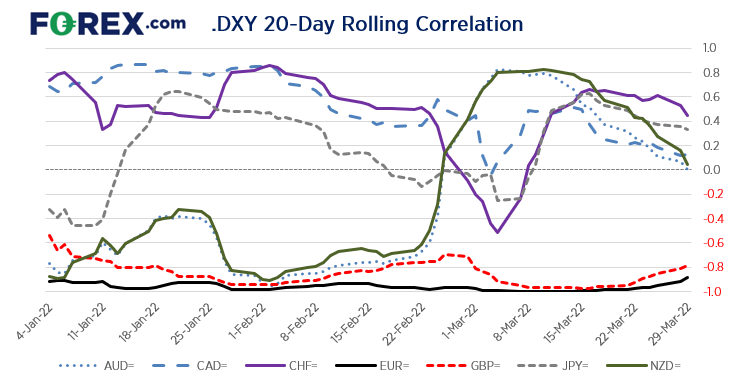

In today’s video we look at the US dollar index and GBP/USD. Both markets are in established trends on the daily charts, although the share an inverted correlation. The chart tells us that the correlation between DXY and other FX majors is not always constant. NZD/USD is effectively not correlated over a 20-day lookback period as its correlation is around zero. Correlation with the Swiss franc and Japanese yen have also diminished notably, whilst the relationship with CAD and NZD has also seemingly broken down.

As DXY is heavily weighted in the euros favour by around 57%, we expect it to share a strong and consistent relationship. But it is also worth noting that GBP/USD shares a relatively strong (yet inverted) correlation with the dollar index. Currently around -0.8, the correlation with GBP has also lessened somewhat yet remains strong overall. But it should also be remembered that correlations are lagging, and in recent days the pound has shared a strong inverted correlation. Therefore, should DXY break above its cycle high then it could send GBP/USD below 1.3000 and head towards 1.2900 or even 1.2800, in line with its dominant bearish trend.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.