Since Friday, the West Texas Intermediate (WTI) US benchmark for crude oil has been rebounding from a critical price juncture around the $43 level. This rise has been driven primarily by tentative hopes for an agreement among Russia, Saudi Arabia, and potentially other OPEC members to limit oil production in the interest of steadying crude prices. Also helping to boost crude oil in the past few days has been a weaker US dollar, which has been pressured by diminished expectations of a September Fed rate hike due to a string of relatively weak US economic data since late last week.

Major oil producers are scheduled to confer on a potential output freeze in late September, and the possibility of an agreement being reached then has been helping to support crude prices. Given April’s disappointing meeting in Qatar that failed to produce any agreement, however, this upcoming meeting is on shaky ground, at best. With that said, any semblance of cooperation among major producers like Saudi Arabia and Russia has the potential to further extend the rebound for crude oil, at least for the time being, and especially if coupled with continued dollar weakness.

Thursday brings the weekly report from the US Energy Information Administration concerning US crude oil inventories. For the most part, the past several weeks since late July have overwhelmingly shown significantly larger inventory builds than previously anticipated. Whether or not this trend continues on Thursday will have a marked impact on the current crude oil rebound.

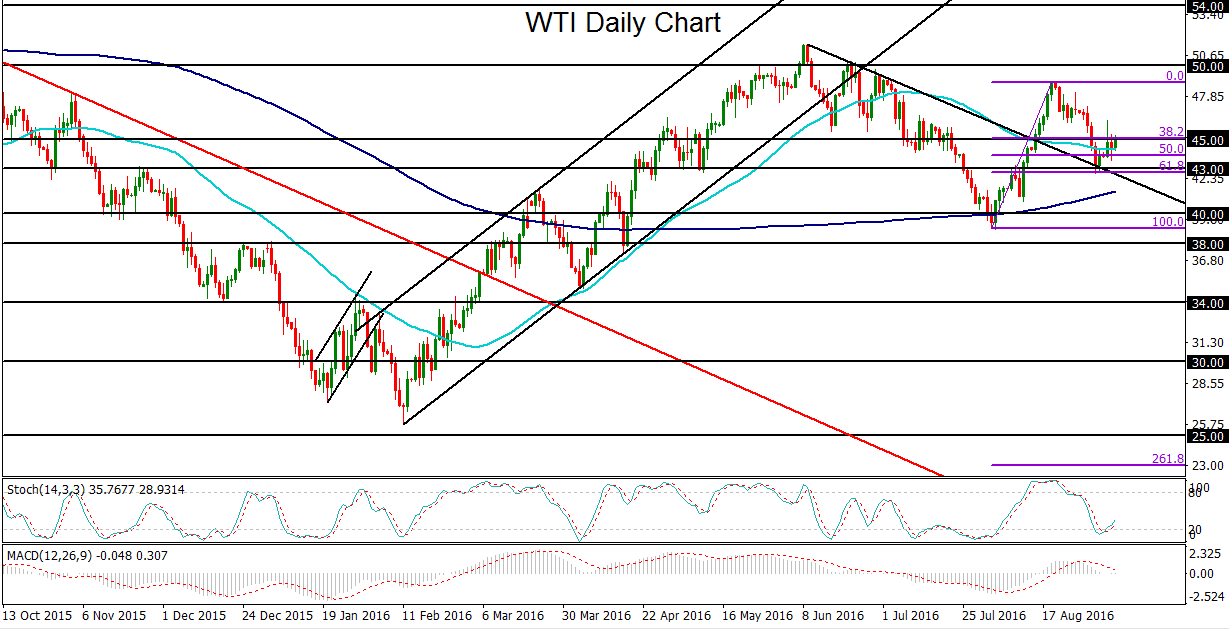

From a technical perspective, the price of US crude oil represented by WTI has rebounded, as noted, off the key $43 support level as of late last week. That price level was also concurrently at a descending trend line extending back to the June price highs, as well as at the 61.8% Fibonacci retracement of the last major rally in August. Therefore, the pullback and rebound were highly technical in nature and could presage an impending extension of August’s rally, as long as price remains above $43 support. In this event, a sustained move above $45 could prompt WTI to begin targeting the $50 psychological resistance level once again.

Major oil producers are scheduled to confer on a potential output freeze in late September, and the possibility of an agreement being reached then has been helping to support crude prices. Given April’s disappointing meeting in Qatar that failed to produce any agreement, however, this upcoming meeting is on shaky ground, at best. With that said, any semblance of cooperation among major producers like Saudi Arabia and Russia has the potential to further extend the rebound for crude oil, at least for the time being, and especially if coupled with continued dollar weakness.

Thursday brings the weekly report from the US Energy Information Administration concerning US crude oil inventories. For the most part, the past several weeks since late July have overwhelmingly shown significantly larger inventory builds than previously anticipated. Whether or not this trend continues on Thursday will have a marked impact on the current crude oil rebound.

From a technical perspective, the price of US crude oil represented by WTI has rebounded, as noted, off the key $43 support level as of late last week. That price level was also concurrently at a descending trend line extending back to the June price highs, as well as at the 61.8% Fibonacci retracement of the last major rally in August. Therefore, the pullback and rebound were highly technical in nature and could presage an impending extension of August’s rally, as long as price remains above $43 support. In this event, a sustained move above $45 could prompt WTI to begin targeting the $50 psychological resistance level once again.

Latest market news

Today 02:05 PM

Today 11:59 AM