- GBP/AUD uptrend faces fresh tests from an event calendar laden with risks

- UK employment and PMIs to set the tone for the GBP-leg of the pair

- AUD interest comes from Q3 CPI and two speeches from RBA Governor Bullock

The meandering GBP/AUD uptrend faces a string of big tests over the next 24 hours, potentially influencing the outlook for interest rates from their respective central banks, the Bank of England (BoE) and Reserve Bank of Australia (RBA).

Experimental survey creates outlier risk for GBP

In the UK, employment data and flash PMI readings dominate the economic calendar, providing a potential catalyst that could scupper any remaining risk of a resumption of rate hikes from the BoE ion November.

Traders should expect anything from the employment report given the UK Office of National Statistics (ONS) has been forced to rejig the survey due to increasingly poor response rates. It’s ‘s been described as experimental, increasing the risk the unemployment figure may deviate substantially from the 4.3% level of July.

Thankfully, the separate ‘flash’ composite PMI report should provide more clarity on the true state of the UK economy, providing insights on activity and inflationary pressures in the UK services sector, of far more importance to the BoE monetary policy committee than the smaller manufacturing sector. In September, the final PMI for services came in at 49.3, up from 47.2 in August.

With traders deeming the risk of the BoE delivering another hike next month as negligible, it would likely require an impressive, across-the-board strength to get money markets jumpy about a resumption of the tightening cycle in November.

It doesn’t get much bigger than this for AUD

For Australia, the flash services PMI for October has already come and gone, delivering something of a shocker with activity levels in the nation’s largest and most important sector contracting at the fastest pace this year. Concerningly, inflationary pressures remanded persistent, providing a segway to what will be the main event of the Australian data calendar, Wednesday’s Q3 consumer price inflation (CPI) report.

The RBA looks for its preferred underlying inflation measure – the trimmed mean – will lift by 0.9% over the quarter, meaning anything hotter could elicit a resumption of the RBA’s tightening cycle when the board next meets on November 7. Markets price thar risk at around 30%, with a full 25 basis point hike to 4.35% deemed a lock by May next year.

Providing extra intrigue around the inflation report, new RBA Governor Michele Bullock will speak on Tuesday and Thursday this week. While she may provide a signal on rates later today, I’m more interested to see what she has to say when she speaks before parliamentarians on Thursday.

Two-way directional risks for GBP/AUD

For GBP/AUD, the constant flow of heavy-hitting events has the potential to generate both intraday volatility and change its longer-term trajectory, even with the tricky geopolitical backdrop and persistent concerns surrounding the Chinese economy that continue to work against the Aussie.

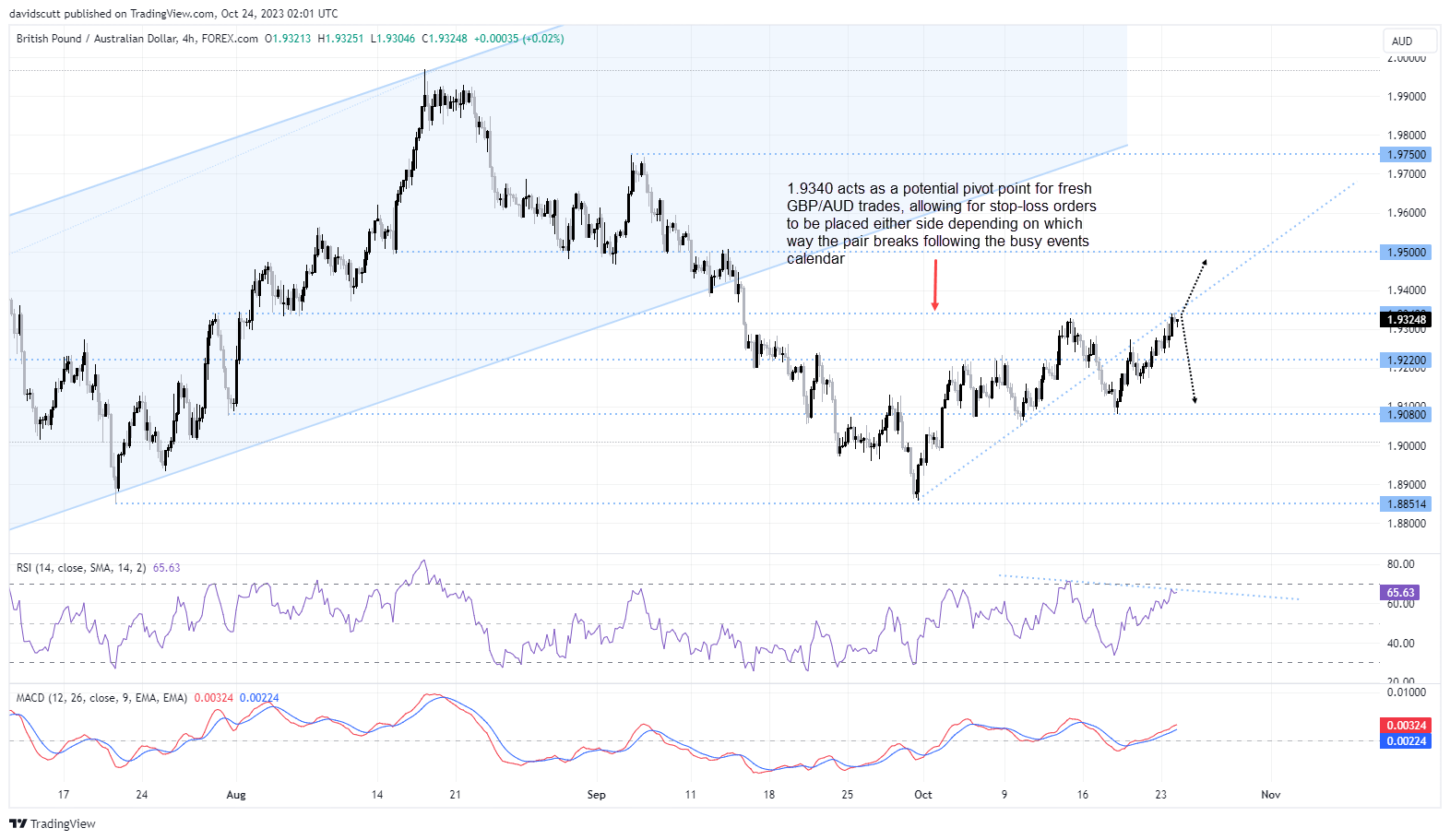

Looking at the four-hourly chart, GBP/AUD has reverted to a buy-on-dips play since the start of October, puncturing layer after layer of resistance until stalling at 1.9340. Sitting in the middle of the 1.8850-1.9970 range it’s been stuck in since July, patience maybe advantageous ahead of the data deluge, providing ample opportunity to establish trades depending on how the near-term price action evolves.

On the topside, a clean break of 1.9340 opens the door to potential push towards next layers of resistance found at 1.9500 and again at 1.9750. A stop below 1.9340 would offer protection against a reversal.

Flipping the trade, another failure at 1.9340 may see prior support at 1.9220 and 1.9080 come into a play. Those considering shorts have the option of placing a stop-loss above 1.9340 for protection.

-- Written by David Scutt

Follow David on Twitter @scutty