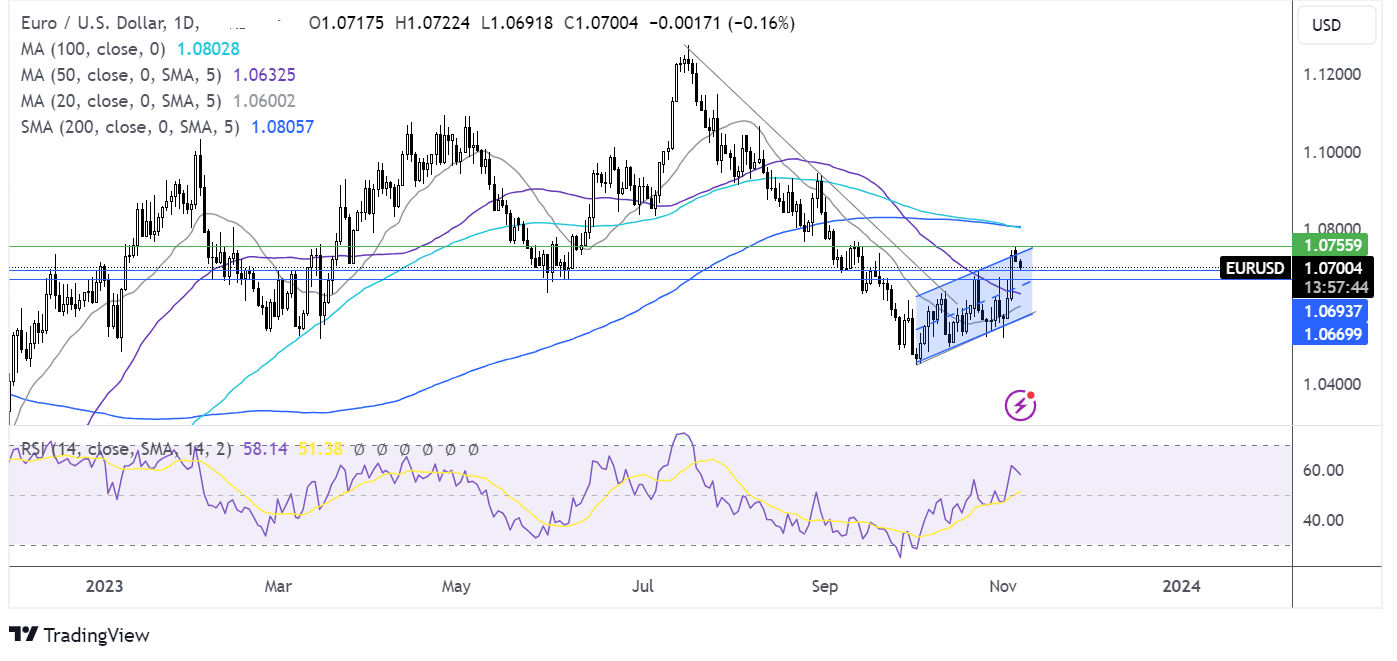

EUR/USD forecast – technical analysis

EUR/USD ran into resistance at 1.0750 and has eased lower, falling back into its rising channel dating back to the start of October.

The price is testing support at 1.0695, the October high, with a break below here opening the door to support at 1.0670 before exposing the 50 sma at 1.0630.

Meanwhile, buyers will need to see a rise over 1.0750 to extend gains and towards the 200 sma at 1.08.

Oil falls below $80 after weak Chinese data

- Chinese exports dropped 6.4% YoY, worse than the -3.3% fall forecast

- API crude oil inventory data is due

- Oil breaks below 80.00 to expose the 200 sma

Oil prices are falling for a second straight day as weak data from China overshadows concerns over supply.

China, the world's largest oil importer, posted worse-than-expected export data, raising concerns over the economy's health. Chinese exports shrank by 6.4% year on year in October, while the country's trade surplus narrowed to its weakest level in 17 months.

The data signals the continued decline in the Chinese economic outlook driven by deteriorating demand in the country's largest export destination - the West.

