It’s all down to inflation expectations. If they remain elevated, equities are likely to remain under pressure and the dollar could continue to see short covering from its lows. But the Fed are yet to walk back their ‘easy’ approach with inflation, and if they can convince markets they still think inflation is transitory, these trends could quickly reverse.

In today’s video we look at US listed Peleton (PTON), catch up on silver and update our USD/CHF analysis from yesterday.

Update: Ominous Signs Across the Tech Sector

- Bears regained control yesterday, with the S&P 500 breaking beneath key support at 4118.38 to confirm the Nasdaq’s fall to 13,000. Next major support for the Nasdaq is a cluster of lows around 12750.

- Tesla (TSLA) fell to 589.89 and breached the March 30th low. It could now be headed for the lows around the 541-556 support zone, although take note that the 200-day eMA sits at 579.80 and may provide interim support.

- Apple also fell to its lowest level since the end of March, on its way to gap support target at 120.40-121.16. However, yesterday’s inverted hammer warns of potential support around current levels, but our bias remains bearish beneath 126.70. Should prices continue lower, major support sits at 118.86 where the April 1st low and 200-day eMA reside.

S&P 500: Market Internals

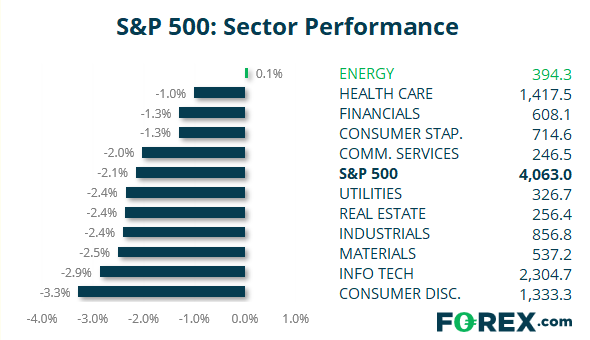

S&P 500: 4063.04 (-2.14%), 12 May 2021

- Energy (0.06%) was the strongest sector and Consumer Discretionary (-3.28%) was the weakest

- 5 out of the 11 sectors outperformed the S&P 500

- 10 out of the 11 sectors traded lower on the S&P 500

- 88 (17.43%) stocks advanced and 417 (82.57%) declined

- 92.08% of stocks closed above their 200-day average

- 59.8% of stocks closed above their 20-day average

Outperformers:

- + 10.8% - NortonLifeLock Inc (NLOK.OQ)

- + 4.82% - Freeport-McMoRan Inc (FCX.N)

- + 3.15% - ServiceNow Inc (NOW.N)

Underperformers:

- -11.9% - HanesBrands Inc (HBI.N)

- -7.89% - Occidental Petroleum Corp (OXY.N)

- -5.90% - Pioneer Natural Resources Co (PXD.N)

Latest market news

Today 02:05 PM

Today 11:59 AM