US futures

Dow future 0.07% at 43881

S&P futures -0.03% at 5944

Nasdaq futures -0.11% at 20709

In Europe

FTSE 1.04% at 8236

Dax 0.4% at 19050

- US fall but is set for weekly gains

- US services PMI is expected to rise to 55.3 from 55

- Oil falls but is set to gain almost 5% this week.

Stocks ease but are set for solid weekly gains

U.S. stocks are heading for a mixed open, ending a broadly positive week on a more cautious tone ahead of the release of PMI data.

The three main indices closed higher on Thursday, helped by Nvidia's earnings. The AI darling of Wall Street post gains after beating earnings and revenue forecasts. The Dow Jones is on track to rise 1% this week, while the S&P 500 is set for 1.3% gains. The Nasdaq is up 1.6%.

The rally this week comes despite rising doubts over whether the Fed will cut interest rates in December. Strong inflation data last week and jobless claims figures this week showing a resilient US labour market have resulted in the market reining in rate cut expectations.. Fed speakers have also sounded less dovish in recent speeches, alluding to a slower pace for rate cuts.

The market is pricing in around a 60% probability over a 25 basis point rate cut in December, down from around 80 not over a week ago.

Attention will now turn to November PMI data, which could further support the view that the Fed will cut rates at a slower pace. The services PMI grew at a faster pace of 55.3, up from 55, and US manufacturing also contracted at a slower pace of 48.8. The data will be watched carefully as it could provide guidance surrounding corporate confidence in the wake of Trump's election victory.

Corporate news

The tech sector remains in focus, with Google owner Alphabet down a further 1% after falling almost 5% yesterday after the Department of Justice demanded Google sell its Chrome web browser to curb the tech giant's monopoly in online search. The recommendation comes after a landmark ruling in August that concluded Google operated an illegal monopoly in online search.

Gap is surging premarket after the fashion retailer lifted annual sales forecasts and said the holiday season was off to a strong start.

Crypto stocks will remain in focus as Bitcoin rises to a fresh all-time high of 99.3k, Within a breath of the magnetic 100k level following news that SEC's Chair Gary Gensler has resigned effective January 20th.

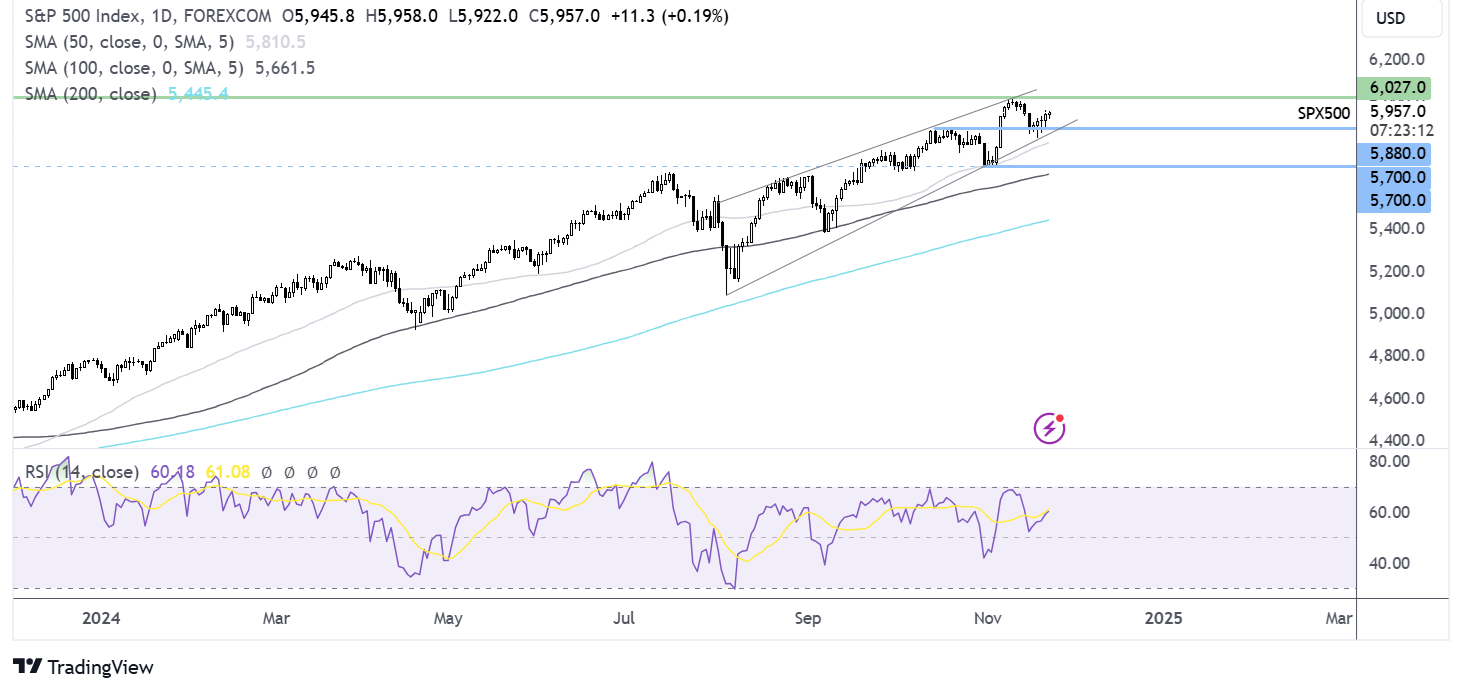

S&P 500 forecast – technical analysis.

The S&P 500 trades within a rising wedge, recovering from the rising trendline support and above 5870. The price looks towards 6027 and fresh all-time highs. Support can be seen at 5875 and 5850, the rising trendline support. A fall below 5700 would create a lower low.

FX markets – USD rises, EUR/USD falls

The USD is rising and is set to gain across the week, marking the eighth straight weekly gain. The market is influenced by safe-haven plays and expectations that the Federal Reserve will cut interest rates at a slower pace than its peers amid U.S. economic strength and expected inflationary policies from Trump.

EUR/USD reached its lowest level since 2022 on USD strength. As eurozone PMI data sounded alarm bells in Europe, the composite PMI fell to its lowest level in 10 months and into contractionary territory, at 48.1 from 50 in October, raising concerns about the region's growth outlook.

GBP/USD has fallen to 125, its lowest level since May, amid U.S. dollar strength and after weak UK data. UK retail sales increased some 0.7% as consumers Rangers funding ahead of the Labour government budget. UK PMI data also showed that business activity contracted in November, with the composite PMI falling to 49.9.

Oil rises as geopolitical tensions rise.

Oil prices are easing lower but are still on track to gain 4% across the week as the war between Russia and Ukraine ramps up and as Chinese imports are set to increase in November.

Oil's on track for its strongest weekly gain since September as the war between Russia and Ukraine intensifies after Britain and the US allowed Ukraine to strike Russia with its weapons. Well, Russian oil exports haven't been impacted, but the risk of supply disruption is rising amid concerns that Ukraine could target Russian oil infrastructure. This could not only disrupt supply but also accelerate the war spiral.

Separately, China announced policy measures on Thursday to boost trade amid worries over possible trade tariffs from Trump. Chinese oil imports are expected to rebound in November after sharp price cuts lifted demand for Iraq and Saudi oil.