US futures

Dow futures +0.24% at 34612

S&P futures +0.23% at 4455

Nasdaq futures +0.22% at 15220

In Europe

FTSE +0.05% at 7652

Dax -0.2% at 15680

- The Fed is expected to leave rates unchanged

- The focus will be on the future path of rates

- GBP/USD falls after UK inflation unexpectedly falls

- Oil eases ahead of EIA stockpile data

The Fed is expected to leave rates unchanged. But what next?

US stocks are heading for a modestly higher open after small losses in the previous session, and as investors look ahead to the keenly awaited Federal Reserve interest rate decision.

The Fed will conclude its two-day meeting today and is widely expected to keep interest rates on hold at a 22-year high of 5.25 to 5.5%. This would mark the second pause in the hiking cycle and the market is doubting whether the Fed will hike again.

However, with inflation still above the Federal Reserve's 2% target, recent data highlighting resilience in the US economy, and oil prices aiming for $100 a barrel, the Fed will want to keep the door open for another potential hike in November or December. The market is currently pricing in just a 30% probability of another rate hike in November.

With this in mind, attention will be on the Federal Reserve's quarterly projections, the dot plot, and Federal Reserve Chair Jerome Powell's press conference for any additional clues over the Fed's determination to raise interest rates again before the end of the year.

Powell is unlikely to want to rock the boat and will most likely stick to the mantra of being data-dependent. However, should Jerome Powell adopt a more hawkish tone, this could unnerve the market and pull equities lower whilst boosting the dollar.

Corporate news

Instacart Is set to open 3% lower on its second day of trading. The grocery delivery store floated yesterday at $30 a share and closed 12% higher. The price reached gains of 40% at one point in the session. The San Francisco Instacart has a value of $11.2 billion. However, it still has some way to climb to reach the $39 billion valuation assigned to the company in 2021.

Disney shares will be in focus after the entertainment giant revealed plans to spend $60 billion on expanding its theme park and cruise line business over the coming decade. The division has been a strong performer for the company, offsetting weakness in its traditional television business.

General Mills is set to rise on the open after reporting a decline in adjusted income in Q1 but still beat forecasts. EPS was $1.09, down 1% from the previous year. Meanwhile, net sales rose 4% at the food processing group to $4.90 billion.

