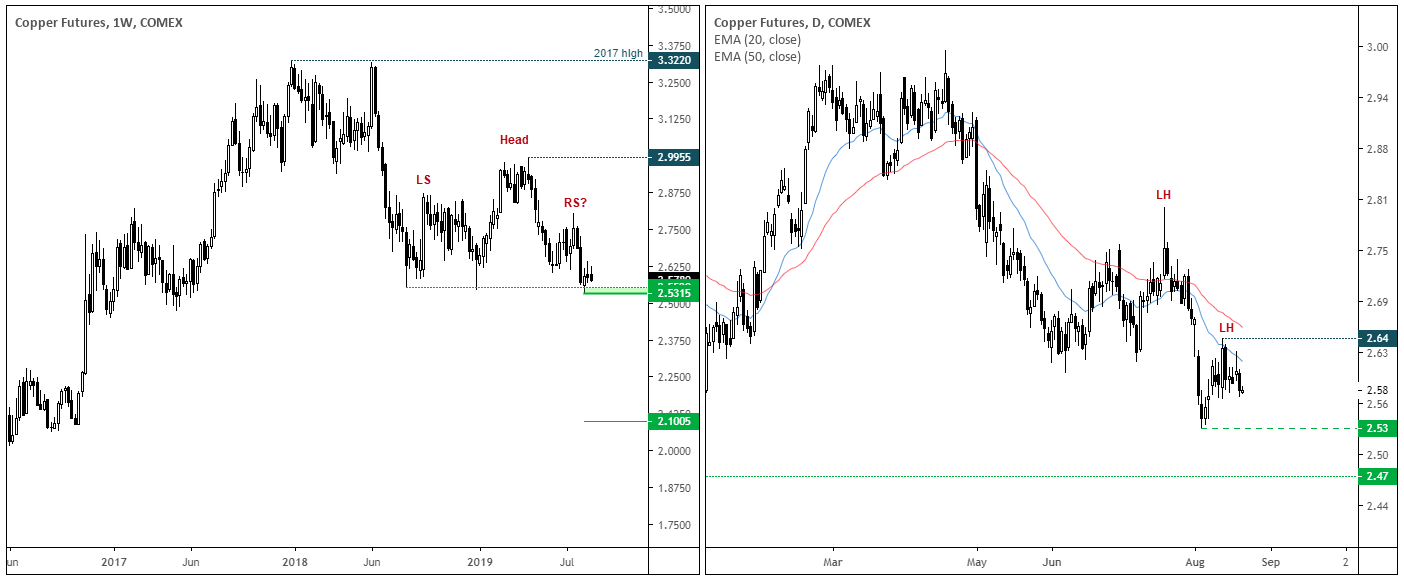

Copper prices have provided a few twists and turns since topping out in 2018. However, price action of the past 1 months appears to be trying to carve out a head and shoulders top pattern. If successful, the pattern projects an approximate target around $2.10 and provides another nail in the coffin of global growth.

Still, the pattern is not perfect (when are they ever) as prices attempted to break support two weeks ago yet remain near recent lows. As this is a weekly chart patience is required, but we would take a break below $2.53 a confirmation of the longer-term reversal.

The daily chart shows that prices have pulled back towards the 20-day eMA, with both the 20 and 50-day eMA’s pointing lower.

- A break above $2.64 warns of a deeper retracement, but bears could consider fading into minor rallies below this key level. This could help improve reward to risk potential.

- Whilst $2.64 holds, we’re looking for prices to head for the $2.53 low and (hopefully) break lower).

- Next support becomes $2.47 but, if the longer-term reversal is to play out, should be temporary.

- Obvious signs of bullish momentum at support levels could provide an argument to exit / step aside.

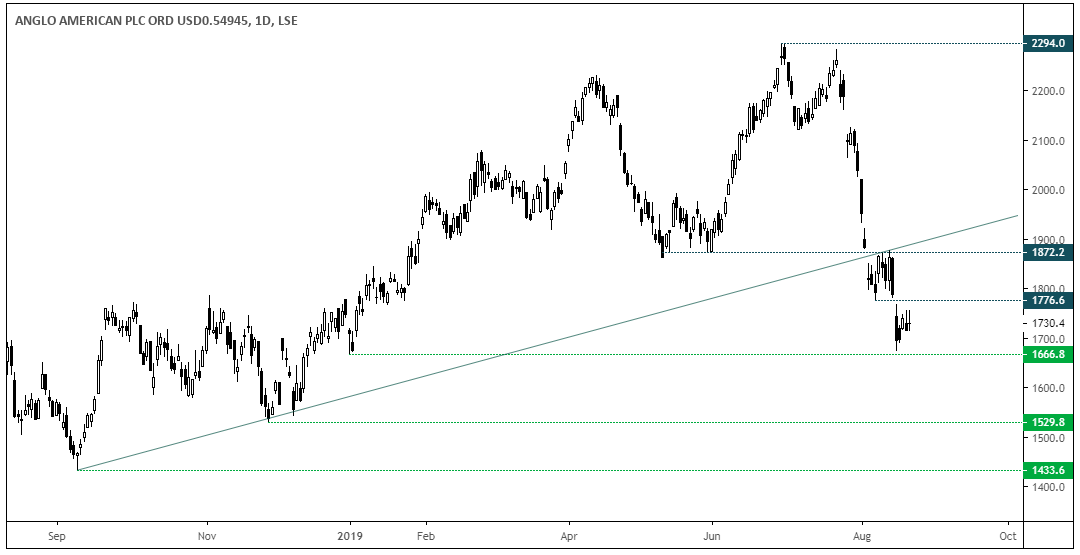

Weaker copper prices will obviously weigh on copper minders, and one such stock we’re closely watching is Anglo American (FTSE 350). However, classified as a diversified mining company, its three largest commodities are coal, platinum and copper – all of which are under price pressures – and the three account for around 68% of its entire business.

Anglo American: Top 5 Revenue Streams- Coal: 28%

- Platinum: 21%

- Copper: 19%

- Iron Ore: 14%

- Nickel: 6%

An impulsive move is clear underway, although prices are currently consolidating between 1666 support and 1776 resistance. A break lower in copper could pave the way for further losses, and its downside could be intensified if platinum rolls over and coal remains within its strong downtrend.

- A break below 1666 assumes a run towards 1530 / 1433

- A break above 1776 warns of a deeper retracement and places it on the backburner