- NZD/USD has swung wildly over recent session on the back of shifting expectations towards the outlook for the RBNZ cash rate

- The latest RBNZ inflation expectations survey revealed greater confidence that inflation will return to the RBNZ’s 1-3% target despite greater levels of expected monetary policy easing

- RBNZ Governor Adrian Orr will deliver a key speech on Friday

- RBNZ has returned to the centre of the range it’s been stuck for the past month ahead of US CPI

I never thought we’d see the see the day when an obscure inflation expectations survey from New Zealand would drive movements in G10 FX, but I can now cross it off the list. Because in the latest Reserve Bank of New Zealand (RBNZ) inflation expectations survey, respondents not only see inflation moving back towards the midpoint of the bank’s 1-3% target but expect that to occur with a lower cash rate. The Kiwi plunged, dragging other names along with it.

ANZ’s hawkish forecast neutralised by dovish inflation expectations

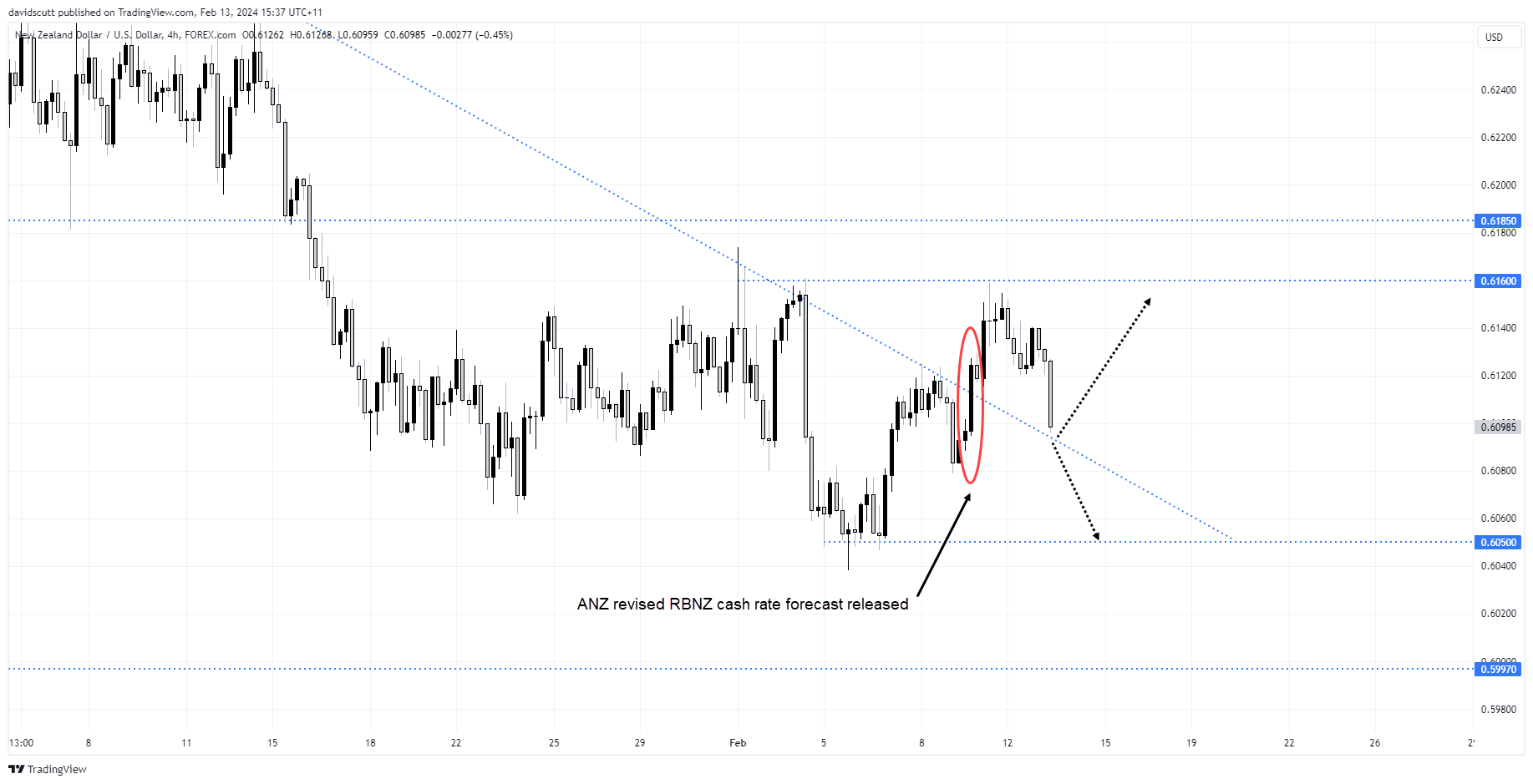

Having surged Friday on the back of a forecast from ANZ looking for an additional two hikes from the RBNZ, the NZD/USD has now given back those gains back following the latest survey. What one hawkish forecaster giveth, 38 dovish forecasters have taketh away.

Source: RBNZ

“Respondents’ expectations for CPI inflation have declined across short, medium, and long terms,” the RBNZ said. “The two-year-ahead, five-year ahead and ten-year-ahead annual inflation expectations decreased from last quarter’s mean estimates and remained within the 1- 3% inflation target band.”

The RBNZ said the average one-year-ahead annual inflation forecast decreased from 3.60% to 3.22% over the quarter with more than half expecting CPI inflation to fall within the bank’s target band by the end of 2024. The average two-year-ahead annual inflation forecast eased 26 basis points to 2.50%.

More rate cuts expected from the RBNZ

Those forecasts were underpinned by an expectation the RBNZ will deliver more monetary policy easing in 2024 than originally anticipated with the average respondent now seeing the cash rate end the year at 4.74%. down 25 basis points on the prior survey and 76 basis points below the current cash rate target of 5.5%.

Higher joblessness likely explains those moves with the average respondent expecting unemployment to finish 2024 at 4.64%, up 13 basis points from three months earlier.

RBNZ rate hike odds unwind

Following the survey’s release, Kiwi overnight index swaps (OIS) rates looking two years ahead eased to 5.175%, down eight basis points from yesterday. The probability of a hike from the RBNZ on February 28 skidded to just 15%, down from 40% beforehand. The NZD/USD was walloped, helping to spark an offer in other G10 FX against the US dollar.

NZD/USD pulls back to centre of trading range

Looking at NZD/USD, gains sparked by ANZ’s hawkish rate call on Friday have now been entirely erased, pushing the price back to the exact same trendline it broke above when the news first broke. The final say on New Zealand’s cash rate trajectory may be delivered by RBNZ Governor Adrian Orr when he speaks on Friday, providing him another platform to live up to his nickname “shock and Orr”.

Before then, traders will have the latest US consumer price inflation (CPI) report for January to contend with markets looking for underlying inflation to lift 0.3% for the month, seeing the annual increase slow again to 3.7%. That will arrive at 8.30am ET Tuesday.

With the former downtrend located just below .6100, the levels to watch below are .6050 and .5997. Above, NZD/USD has struggled to break .6160 on over the past few weeks, making that an obvious upside target. The pair has also done plenty of work either side of .6185 over the turn of the calendar year.

-- Written by David Scutt

Follow David on Twitter @scutty