- DAX analysis: China’s efforts failing to lift sentiment

- Bond yields ease to provide gold mild support

- Looking ahead to next week: Global PMIs and Jackson Hole Symposium

- DAX technical analysis point lower

The risk off tone continued in the first half of today’s session. The major global indices hit fresh weekly lows, reaching their lowest levels in several weeks, causing the VIX – the fear index – to rise to its highest level since May.

DAX analysis: China’s efforts failing to lift sentiment

As mentioned previously, China’s efforts are unlikely to have lasting impact on the wider financial markets. This was the case on Thursday as the earlier optimism faded in the second half of the day. The People’s Bank of China was at it again overnight, taking its defence of the yuan to a whole new level as it fixed the USD/CNY more than 1,000 pips stronger than expected. But this failed to prevent the yuan from falling sharply, and the USD/CNH held recent gains. Chinese equities dropped sharply, along with global markets.

In recent days, traders have used the yuan as a proxy for risk appetite, since the currency closely tracks the country’s economic performance. Its repeated falls to fresh yearly lows was already hurting Chinese stocks, failing to keep up with the rising markets elsewhere in the world previously. But in recent weeks, other markets have started to feel the squeeze, too, with US indices falling to fresh multi-week lows this week and European markets also falling significantly, along with the euro.

The fact that China is now intervening more aggressively goes to show how concerned the government has become about the state of the world’s second largest economy. The markets initially found mild support from this on Thursday, but after a second thought investors released that, actually, China’s yuan fixing is akin to papering over the cracks. So, markets resumed lower and fell even further when the PBOC went for an even bigger FIX overnight.

Bond yields ease to provide gold mild support

The sell-off in stocks meant US bonds would attract some demand on haven flows. This caused the US 10-year yields to drop back to 4.219% by mid-day in London, after nearly testing the October 2022 high at 4.335% the day before. The slightly weaker yields and risk off tone helped to offer gold some support as it held onto mild gains after falling sharply in recent days.

Recently, bond yields have been pushing higher, discouraging investors from investing into growth stocks, which is why the Nasdaq has been underperforming of late (along with XAUUSD). A surprisingly resilient US economy has helped to keep bond yields supported, making stocks which have low dividend yields less attract compared to the higher “risk free” returns from investing in government bonds.

Looking ahead to next week: Global PMIs and Jackson Hole Symposium

Global PMIs

Wednesday, August 23

All Day

Concerns over the health of the global economy intensified last week with the release of soft Chinese industrial data. This week, the focus will be on manufacturing PMI data from around the world, including the Eurozone, UK and US. Activity in the sector has been deteriorating, across all regions. Another disappointing set of PMI numbers could raise recession alarm bells.

Jackson Hole Symposium

Thursday, August 24

All Day

In recent years, central bank officials have used the Jackson Hole summit to signal major policy shifts. This year’s event will be held on 24 to 26 August. Many central banks are looking to pivot away from policy tightening. The Fed, ECB and BoE are all nearing the end of their rate hiking cycles if they haven’t already. But given upside risks to inflation, the likes of Powell, Lagarde and Bailey will probably signal intention to remain flexible and data dependent.

German ifo Business Climate

Friday, August 25

09:00 BST

Although last week’s data releases were mostly positive from the Eurozone, with Eurozone industrial production beating and GDP matching expectations, the more forward-looking indicators point to a slowdown, especially in Germany. This makes the closely-watched German ifo Business Climate index, which is based on surveyed manufacturers, builders, wholesalers, services, and retailers, all the more important.

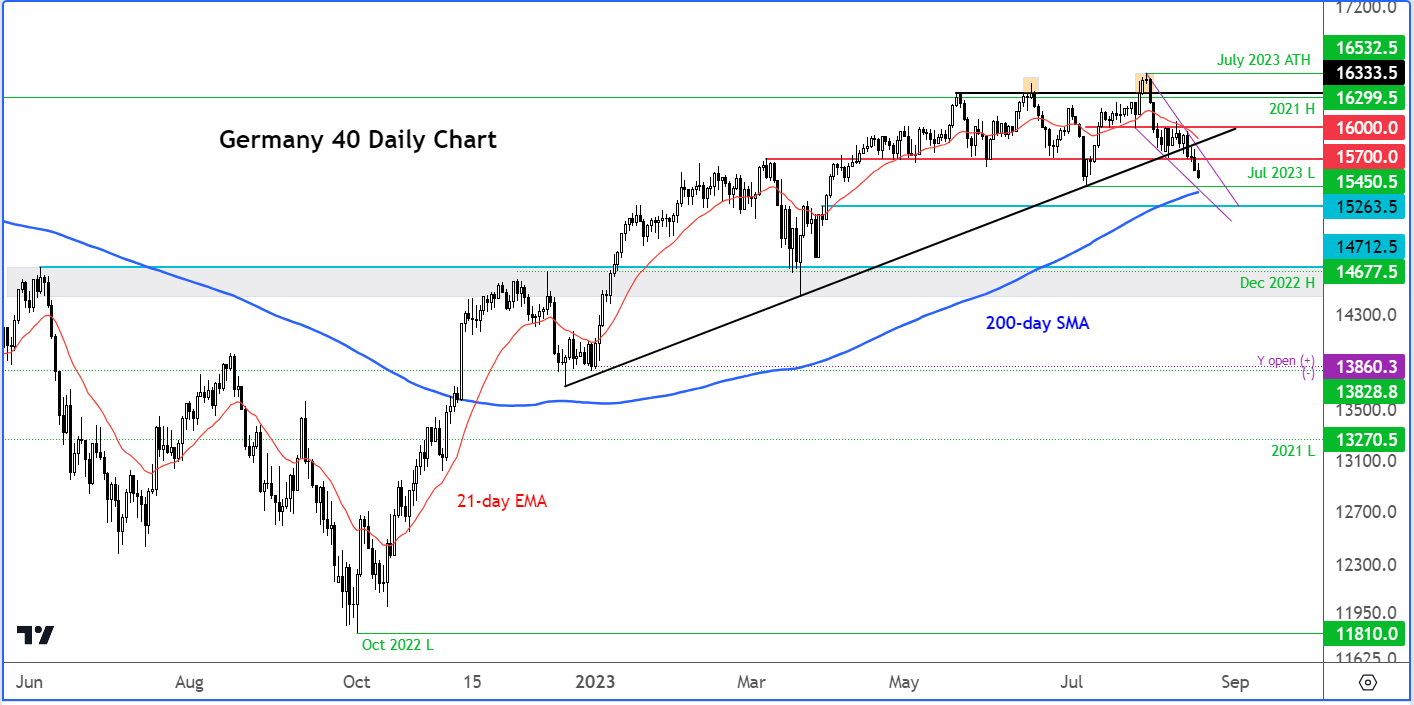

DAX technical analysis

With China struggling, this is not good for the Chinese-sensitive European markets. Indeed, the German DAX index has broken several major support levels lately, after failing to hold the break out to a new record high above the 2021 high of 16300. Broken support levels such as 16,000 and now 15,700 have turned into resistance. Very clear price action indeed. From here the DAX looks poised to drop below the July low at 15450, where many traders’ stops would undoubtedly be resting. Slightly below this level is the 200-day average at 15390. Watch for a possible bounce there. Below the 200-day average, 15260ish is an interesting level to watch. On the upside, 15595 – Thursday’s low – followed by old support at 15700 are the most important resistance levels to watch. These levels must be reclaimed by the bulls to signal a bullish reversal, unless we see a big reversal pattern at lower levels first. But for now, the path of least resistance is clearly to the downside and so the DAX analysis remains bearish.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R