AUD/USD rebounded on Tuesday ahead of critical Australian inflation data scheduled for Wednesday morning in Australia, as well as the highly-anticipated FOMC rate decision out of the US on Wednesday afternoon.

Australia’s quarterly Consumer Price Index (CPI), a major inflation indicator, has a consensus forecast of +0.4% for the second quarter of this year. The actual reading will be particularly important and potentially market-moving because data for the previous quarter that was released in April showed a colossal disappointment at -0.2% versus +0.3% expected. That helped compel the Reserve Bank of Australia (RBA) to cut the cash rate in May to its current 1.75%, a record low. Last week, the RBA released minutes of its July policy meeting, after which speculation increased that the central bank could move to cut interest rates even further in August, prompting a sharp drop for the Australian dollar. Any such rate cut, however, would largely be dependent upon the impending CPI inflation reading. Another significant disappointment in that reading could send the Australian dollar plunging once again, while an outcome that is either in-line or above expectations should prompt a continued rebound for AUD.

Later on Wednesday, the US FOMC rate decision will be released. While the Fed is not expected to raise interest rates this time around, it could very likely display a more hawkish tone due to a spate of better-than-expected US economic data in the past several weeks that have helped boost the perceived probability of a rate hike this year. Also potentially contributing to a more hawkish tone should be the fact that concerns over the impact of Brexit on the US economy have diminished dramatically, and the US equity markets have recently hit progressively higher all-time highs.

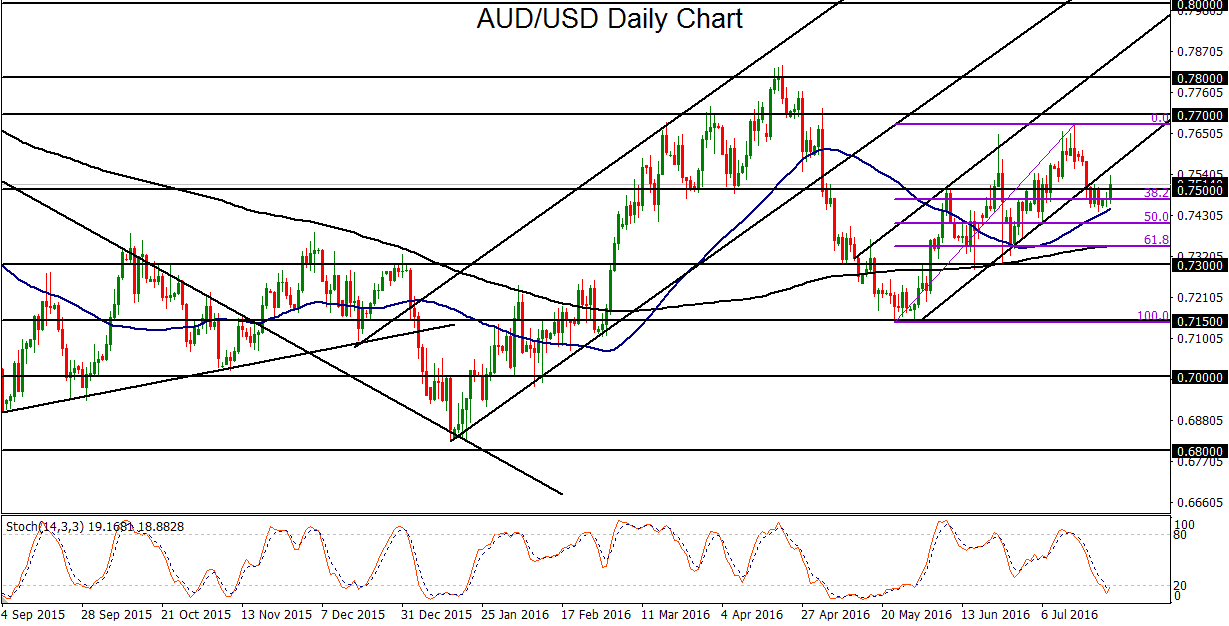

When these two very substantial risk events are combined on Wednesday – Australian CPI and US FOMC – volatility for AUD/USD is likely to increase considerably. On the noted release of the minutes from July’s RBA meeting last week, the currency pair broke down below key 0.7500 support and the lower border of a well-defined parallel uptrend channel extending back from May lows. While Tuesday saw a modest rebound after that breakdown, any lower-than-expected CPI reading and/or hawkish FOMC meeting could send AUD/USD reeling once again, with a key downside support target around the 0.7300 level. Further to the downside is the 0.7150 support target, which represents the May lows. In contrast, an in-line or higher-than-expected CPI, which may help preclude another RBA rate cut in August, could lead to a sharp relief rally for the Australian dollar, potentially boosting AUD/USD back up towards the 0.7700 resistance level.

Australia’s quarterly Consumer Price Index (CPI), a major inflation indicator, has a consensus forecast of +0.4% for the second quarter of this year. The actual reading will be particularly important and potentially market-moving because data for the previous quarter that was released in April showed a colossal disappointment at -0.2% versus +0.3% expected. That helped compel the Reserve Bank of Australia (RBA) to cut the cash rate in May to its current 1.75%, a record low. Last week, the RBA released minutes of its July policy meeting, after which speculation increased that the central bank could move to cut interest rates even further in August, prompting a sharp drop for the Australian dollar. Any such rate cut, however, would largely be dependent upon the impending CPI inflation reading. Another significant disappointment in that reading could send the Australian dollar plunging once again, while an outcome that is either in-line or above expectations should prompt a continued rebound for AUD.

Later on Wednesday, the US FOMC rate decision will be released. While the Fed is not expected to raise interest rates this time around, it could very likely display a more hawkish tone due to a spate of better-than-expected US economic data in the past several weeks that have helped boost the perceived probability of a rate hike this year. Also potentially contributing to a more hawkish tone should be the fact that concerns over the impact of Brexit on the US economy have diminished dramatically, and the US equity markets have recently hit progressively higher all-time highs.

When these two very substantial risk events are combined on Wednesday – Australian CPI and US FOMC – volatility for AUD/USD is likely to increase considerably. On the noted release of the minutes from July’s RBA meeting last week, the currency pair broke down below key 0.7500 support and the lower border of a well-defined parallel uptrend channel extending back from May lows. While Tuesday saw a modest rebound after that breakdown, any lower-than-expected CPI reading and/or hawkish FOMC meeting could send AUD/USD reeling once again, with a key downside support target around the 0.7300 level. Further to the downside is the 0.7150 support target, which represents the May lows. In contrast, an in-line or higher-than-expected CPI, which may help preclude another RBA rate cut in August, could lead to a sharp relief rally for the Australian dollar, potentially boosting AUD/USD back up towards the 0.7700 resistance level.

Latest market news

Today 02:05 PM