- Crude oil has not had a good week, sliding close to 4%

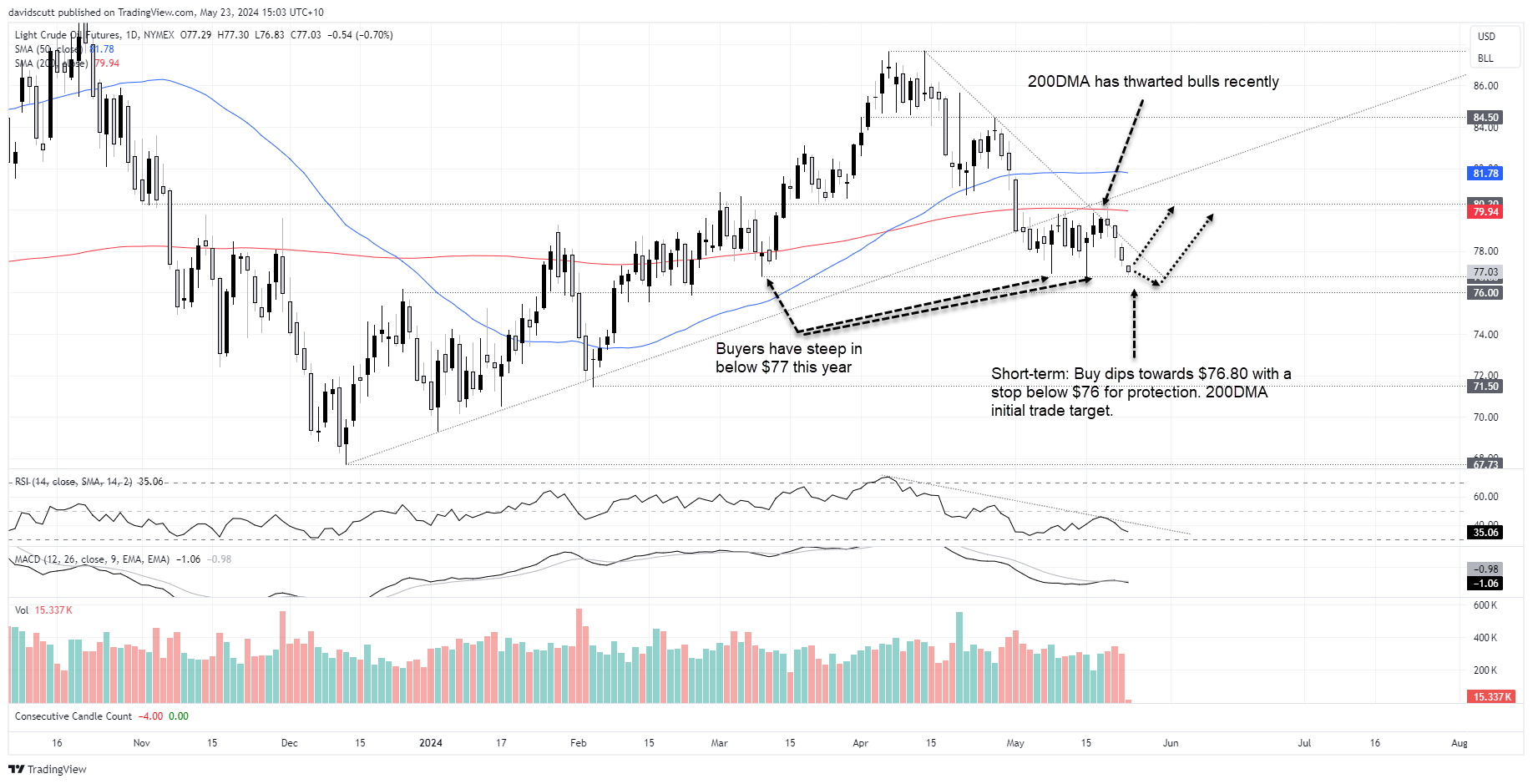

- The 200-day moving average has been a formidable foe to bulls latterly

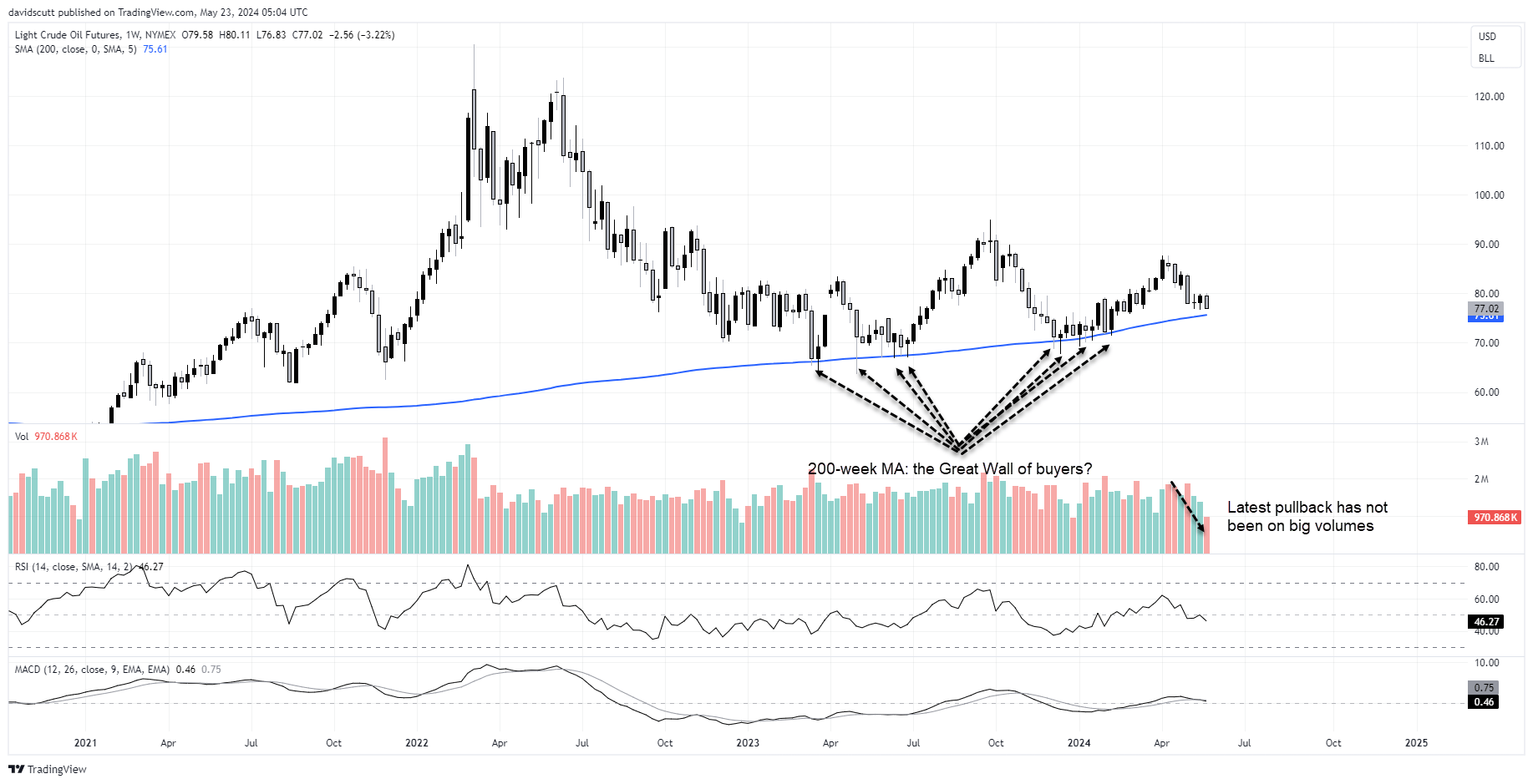

- WTI crude nears level where buyers have enjoyed much success over the past two years

WTI crude hammered: choose your reason why

Whether you put it down to a stronger US dollar, higher interest rates, waning geopolitical tensions in the Middle East or a surprise build in US inventories, or perhaps even something else, it’s not been a good week for crude oil, falling for four consecutive sessions, seeing its losses swell to nearly 4%. As things stand, it’s on track to log the third largest weekly decline of 2024.

However, the pullback has seen WTI move into what’s a been a decent buying zone in recent years, providing an opportunity to establish longs at lower levels.

Price action explains much of what we’ve seen

Rather than vague linkages to fundamental factors, much of the price action can be explained by how the crude price has performed recently.

I wrote about the crude outlook in a weekend note, suggesting that with momentum building to the upside, there were grounds to get bullish should it manage to clear $80.30. However, as the daily chart below shows, that was a stretch too far. The price was rejected again at the 200-day moving average, seeing it reverse back into the existing range, reasserting the downward momentum that had been in place for over a month.

Bears in control for now but beware lurking bulls

However, while the bears are in control near-term, the pullback has provided a good entry level for bulls, should the price hold around these levels. As seen earlier this month, dips below $77 did not last long, delivering a pair of bullish hammer candles that sent the price hurtling back to the upper end of its trading range. With dips below $76 bought aggressively earlier this year, it’s not surprising to see prices supported around these levels, especially when you zoom out to look at where WTI sits on the weekly chart.

200-week moving average a formidable barrier to downside

From a psychological perspective, there are few things more exciting for bulls, and a deterrent for bears, than how WTI has fared below the 200-week moving average over recent years, either dipping below or testing it without closing below it on 15 separate occasions. And with the latest pullback, the level is only two bucks away.

Given where WTI sits on the charts, shorter-term traders could look to establish longs should the price hold above $76.80, allowing for a stop to be placed below $76 for protection. The obvious trade target would be the 200-day moving average, currently located just below $80.

For those with a longer-term trade horizon, dips towards the 200-week moving average would provide a decent entry point, allowing for long positions to be established with a stop below the 200-week moving average for protection. The 200-day moving average would be the first obvious upside target.

-- Written by David Scutt

Follow David on Twitter @scutty