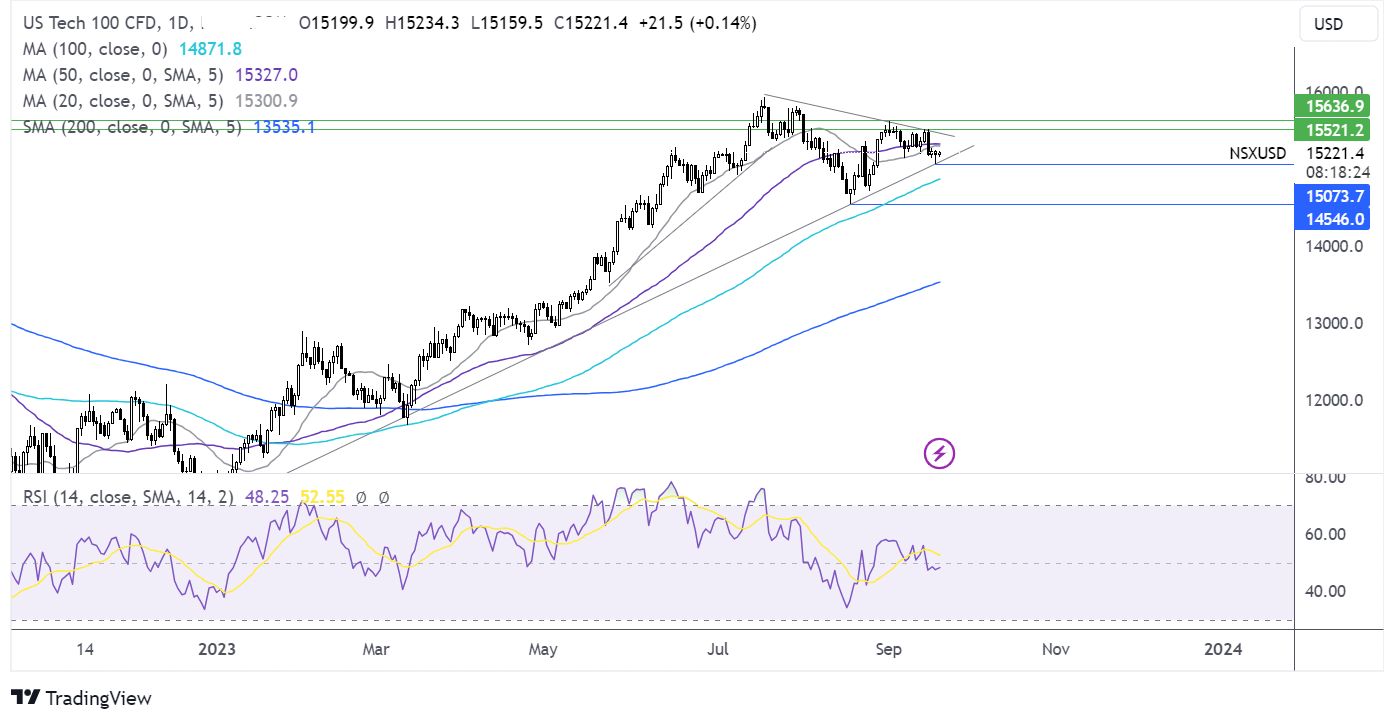

Nasdaq 100 forecast – technical analysis.

The Nasdaq has risen off support at 15065, the rising trendline, and pushed higher. However, the price remains below the confluence of the 20 & 50 sma, the next hurdle that it must overcome. The RSI is neutral, giving away a few clues. Should the price retake the 20& 50 sma at 15325, buyers will look to rise above the falling trendline resistance and last week’s high at 15500 and 15630 the September high to create a higher high. Sellers will look to break below 15065 to create a lower low and expose the 100 sma at 14870.

FX markets –USD falls, GBP falls

The USD is slipping ahead of the Fed rate decision, where rates are expected to be left unchanged. The focus will be on what comes next and the Fed's level of determination to raise rates again before the end of the year.

EUR/USD is trading marginally higher, above 1.07, after the German PPI rose 0.3% MoM in August after falling -1.1% in July. ECB speakers are also on tap across the day. The pair could struggle to push the price much higher ahead of the Fed decision later.

GBP/USD is falling to a 4-month low after UK inflation data showed an unexpected easing to 6.7% YoY in August, down from 6.8%. Expectations had been for an increase to 7%. Core inflation also dropped sharply to 6.2% from 6.9%. The data has the market questioning whether the BoE will raise interest rates again tomorrow. Expectations have eased from a 90% probability of a hike to a 70% probability of a hike, and the market has as good as discounted another hike from the Bank of England after that.

EUR/USD +0.13% at 1.0702

GBP/USD -0.23% at 1.2373

Oil slips ahead of the Fed & EIA stockpile data

Oil prices are easing for the third straight session, dropping by over $1.00 ahead of the US Federal Reserve interest rate decision, which could give some clues about what the demand outlook over the coming month.

The focus will be on the projected policy path which at the moment is unclear. However, the Feds could give some clues over whether the US economy is heading for a hard or soft landing. A soft landing would be good news for the oil demand outlook.

The oil markets have shrugged off the API oil inventory data, which showed that stockpiles fell by 5.25 million barrels, larger than the 2.2 million barrel decline expected.

Goldman Sachs has said that it's up to its 12-month Brent forecast to $100 a barrel from $93 as they expect sharper inventory draws going forward due to lower OPEC supply and higher demand from the US.

EIA inventory data is due shortly.

WTI crude trades +0.6% at $89.65

Brent trades -0.9% at $99.65

Looking ahead

15:30 crude oil imports