GBP/USD still below 1.30 after the Budget

The pound is edging higher after yesterday's losses as the dust settles on the first labour budget in 15 years. Chancellor Rachel Reeves managed to avoid a repeat of the chaos caused by Liz's trust budget two years ago and broadly kept the market happy.

The chancellor announced a £40 billion package of tax increases, which, according to the Institute of Fiscal Studies, is the second largest fiscal tightening on record. However, there have also been substantial increases in spending and government borrowing.

Between the rising minimum wage and increased employer National Insurance contributions, rising labour costs are expected to add to prolonged sticky inflation. Meanwhile, high debt issuance and fiscal stimulus mean that interest rates are likely to stay higher for longer.

The Office of Budget Responsibility has made it clear that more borrowing and inflation were now in the pipeline following the budget, and as a result, the market has reined in Bank of England rate cut expectations. The market now sees a 25-basis points rate cut in November but not one in December.

The market also sees 100 basis points worth of cuts by August next year down from 120.

Looking ahead to the US session US core PCE and jobless claims will be in focus. Core PCE is expected to ease to 2.6%, while jobless claims are expected to rise to 230K.

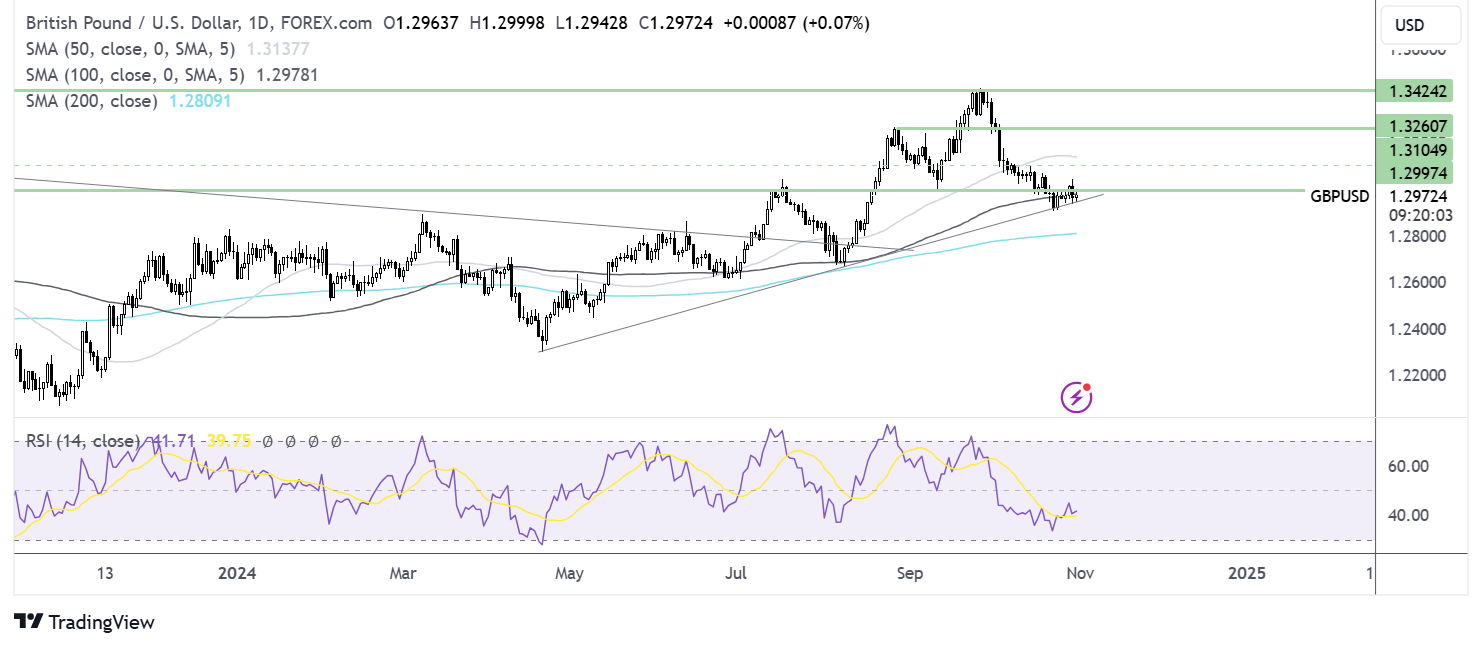

GBP/USD forecast – technical analysis

After falling from 1.3420 to 1.29, the trendline support, GBP/USD, continues to trade above the rising trendline and consolidates below the 1.30 level.

Sellers will look to take out the 1.29 weekly low to extend losses towards the 200 SMA at 1.28.

Buyers will look to rise above the 1.30 level to bring 1.31 into focus, the mid-October high.

