- Crude oil inventories recorded a positive change of 3.6 million barrels, compared to the previous decrease of 2.5 million barrels

- Oil charts are maintaining a tight trading range for the seventh consecutive day

- Markets are anticipating disinflation data to continue with easing PCE metrics

Why is the Personal Consumption Expenditures (PCE) the Fed’s favored inflation gauge over the CPI?

- It includes a wider range of goods and services

- It better captures changes in consumer spending patterns and preferences

- It updates over time, providing a more accurate and consistent measure of inflation

How can the PCE data affect oil prices?

As market anticipations lead the trends, a decrease in inflation metrics can have a positive demand outlook for oil prices, as the trend of contractionary policies would be considered to start its reversal.

The market is eagerly waiting for the latest PCE data to align with a disinflationary trend, alongside the Consumer Price Index (CPI) and the ISM Manufacturing PMI, which could increase the likelihood of a potential rate cut in September.

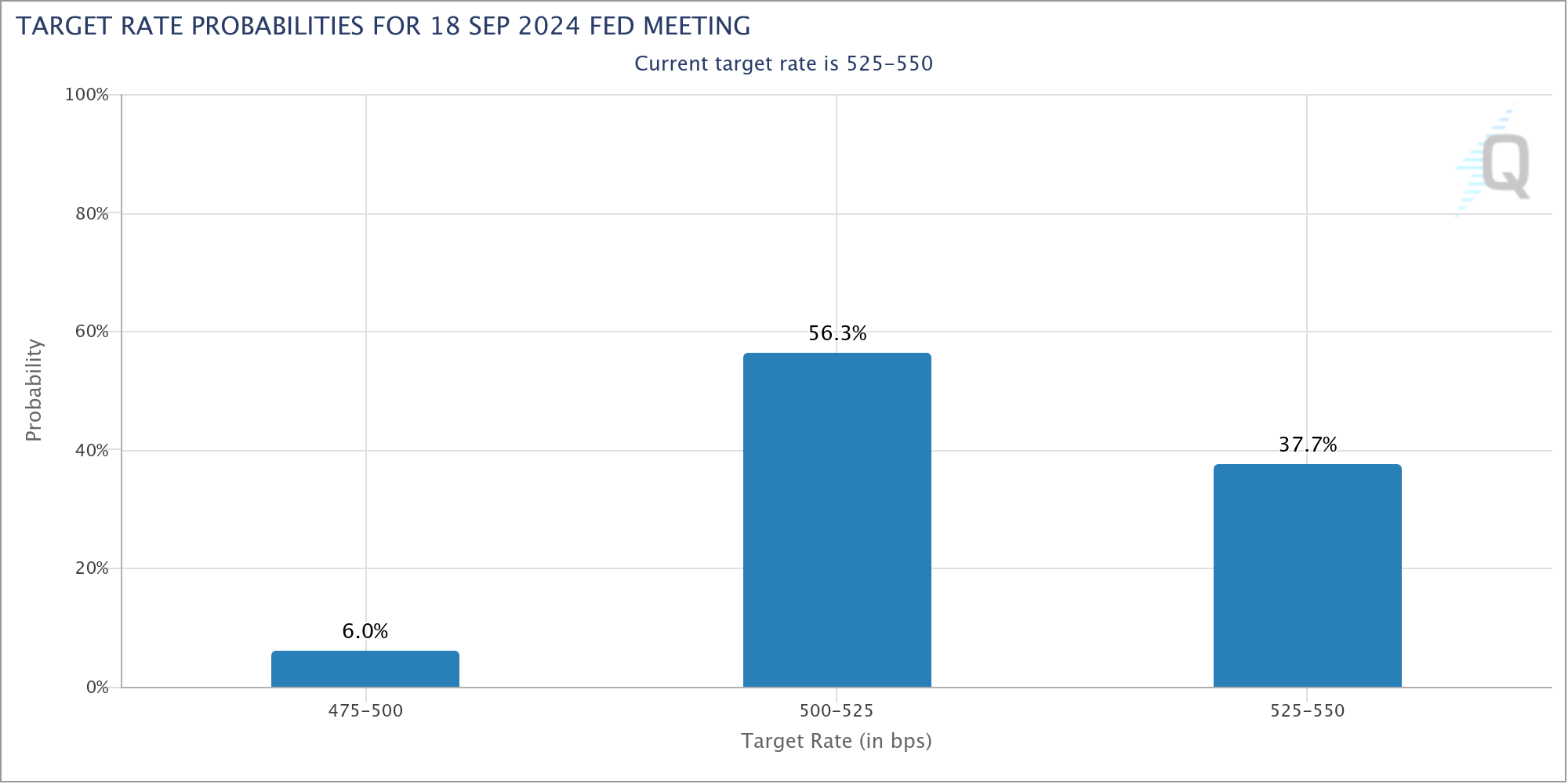

According to CME Fed Watch Tool, the higher share of rate projections for September is biased towards a rate cut:

Probability rates may shift after the PCE data release, with the market ready to react to the Fed’s next moves.

