- USD falls after 8-week of gains

- USD-tracked treasury yields lower

- GBP supported by less dovish BoE comments this week

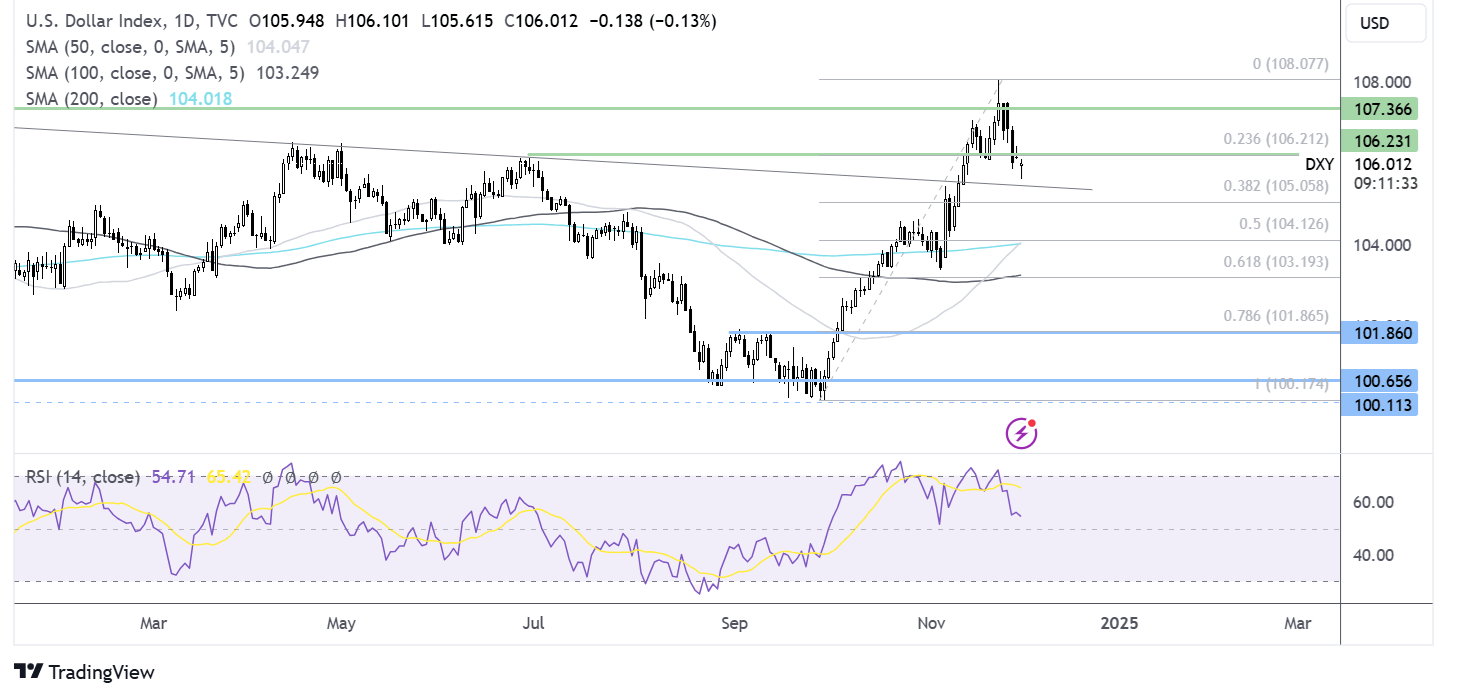

- DXY breaks below 23.6% fib retracement

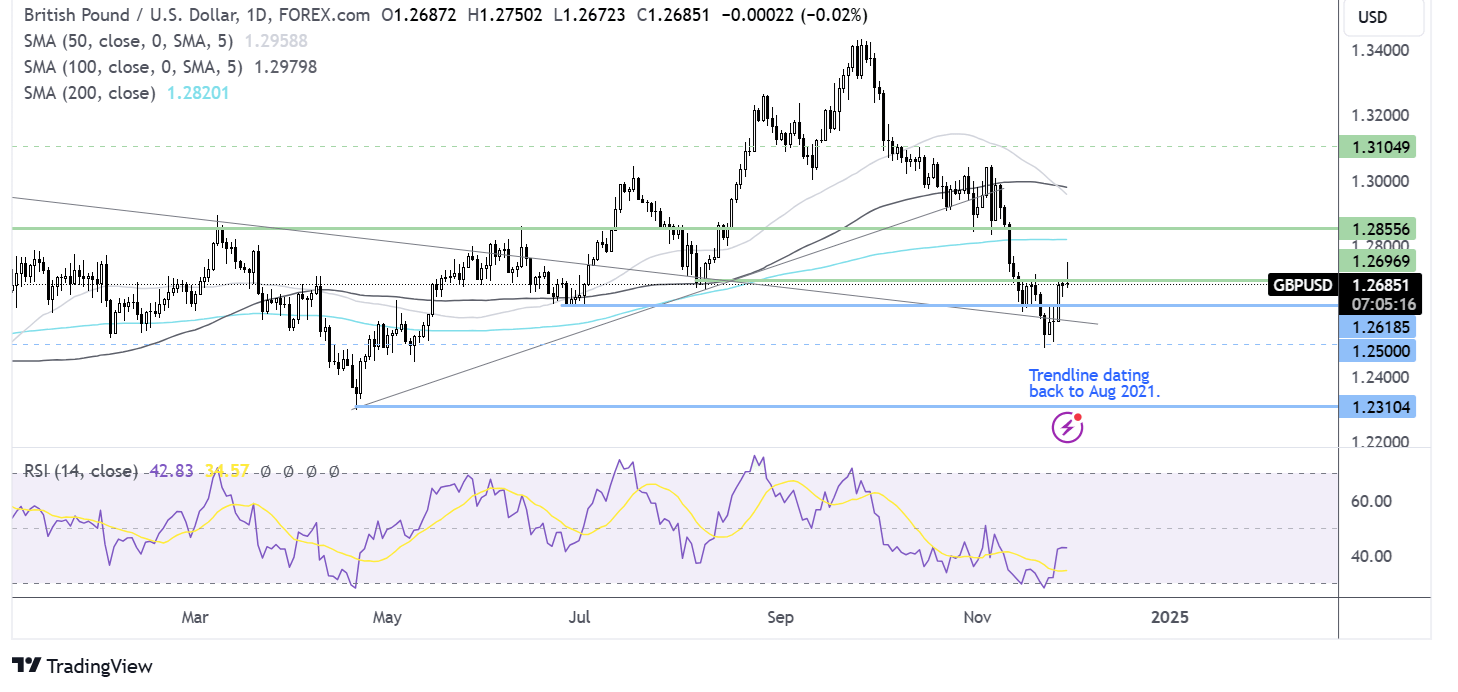

- GBP/USD fails to hold above 1.27

GBP/USD held steady on Friday but is on track for its largest weekly rise since mid-September as the US dollar gave back some of its Trump victory gains.

The dollar has fallen this week after eight straight weeks of games. The fall comes as the dollar tracks treasury yields lower following President-elect Donald Trump's pick of hedge fund manager Scott Bessent as Treasury Secretary. The appointment reassured investors as the Bessent is seen as an old hand on Wall Street, and it's hoped it will moderate some of Trump's more radical inflationary policies.

Interestingly, the US dollar continued to fall this week, even though U.S. data showed the economy to be resilient, with an upward revision to Q3 GDP and lower jobless claims. Meanwhile, inflation ticked higher to 2.8% from 2.7%. Later, the market reassessed the likelihood of a December rate cut by the Federal Reserve, increasing the probability to 68%, up from 55% at the start of the month.

Looking ahead to next week there is plenty of U.S. data for traders to contend with as traders return to their desks following the Thanksgiving long weekend. ISM services, as well as US non-farm payroll data after October’s 12k headline shocker. Any sign of a slowing economy could bring the USD lower.

Meanwhile, the UD has broken below a key technical level, the 23.6% retracement of the 100.15 low to 108.09 high, opening the door to further weakness..