Meanwhile, on the supply side, Saudi Arabia and Russia reiterated their commitment to voluntary production cuts over the weekend.

Saudi Arabia said that it would stick with its 1 million barrel per day voluntary output until the end of the year, while Russia confirmed that its 300,000 barrel a day cut would remain in place till the end of 2024.

Given weak global demand, OPEC+ is unlikely to be in a rush to reverse oil production cuts when it meets at the end of this month.

Looking ahead, API crude oil inventory data will be in focus after rising 1.34 million barrels in the previous week.

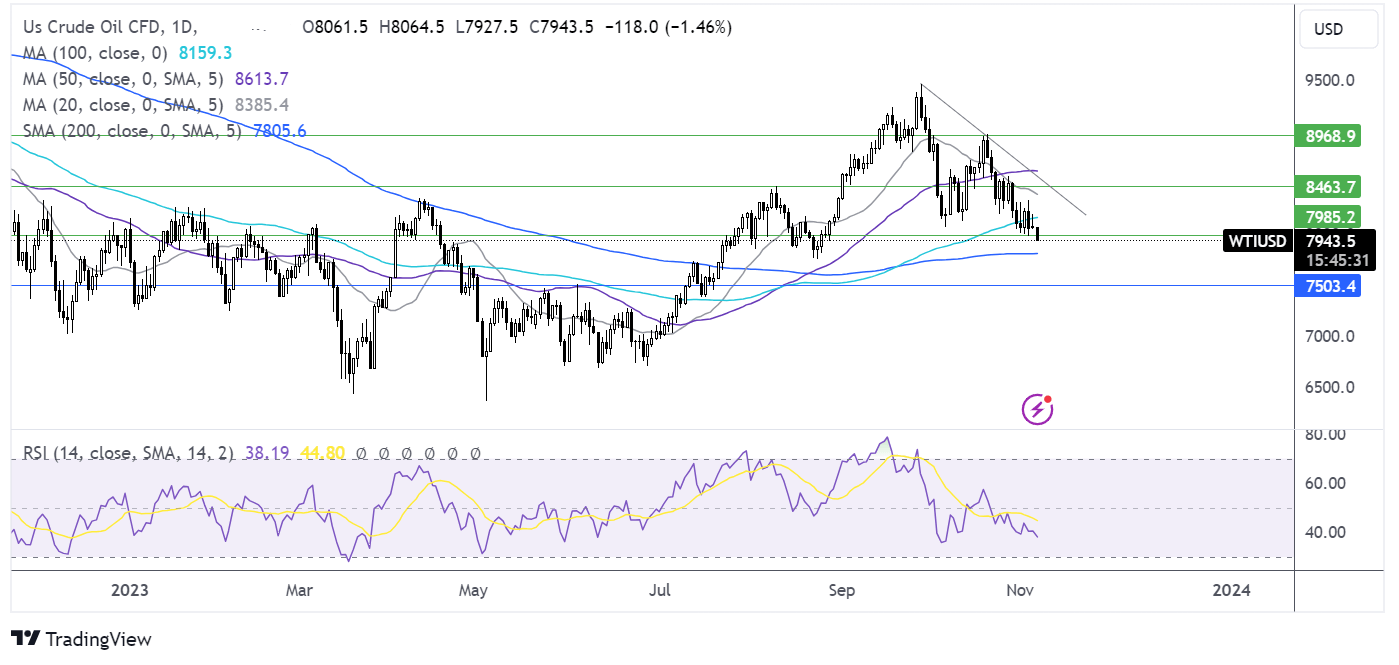

Oil forecast – technical analysis

Oil has extended its decline below the 80.00 psychological level and is falling towards the 200 sma. The break below this key level, combined with the RSI below 50 keeps sellers hopeful of further downside.

Support can be seen at 78.00, the 200 sma, with a fall below here bringing 75.00, the June high into focus.

On the upside, buyers need to rise back above 80.00 to expose the 100 sma at 81.50 and 84.60, the August high. A rise above here could negate the near-term bearish trend.