Disappointing results could lead the market to reduce expectations of two rate cuts this year, potentially pausing the anticipated economic stimulus through easing monetary policies.

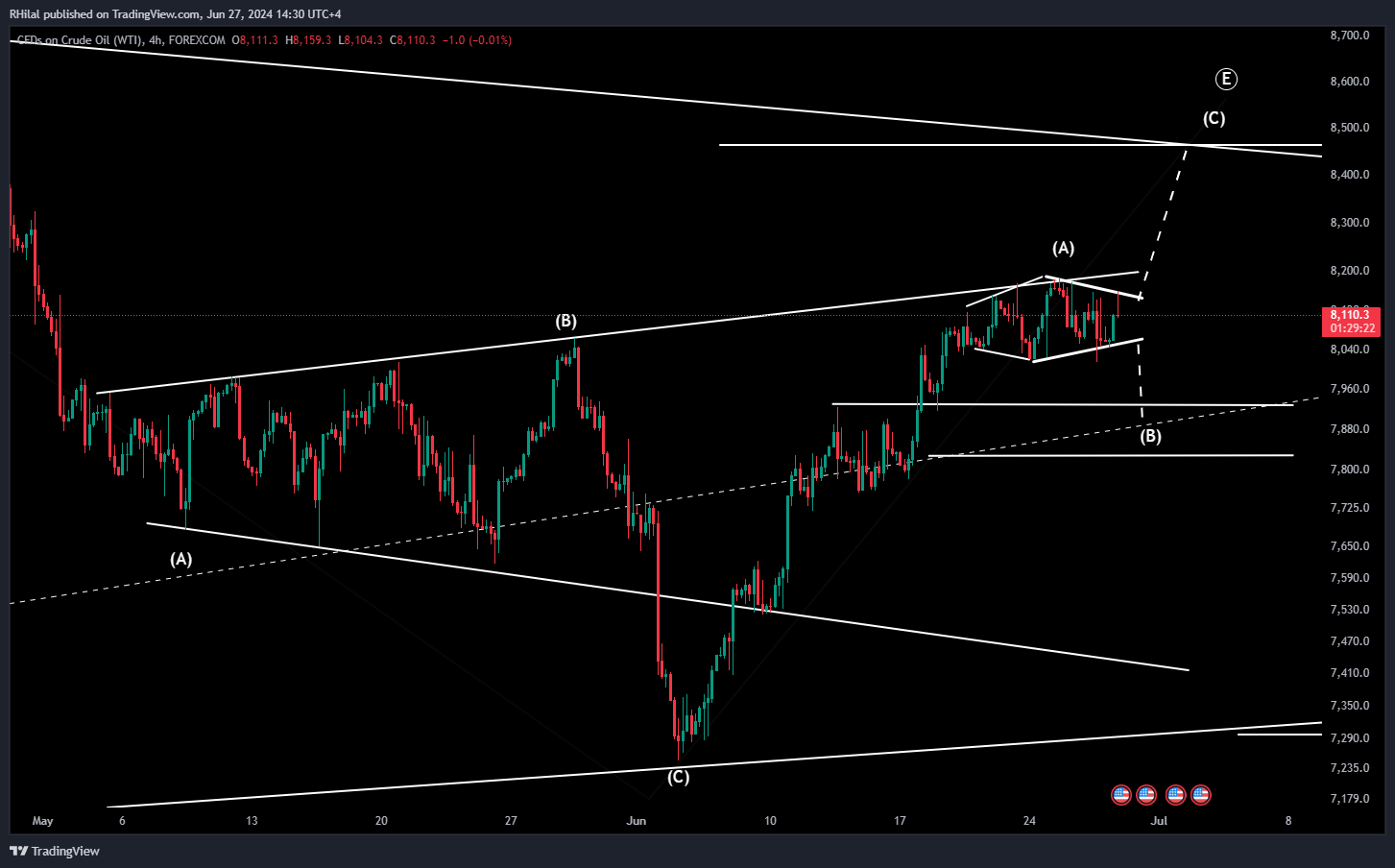

Crude Oil Forecast: USOIL – 4 Hour Time Frame – Logarithmic Scale

Source: Trading view

From a 4-hour perspective, the latest consolidation appears poised for a breakout. The advantage of consolidations is that they often predict potential targets in the breakout direction.

The possible pattern here can be a diamond, a pattern which combines a broadening pattern and contracting pattern simultaneously. Given a confirmed breakout direction for the oil prices beyond the consolidation:

- A break below 80 can meet a potential support near the 79 zone

- A break above 82 can meet a potential resistance near the 84.50 – 85 price range

Despite the recent surge in crude oil inventory data and the anticipated decline in U.S. GDP, oil remains at its two-month highs, awaiting the next fundamental push to continue its trends.

--- Written by Razan Hilal CMT