The pound' booked gains this week despite a relatively quiet UK economic calendar. Instead, the pound found support from comments by Bank of England deputy governor Claire Lombardelli at the start of the week, who said she supported a slow, gradual pace of two rate cuts. The market is currently expecting around 75 basis points worth of rate cuts before the end of next year.

Today, the Bank of England's financial stability report warned that higher trade barriers could hit global growth, fueling uncertainty and creating volatility.

The pound has held up better than most other currencies against the USD this year. Economic growth has been satisfactory, while wage and service inflation have been sticky. This has limited the outlook for Bank of England rate cuts.

Looking ahead next week is a relatively quiet week for the UK economic calendar, which leaves USD and sentiment in the driving seat. Any further gains would likely be owing to USD weakness. That said the technical picture isn't convincing for the GBP/USD bulls.

GBP/USD forecast – technical analysis

GBP/USD has recovered from the 1.2487 November low, rising back above the 1.2620 June low but has failed to hold above 1.27. The long upper wick on today’s candle is not encouraging, which, combined with holding below the 200 SMA and the 50 SMA crossing below the 100 SMA, the picture remains bearish.

Buyers would need to close above 1.27 to move onto a more neutral setting before looking towards the 200 SMA at 1.2820.

Sellers will loom to take out 1.2560, the falling trendline dating back to August 2021, bringing the 2024 low of 1.2487 into focus. A break below here is needed to create a lower low.

Latest market news

Yesterday 11:06 PM

Yesterday 01:00 PM

November 30, 2024 12:00 PM

November 29, 2024 05:53 PM