- Our crude oil analysis suggests prices may bounce back

- Prices have fallen sharply in recent weeks amid waning risks of supply disruptions

- Crude inventories data on tap next

Our crude oil analysis suggests prices may bounce back in the coming days. In fact, crude oil prices managed to bounce off their worst levels, after reaching fresh multi-week lows earlier. Both Brent and WTI hit their lowest levels since mid-March, at $82.35 and $79.25, respectively, before recovering in the last couple of hours. Despite, today’s recovery, prices have struggled to hold onto their gains after last week’s steep declines.

Crude oil analysis: Waning risks of supply disruptions

The recent oil-price drop is purely a reflection of waning risks of supply disruptions in the Middle East, even as a truce in the Israel-Gaza conflict remains elusive. Oil prices posted their sharpest weekly losses in three months last week as investors priced out the risks of a direct and wider conflict between Israel and other big oil producers in the region. The repricing may have completed by now, allowing oil investors to look at other factors. With that in mind, today’s recovery of oil prices from their earlier lows suggests investors have welcomed news that Saudi Arabia has lifted its official selling price for crude oil in Asia for June, as this points to stronger demand.

Crude oil analysis: Oil prices may have over-corrected

Oil prices look like might have fallen too far, too fast. Since reaching their peak in mid-April, crude oil has tumbled by around 10% in just a matter of weeks. This sharp decline is partly attributed to the removal of the war risk premium, which had been gradually factored in as tensions flared between Iran and Israel in the Middle East. However, as hostilities between the two nations have eased and hopes for a ceasefire between Israel and Hamas have swelled amid international pressure on Jerusalem, oil prices have essentially relinquished all the gains made since early March. There is also some apprehension regarding demand in the US, where commercial crude inventories have been accumulating more than anticipated, alongside a noticeable slowdown in the rate at which refiners are processing crude into products. Nevertheless, the potential for further decline may be limited from here. Firstly, there remains the risk of renewed escalation in the Middle East conflict. Additionally, economic data in Europe have shown improvement, while concerns in China have eased, bolstering the demand outlook. What’s more, ongoing supply cuts by the OPEC+ group is likely to continue in the background, limiting any bearish moves.

Crude oil inventories data on tap

Oil investors will shift their focus onto US crude oil stockpiles data. The American Petroleum Institute will report its latest figures tonight, as usual, ahead of official data from the Energy Information Administration on Wednesday. Commercial inventories are expected to have fallen by 1.2 million barrels in the week ending May 3.

The bulk of last week’s drop in oil prices took place on Tuesday and Wednesday, evidently on the back of the stockpiles data from the US. A surprise build of 7.3 million barrels of crude into stockpiles was reported during the week ending April 26. That pushed inventories to reach their highest levels since June 2023.

Also catching the attention of oil bears was the refinery utilisation rate, which dropped to 87.5%, significantly lower than 90.7% in the year-ago period. In essence, it suggested demand for gasoline has dropped.

That being said, the refinery rate should climb as we head towards the US driving season, unofficially starting on Memorial Day weekend on May 27, all the way through Labor Day in early September.

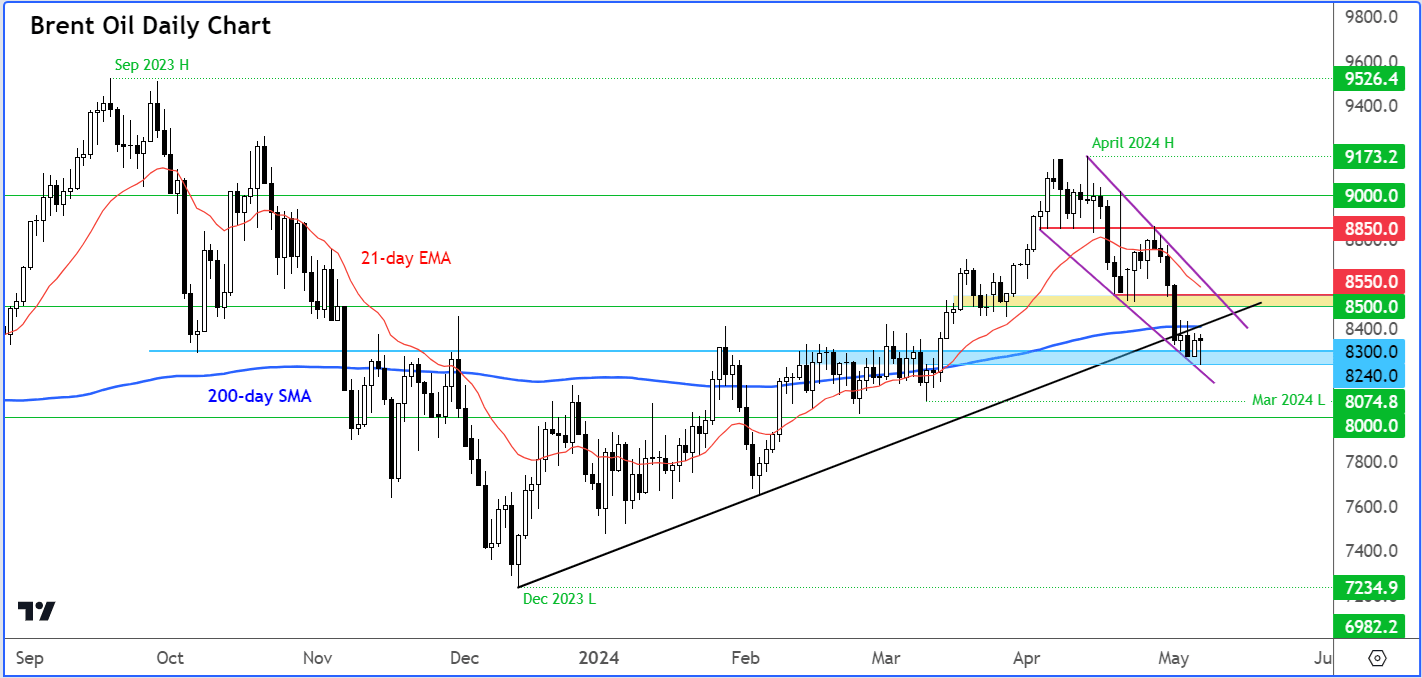

Crude oil analysis: Brent technical analysis

Source: TradingView.com

Although crude oil prices are not technically in the “oversold” territory yet, with the daily RSI hovering around 35 on the Brent oil contract, prices are nonetheless showing some signs of stabilisation around key technical levels.

Brent oil has been testing a crucial support zone around $83.00 to $82.40, in the last couple of days. This area served as the base of a breakout following a multi-week consolidation in March. Additionally, the support trend of the falling wedge or bull flag pattern comes in around these levels.

So, can we see a recovery from here now?

On the upside, the now broken bullish trend that had been in place since December and the 200-day moving average converge near $84.00. This area is now the first line of defence by the bears, followed by additional resistance around $85.50.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R