EUR/USD edges higher as Eurozone inflation rises

EUR/USD is inching higher above 1.0850, marking a fourth day of gains. The USD hovers around a three-month high, and inflation data from the eurozone and the US are in focus.

Eurozone inflation rose to 2% YoY in October, up from 1.7% and ahead of forecasts of 1.9%. The data comes after Spanish and German inflation data yesterday was hotter than expected. The data is at the ECB’s target level and comes as the market is pricing in a 90% probability of the ECB cutting interest rates by 25 basis points in the December meeting. This is down from the rate cut being fully priced in before yesterday.

Yesterday eurozone GDP figures came in stronger than expected 0.4% growth in the July-September period, twice the level of growth that was forecast while Germany avoided a recession. Growth in the region had been an area of concern, so the stronger data helped to ease those worries slightly.

Meanwhile, the US dollar continues to hover around a three-month high after mixed data yesterday and ahead of core PCE figures later today.

Core PCE is expected to ease to 2.6% from 2.7% however, personal spending is expected to rise to 0.4%, highlighting the resilience of the US consumer I'm paving the way for gradual rate cuts from the third

The data comes after yesterday's GDP figures showed that growth in Q3 was 2.8%, slightly below the 3% in Q2 and below forecasts, although it's still above the historical average.

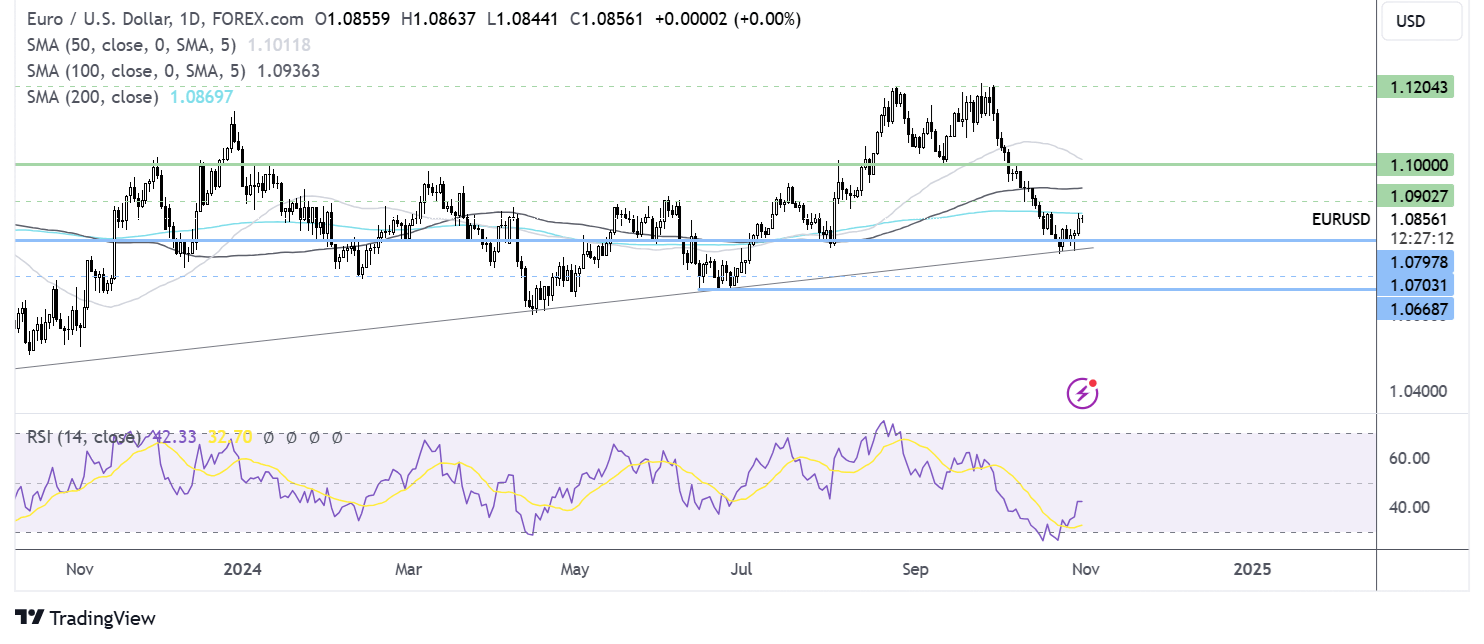

EUR/USD forecast - technical analysis

EUR/USD has recovered from the rising trendline, pushing back above 1.08, but it has run into resistance at the 200 SMA at 1.0870.

Buyers will need to retake this level to extend the recovery towards 1.09 round number and 1.0950 the 100 SMA.

Should sellers successfully defend the 200 SMA, a retest of 1.08 and 1.0760 the weekly low could be on the cards. A break below here creates a lower low.