We remain bearish on Morgan Stanley (MS) after it reversed at our bullish target at its Dotcom bubble high, and price action suggests it may now produce another leg lower. And the same could be said for FedEx (FDX) now its higher low is in place and it broke out of a bearish flag formation.

Elsewhere, copper futures closed beneath trendline support and gold prices blew through key support, all discussed in yesterday’s video: Is Dr Copper About to Take a Turn for the Worse? (XAU, SPX). The S&P remains beneath its pivotal resistance level, yet its Doji which closed back above the 20-day eMA suggests it may now try to break above that key level and catch up with the Nasdaq at its record highs.

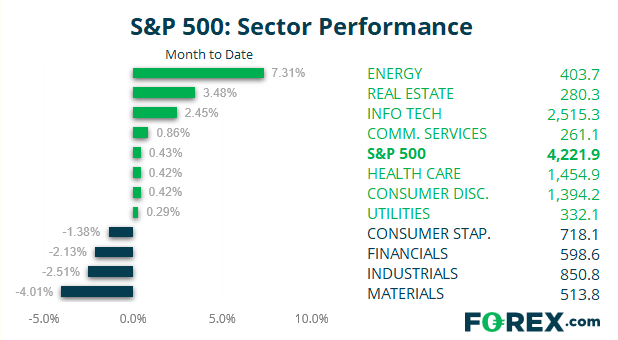

S&P 500: Market Internals

S&P 500: 4221.86 (-0.04%), 17 June 2021

- Information Technology (1.16%) was the strongest sector and Energy (-3.49%) was the weakest

- 7 out of the 11 S&P 500 sectors closed higher (and outperformed the index)

- 181 (35.84%) stocks advanced and 323 (63.96%) declined

- 89.9% of stocks closed above their 200-day average

- 44.16% of stocks closed above their 50-day average

- 36.04% of stocks closed above their 20-day average

Outperformers:

- + 6.56% - Enphase Energy Inc (ENPH.OQ)

- + 5.55% - Advanced Micro Devices Inc (AMD.OQ)

- + 5.04% - Danaher Corp (DHR.N)

Underperformers:

- -7.60% - Occidental Petroleum Corp (OXY.N)

- -7.52% - DXC Technology Co (DXC.N)

- -7.38% - Regions Financial Corp (RF.N)

Keep up to date with market moves and key levels with our daily market analysis videos: