- Crude oil analysis: WTI technical factors and levels to watch

- Drop in stockpiles, uptick in refinery utilisation rate welcome news ahead of driving season

- Oil prices may be closer to bottom as investors have now mostly priced out the risk of a wider conflict in the Middle East.

In recent days, I have been banging on about a potential recovery in oil prices following their 10% decline from the peak of April. On Wednesday, we finally saw a decent rally. But while that may be a bullish signal, the bulls still need to do a little more before one can confidently call it the bottom. For now, though, the downside looks to be limited as investors have now mostly priced out the risk of a wider conflict in the Middle East. If anything, there remains the risk of renewed escalation in the conflict with Israel wanting to invade Rafah. Additionally, the demand outlook in Europe and China have improvement somewhat in recent times, owing to slight improvement in data. What’s more, ongoing supply cuts by the OPEC+ group is likely to continue in the background, limiting any bearish moves. So, our crude oil analysis point to higher prices moving forward.

Before discussing these macro influences further on oil prices, let’s have a quick look at the technical outlook on oil first, as prices may have formed a low in light of Wednesday’s rally.

Crude oil analysis: WTI technical factors and levels to watch

Crude oil bounced back from near oversold levels to form a potentially bullish signal on Wednesday.

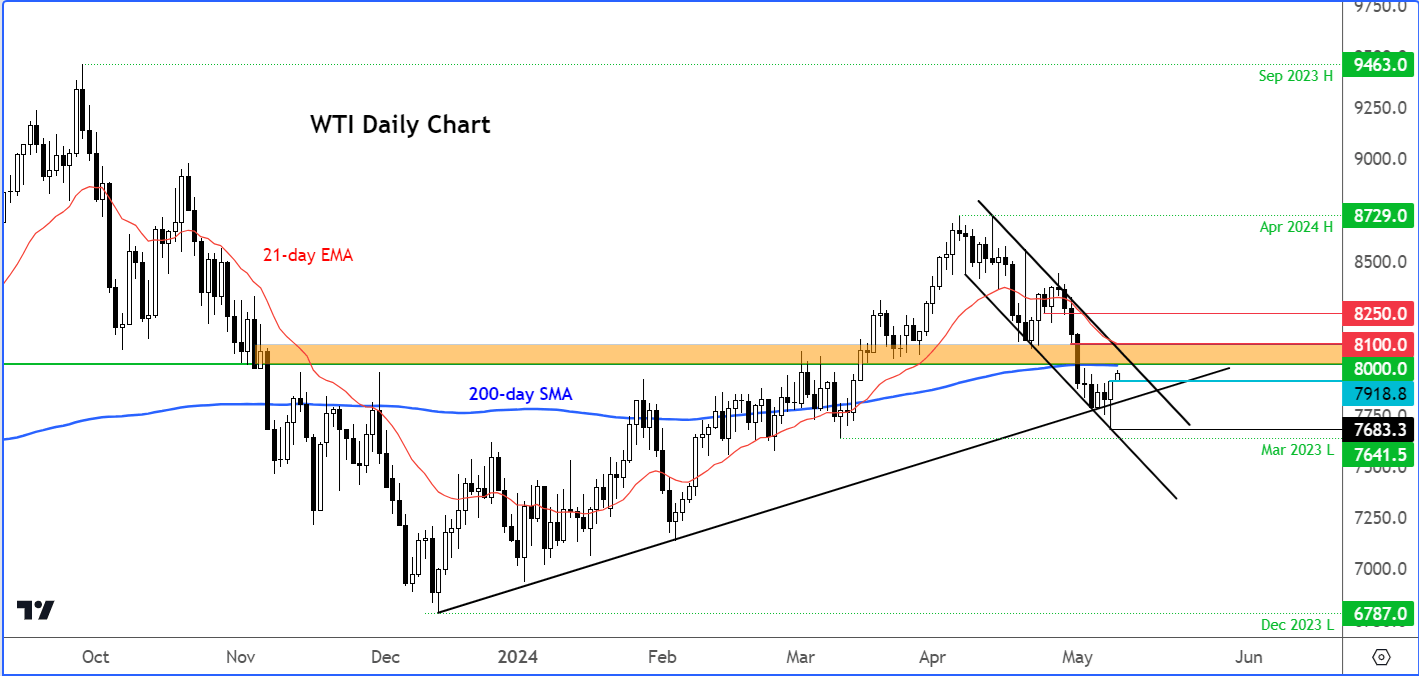

As can be seen on the daily chart of WTI, it formed a hammer-like candle after bouncing from its lows to closes near the highs, and in doing so it made back the losses seen since Thursday of last week. At this stage though, it is too early to tell whether WTI has formed a low, as it still needs to climb out of its bearish channel that has been in place since early April when prices peaked at $87.29.

Source: TradingView.com

The next key area of resistance is between $80.00 to $81.00. Here, the psychologically important level converges with the 200-day moving average, broken support and the resistance trend of the bear channel.

If and when WTI clears this $80-$81 resistance zone, then that could trigger a fresh wave of technical buying that could lifted oil prices significantly. Beyond this area, $82.50 is the next area of potential trouble, followed by $85.00 and finally the April peak itself at $87.29.

Meanwhile, support is now seen at $79.00 to $79.20 area, roughly corresponding with the highs of Wednesday, Tuesday and Monday. WTI will need to hold its own above these levels, if we are to see the resumption of the bullish trend, else it would sharply raise the risks of a drop below $76.41, which was the last significant low formed in March.

Why did oil prices rally on Wednesday?

