Key Events for the Week Ahead

- OPEC Monthly Report on Monday

- US CPI on Wednesday

- Crude Oil Inventories on Wednesday

- FOMC Member Speeches on Tuesday, Thursday, and Friday

IEA August Short-Term Energy Outlook

The latest IEA short-term energy outlook highlighted an increased forecast for oil prices in the second half of 2024 due to the notable decline in global oil inventories, attributed to OPEC+ production cuts. However, a decreased forecast in global oil consumption suggests that the annual average for oil prices will remain below the highs of the first half of 2024.

Natural Gas Prices

Milder weather forecasts in August are expected to dampen overall natural gas consumption levels. However, the latest incursion of Ukraine into Russian territories, marking the biggest attack since the beginning of the 2022 war, targeting a gas distribution station, has increased volatility risks on natural gas prices.

US CPI Figures and FOMC Member Speeches

Following recent calls for an earlier rate cut due to US recession fears, volatility is expected with next week’s FOMC member insights. With the US CPI data due on Wednesday, rate cut probability polls are ready to adjust accordingly, and market volatility is expected to spike. When it comes to oil, recession fears could equate to bearish pressures on the trend, yet positive market insights from economic resilience to rate cuts could support further bullish sentiment on the chart.

Geo-Political Tensions

Beyond the conflicts between Russia and Ukraine, escalating tensions between Israel, Iran, and Hezbollah in the Middle East are being watched closely for potential escalation beyond targeted strikes. Commodity charts, including those for oil, are being monitored for haven spikes alongside oil speculation spikes.

Technical Outlook

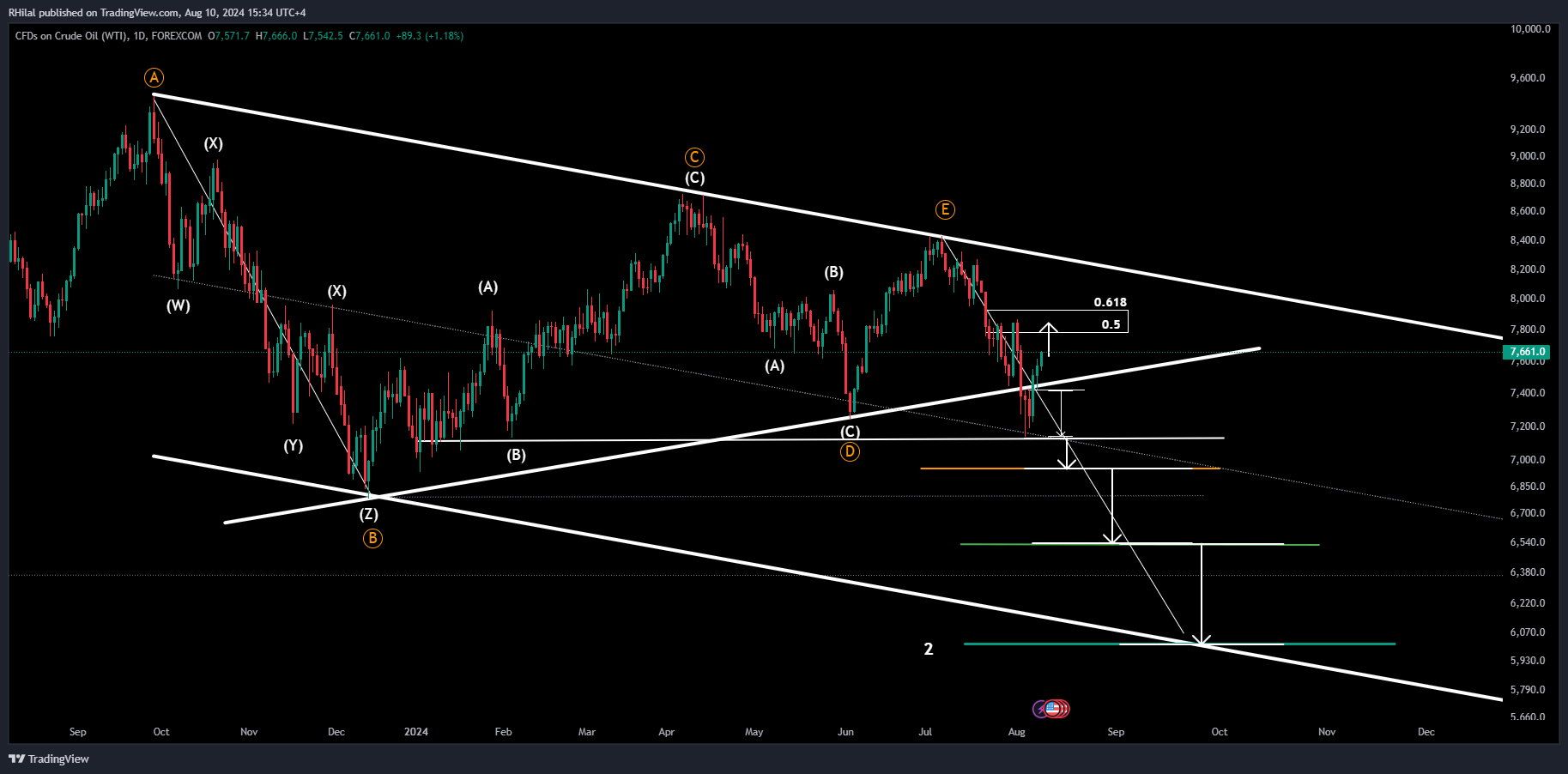

Crude Oil Outlook: USOIL – Daily Time Frame – Log Scale

Source: Tradingview

Crude Oil's positive bounce is set to proceed its trend towards the 77.80 and 79.30 zone. From the downside, a short-term support level aligns with the 74.30 level prior to retesting the 2024 opening at 71.40.

