The German DAX index was down alongside global indices and US futures in the first half of Monday’s session. The losses came after China’s markets weakened despite a fresh rate cut by the People’s Bank of China overnight. Today’s German wholesale inflation data pointed to further ECB rate cuts in December, keeping the bullish DAX forecast intact – for now, anyway. However, ongoing weakness in the Eurozone economy, coupled with political uncertainty in the US – with the presidential election now only two weeks away – and not to mention the fact China’s markets don’t seem to be finding a sustainable recovery despite ongoing government stimulus efforts, all point to a potential dop in the coming weeks.

Quieter week for data helps shift focus to US presidential election

Today’s macro calendar has been quite quiet apart from that bigger than expected rate cut by China’s central bank we saw overnight. In fact, there won’t be much in the way of any important scheduled data release until Thursday’s publication of the PMI numbers from the Eurozone and around the world.

Overnight, the PBOC cut its one-year loan prime rate to 3.10% from 3.35%, while the five-year LPR was reduced to 3.60% from 3.85%, as part of a series of stimulus measures to help revive economic growth and halt a housing market slump. This comes after data on Friday showed that the Chinese economy grew at a slow pace in 18 months.

In the eurozone, the only notable data release was German PPI, which came in at -1.4% YoY in September, below forecasts of -0.8%. The data points to weak demand and suggests that consumer inflation could fall further, thus allowing more rate cuts by the ECB.

Meanwhile, in the US, the Trump trade is gaining momentum after the latest opinion polls and odds trackers point to an increasing likelihood of him winning the US presidential election. So far, we have seen the US dollar gaining tracking, but stocks haven’t been impacted noticeably. Trump’s protectionist policies should be bad news for the Eurozone as compared to a Harris win. So, if Trump’s odds of success increases over the next couple of weeks, then, assuming everything else being equal, we could see the DAX weaken as a result.

Global flash PMIs are week’s data highlights

This week’s key data highlights are not out until Thursday, with the release of the latest PMI data from both the manufacturing and services sectors. Central bank easing has been gaining momentum amid signs of weakness in global economy and falling inflationary pressures. The euro area has been a particularly weak spot, especially in the manufacturing sector where the sector’s PMI has remained in contraction for two years. The data will put the euro and indices in focus. Any further deterioration in the PMIs may raise recession alarm bells and potentially weigh on the DAX forecast.

Technical DAX forecast and trade ideas

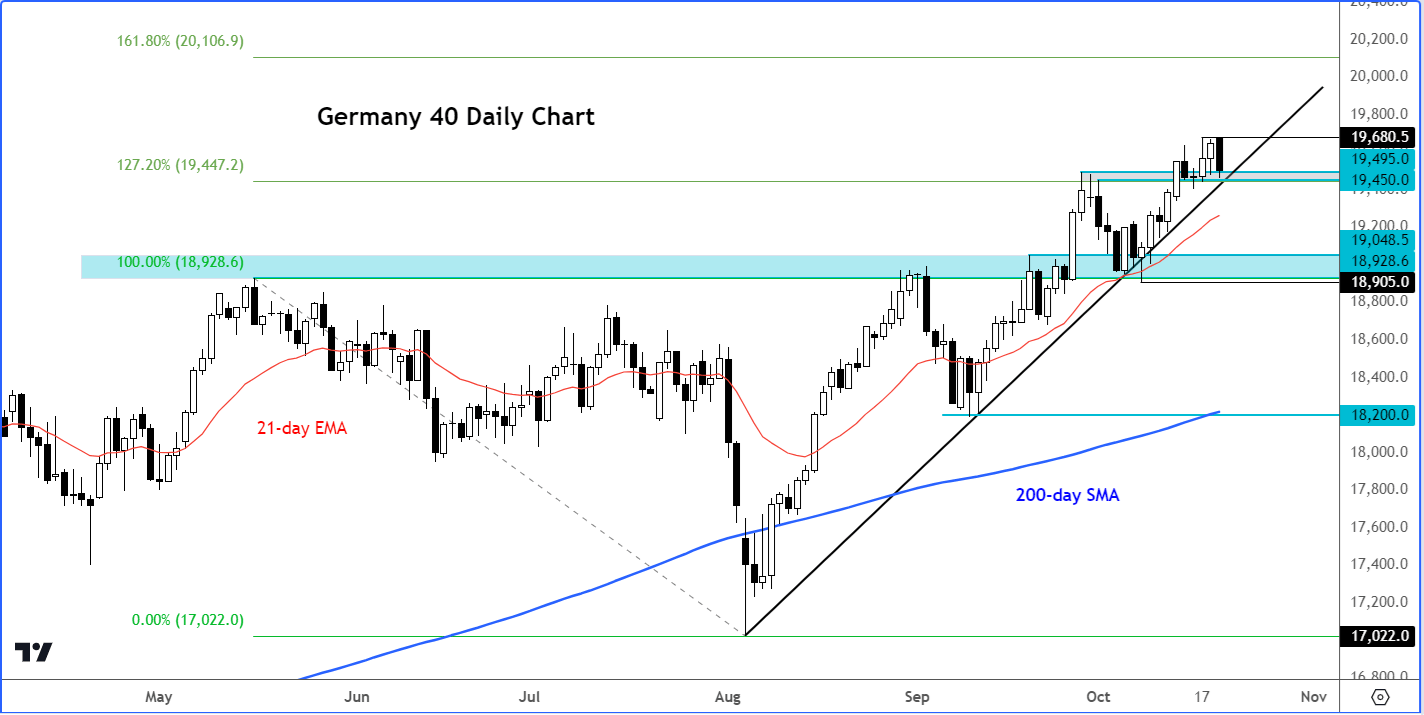

Source: TradingView.com

The German DAX remains in a strong bullish trend having just hit a fresh record high last week. Though it has pulled back from those highs and has wiped out Friday’s gains, more effort is needed from the bears to turn the tide in their favour.

As a minimum, we would need to see the breakdown of the bullish trend line that has been in place since the market bottomed in August. This trend line comes in around 19450 area, which also happens to be a prior resistance zone. A decisive break below here would be deemed a bearish development in the short-term outlook, which could then pave the way for a deeper pullback towards a more significant support area seen between 18925 to 19050 (shaded in blue on the chart).

But if support holds here around the 19450 area then we could see a continuation of the rally and a new all-time high above last week’s peak of 19680 at the very least.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R