Wednesday’s rally came after the US Department of Energy reported a bigger-than-expected drop of 1.4 million barrels in commercial crude stocks as refiners presumably ramped up output ahead of the summer driving season. Indeed, the refinery utilization rates rose by 1 percentage point. But at 88.5% of total capacity, they were still lower than 91% from a year ago.

That helped to unwind some of the previous week’s large build of 7.3 million barrels of crude into stockpiles for the week ending April 26. That build had pushed inventories to reach their highest levels since June 2023, as demand for gasoline dropped.

But the latest data this week showed the refinery rate has climbed back a tad as we head towards the US driving season. The Memorial Day weekend at the end of May kicks off the peak season for gasoline demand.

Meanwhile in the Middle East, Israel looked like it wanted to mount an invasion of Rafah, against the advice of the US and her other allies. Rafah is the congested part of southern Gaza where people have been forced to take refuge from other parts of the city. If Israel continues with its plans, then there is a risk we may see a lot more civilian causalities and possibly increased risks of retaliation by supporters of Palestine in the region.

In recent days, hopes of a ceasefire in Gaza had put downward pressure on prices as the risk premium on oil declined. With a risk of a war having been mostly priced out, any fresh escalation in the conflict is going to provide support to prices moving forward.

Crude oil analysis: Oil prices may be closer to bottom

Since reaching their peak in mid-April, crude oil has tumbled by around 10% in just a matter of weeks. This sharp decline is partly attributed to the removal of the war risk premium, which had been gradually factored in as tensions flared between Iran and Israel in the Middle East. However, as hostilities between the two nations have eased and hopes for a ceasefire between Israel and Hamas have swelled amid international pressure on Jerusalem, oil prices have essentially relinquished all the gains made since early March.

So, the recent oil-price drop is purely a reflection of waning risks of supply disruptions in the Middle East, even as a truce in the Israel-Gaza conflict remains elusive for now.

Investors have now potentially priced out the risks of a direct and wider conflict between Israel and other big oil producers in the region. This should allow oil investors to look at other factors. They have welcomed this week’s earlier news that Saudi Arabia has lifted its official selling price for crude oil in Asia for June, as this points to stronger demand. In the US, the government raised the price it is willing to pay to refill the country’s emergency oil reserves, which have fallen to multi-decade lows amid the recent conflicts in Ukraine and Gaza either disrupting supplies or causing big price spikes. It is now willing to pay as much as $79.99 per barrel, which is up nearly $1 and close to the current market prices of WTI.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R