The previously mentioned bearish scenario below 71 remains intact, with a break below the 71-zone paving the way towards levels 69.60, 65.30, and 60 respectively.

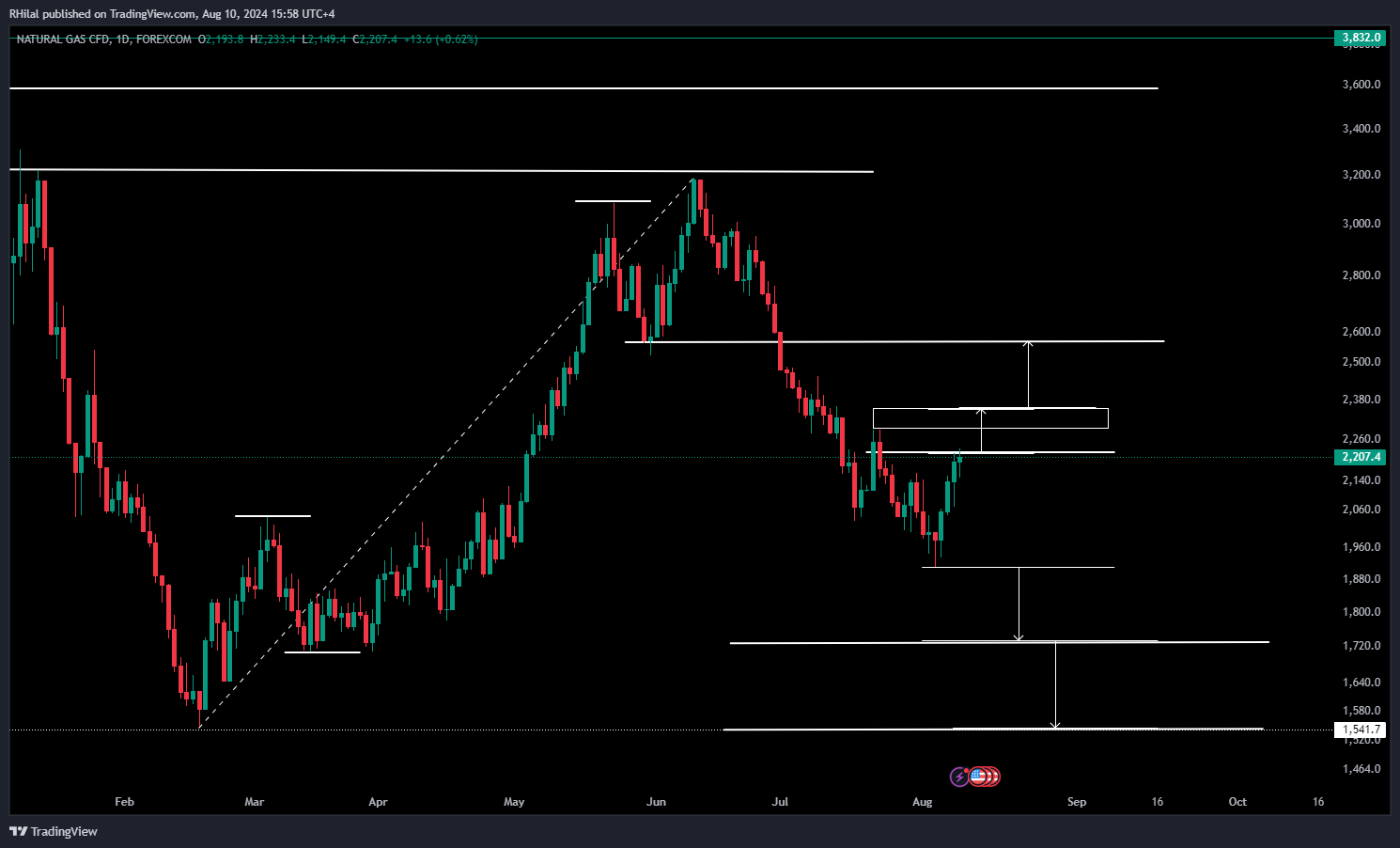

Natural Gas Outlook: NATGAS – Daily Time Frame – Log Scale

Source: Tradingview

Following the broader market reversal, natural gas prices rebounded from a 3-month drop back towards the 2200 zone. Increased volatility risks can be expected with the escalating challenges between Ukraine and Russia. Breaking above the 2240 level, natural gas prices could retest the 2300-2360 zone and the 2500 level respectively.

On the downside, a break below the latest 1900 low could pave the way towards levels 1700 and 1500 respectively.

--- Written by Razan Hilal, CMT - on X: @Rh_waves