The negative lead from Wall Street weighed on the Australian share market, the ASX200, as it closed out the week almost 3% lower at 7175. The heavy falls coming despite last week's robust Australian labour force data and additional monetary policy easing by Chinese authorities.

Ahead of this Thursday's crucial FOMC meeting, the ASX200 will need to negotiate the release of Australian Q$ CPI data tomorrow morning, before the RBA's next Board Meeting on February 1.

Headline inflation is expected to rise by 1% q/q on the back of gains in petrol prices and new dwellings, taking the annual inflation rate up to 3.2% y/y. The trimmed mean (core or underlying inflation) is expected to rise 0.7 %q/q, taking the annual rate of underlying inflation to 2.4% y/y, above the 2.25% forecast by the RBA in November.

Presuming tomorrow's inflations numbers come in at or higher than expected, and following the robust jobs data last week, it will likely confirm the end of quantitative easing (QE) at the RBA's February meeting. It may also prompt the RBA to elect to shrink its balance sheets as bonds mature, aka quantitative tightening (QT).

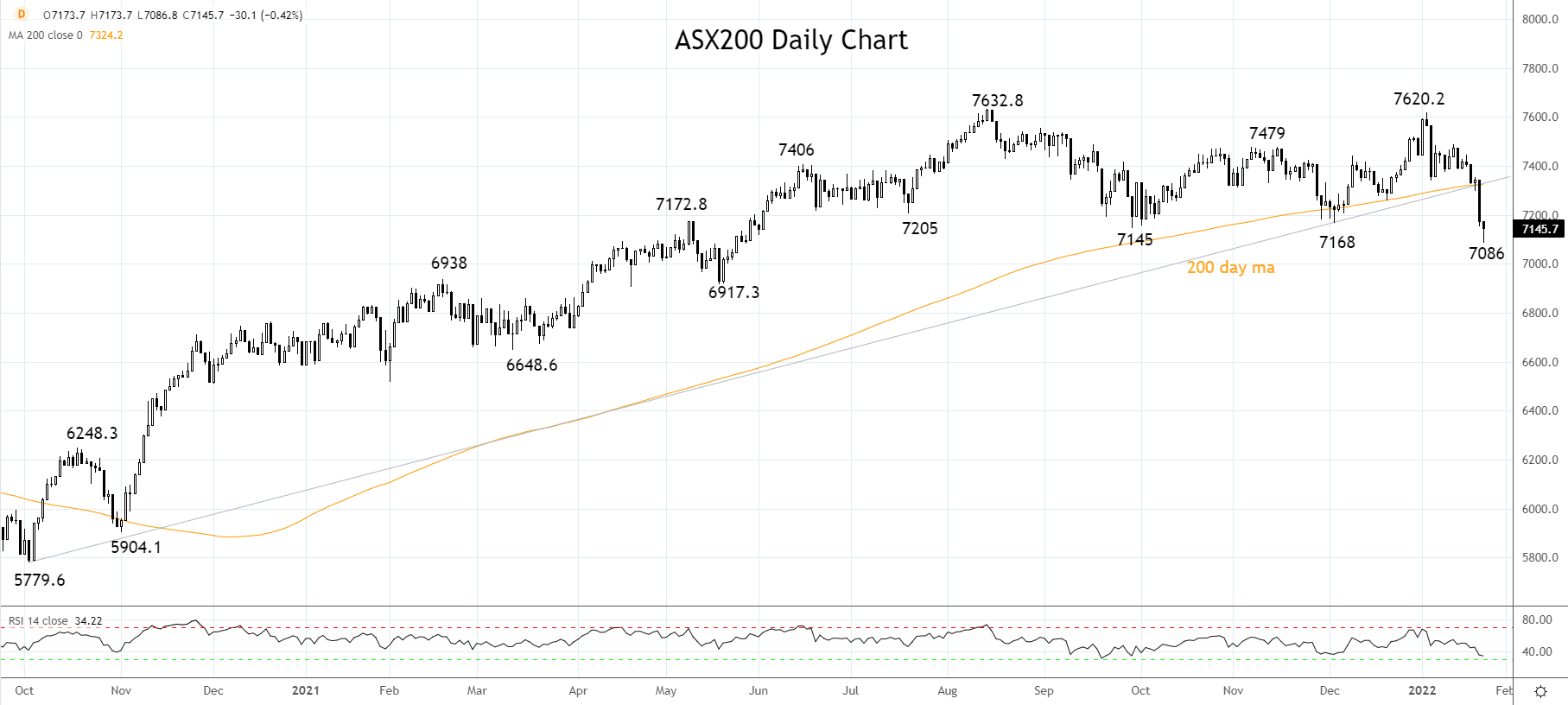

The break of critical support at 7310/00 noted in this article last week here has seen the initial pullback target of 7150 reached in rapid time.

"A sustained break below 7310/00 would warn a deeper pullback is underway initially towards 7150 before 7000."

There remains scope for the pullback to continue lower towards 7030/00, which, if achieved, would amount to an ~8.5% pullback from the August 7632 high. To negate the bearish bias and provide the first indication that the correction is complete, the ASX200 needs to reclaim the 7320/00 breakdown level.

Source Tradingview. The figures stated areas of January 24, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation