Asian Indices:

- Australia's ASX 200 index fell by -74.3 points (-1%) and currently trades at 7,385.90

- Japan's Nikkei 225 index has fallen by -253.91 points (-0.83%) and currently trades at 30,259.09

- Hong Kong's Hang Seng index has risen by 97.6 points (0.4%) and currently trades at 24,765.45

UK and Europe:

- UK's FTSE 100 futures are currently up 29 points (0.41%), the cash market is currently estimated to open at 7,056.48

- Euro STOXX 50 futures are currently up 22.5 points (0.54%), the cash market is currently estimated to open at 4,192.37

- Germany's DAX futures are currently up 55 points (0.35%), the cash market is currently estimated to open at 15,706.75

US Futures:

- DJI futures are currently down -63.07 points (-0.18%)

- S&P 500 futures are currently up 8.25 points (0.05%)

- Nasdaq 100 futures are currently up 2.5 points (0.06%)

Indices

Energy stocks weighed on the ASX 200 which is on track to close below its 200-day eMA with a bearish engulfing day. It was one of the weakest performers overnight, during a session where equity markets across China, Japan and South Korea are on track to close the day higher.

Futures markets are currently pointing to a firmer open for Europe, although US futures have opened slightly lower. UK retail sales is in focus for the FTSE in just over an hour, whilst consumer sentiment is the main economic data point for the US just after lunch.

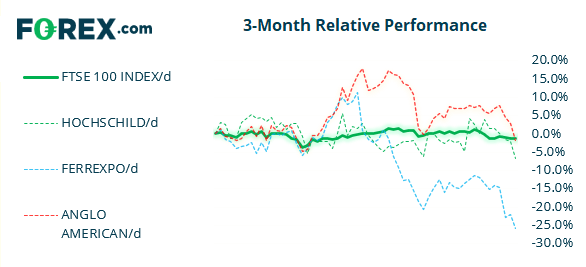

The FTSE 100 trades in the lower third of the 7000 – 7090 range. Bulls have failed to hold onto gains for the past three sessions, yet bears are also struggling to break below 6993 to confirm its bearish leg. Until that happens then range trading strategies are preferred (bullish at range low, bearish at the top).FTSE 350: Market Internals

FTSE 350: 4065.08 (0.16%) 16 September 2021

- 267 (76.07%) stocks advanced and 73 (20.80%) declined

- 10 stocks rose to a new 52-week high, 12 fell to new lows

- 69.8% of stocks closed above their 200-day average

- 58.12% of stocks closed above their 50-day average

- 11.68% of stocks closed above their 20-day average

Outperformers:

- + 8.76% - Drax Group PLC (DRX.L)

- + 7.17% - Easyjet PLC (EZJ.L)

- + 5.26% - Ashtead Group PLC (AHT.L)

Underperformers:

- -4.69% - Hochschild Mining PLC (HOCM.L)

- -4.67% - Ferrexpo PLC (FXPO.L)

- -4.57% - Anglo American PLC (AAL.L)

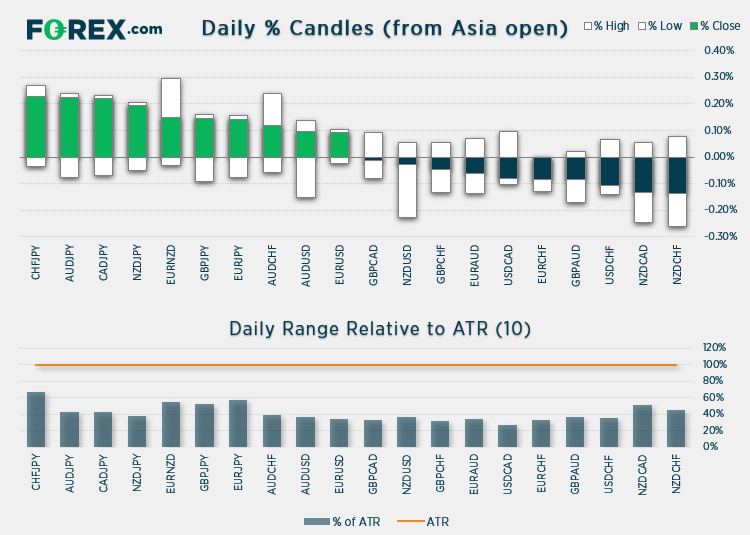

Forex: UK retail sales and US consumer confidence in focus

UK retail sales are scheduled for 07:00 BST. It fell unexpectedly last month by -2.5% and expected to soften slightly further by -0.5%. If it is to surprise to the downside then GBP/USD look interesting for bearish setups below 1.3765, as it would clear yesterday’s bearish engulfing low and the monthly pivot point.

GBP/NZD printed a bullish outside candle yesterday and has since edged its way to 2-week high overnight. It’s possible the daily bear flag is still playing out (and there could be some minor highs) so it’s one to watch for bearish setups at resistance, although momentum is currently pointing the wrong way.

The preliminary University of Michigan Consumer Survey is released at 15:00 BST. Last month it caused a stir as it plummeted to a 10-year low and dragging the US dollar lower with it. Today we get to find out if this was merely a blip, or whether the negative outlook has more to offer. Take note that USD/CHF fell -0.7% following last month’s preliminary report, but if sentiment can improve compared with last month’s print then perhaps USD/CHF can break higher.

USD/CHF was a strong performer yesterday and enjoyed its most bullish session in 3-months. It closed just on the June high, but more importantly cleared its was above a multi-week period of messy price action and overlapping ranges. Its structure remains bullish above the Doji low of 0.9164, and we’d be keen to see low volatility pullbacks towards 0.9230/40 or 0.9205 to seek bullish setups, in anticipation of a break above the June high / 0.9300.

Learn how to trade forex

Commodities: Silver remains below $23

Silver remains below $23 and is potentially carving out a 3-wave (corrective) move. So we did not see the secondary reaction to yesterday’s sell-off in Asia, but a strong dollar tonight could help it on its way in the US session. As before, a clear break above 23.0 assumes a deeper correction.

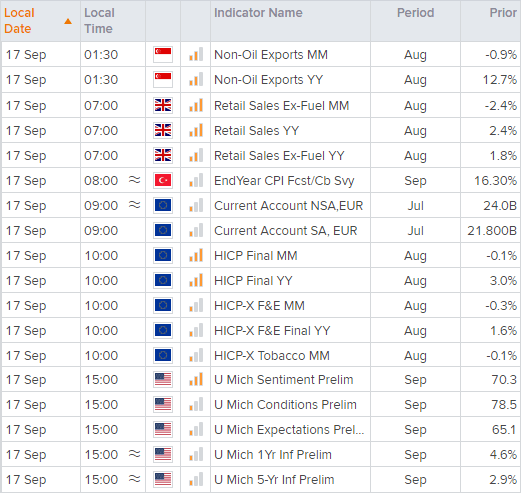

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.