US futures

Dow future 0.06% at 38,805

S&P futures 0.18% at 5500

Nasdaq futures 0.23% at 19972

In Europe

FTSE 0.48% at 8236

Dax 0.20% at 18124

Nvidia lifts chips stocks & the index higher

Jobless claims were weaker than expected

The breadth of the rally to ATH’s is narrow

Oil holds steady ahead of EIA inventory data

Nvidia just keeps on rising

U.S. stocks are set for a stronger open as traders return from the Juneteenth public holiday, digest softer-than-expected US jobless claims, and Nvidia extends its impressive rally. The Dow Jones is lagging its peers amid a lack of exposure to tech stocks.

Once again, Nvidia has been the standout performer in recent sessions, leading chip stocks higher. However, there are rising concerns over the rally's lack of breadth.

Meanwhile, jobless claims came in weaker than expected at 238k, down from the nine-month high of two 42k in the previous session but ahead of the 235k forecast. The softer jobless claims data is another sign that the U.S. economy is starting to slow. Meanwhile, continuing claims, a proxy for the number of people receiving unemployment benefits, also ticked higher to 1.82 million.

Data comes after retail sales earlier in the week, which were also softer than expected and raised expectations that the Federal Reserve could move to cut interest rates sooner rather than later.

Attention now turns to comments from Minneapolis Fed president Neel Kashkari for further clues about when the Fed may start to cut rates. After the closing bell, Richmond Fed President Thomas Barkin and San Francisco Fed President Mary Daly are expected to speak.

Corporate news

Nvidia is set to open over 3% higher, adding to gains in the previous session. The chipmaker became the most valuable company in the world, with a market cap of $3.3 trillion, overtaking Microsoft.

Accenture is set to open over 7% higher after the IT services provider forecasts annual revenue growth ahead of expectations. The growing use of AI offsets sluggish growth in enterprise spending.

Dell is set to climb 3% on the open. Super Micro Computer will also open over 4.5% higher after Elon Musk posted on social media that these companies would provide server racks for the computer supercomputer his X AI startup is building.

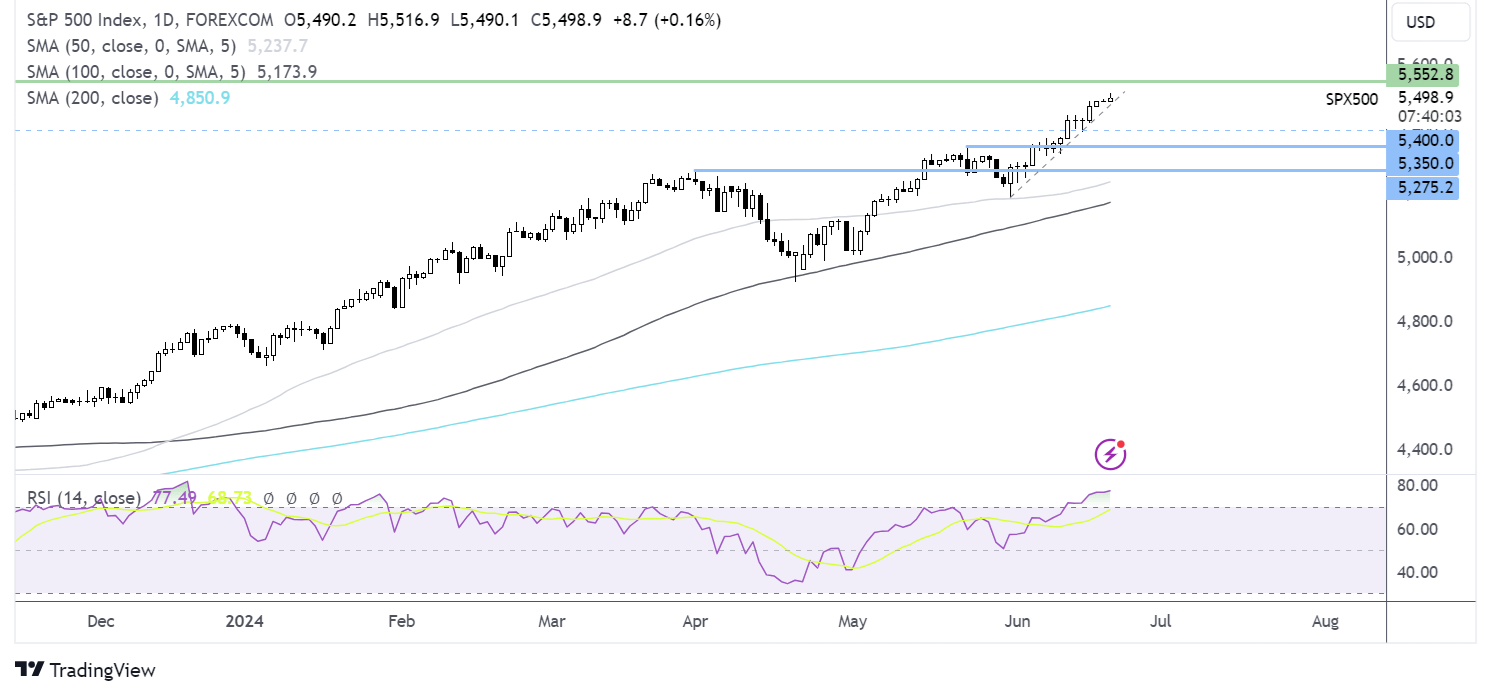

S&P 500 forecast – technical analysis.

The S&P 500 has risen to a fresh ATH at 5500, and while the RSI remains in overbought territory, this doesn’t appear to be deterring the bulls. The next logical level is 5550, ahead of 5600. Immediate support is at 5400, ahead of 5350, the May high.

FX markets – USD rises, GBP/USD falls

The USD is rising, tracking treasury yields higher despite the weaker-than-expected jobless claims data. Fed speakers are in focus for further clues about when the Fed could cut rates.

EUR/USD is falling after the ECB’s economic bulletin pointed to growth risks being neutral and the central bank seeing inflation trending lower.

GBP/USD is falling after the BoE left interest rates unchanged at 5.25%, a 16-year high, as expected, but signaled that it could cut rates as soon as the August meeting. The announcement comes after UK inflation data cooled to 2%, the BoE’s target level, but service sector inflation was hotter than expected. BoE Governor Andrew Bailey will speak shortly.

Oil holds steady ahead of EIA data

Oil prices are hovering around 7-week highs ahead of US inventory data.

Prices remain supported around current levels amid rising geopolitical tensions in the Middle East. Yesterday, oil prices rose on news that Israeli tanks were heading into Gaza, raising concerns over supply. However, gains are being limited by expectations of an inventory build.

US EIA inventory data is due later today. It follows API data showing a build of 2.264 million barrels in the week ending June 14. Gasoline inventories fell.