US futures

Dow futures -0.17% at 37960

S&P futures +0.11% at 4855

Nasdaq futures 0.17% at 17393

In Europe

FTSE -0.17% at 7476

Dax -0.16% at 16625

- US muted after record highs yesterday

- Earnings season ramps up this week with NFLX after the close

- Oil gives back yesterday's gain

Stocks ease back from record highs

U.S. stocks point to a subdued start as investors look to a slew of quarterly corporate earnings and wait cautiously for key economic data later in the week.

The muted start comes after record highs in the previous session, which saw the Dow Jones rise above 38,000 for the first time and the S&P 500 book its third straight positive close for the first time this year.

After a weak start to 2024, stocks have rebounded strongly thanks to optimism over a soft landing and a strong performance in AI and chip-related stocks. The turnaround has come despite the market pushing back on rate cut expectations and pricing in less than a 50% probability of a rate cut in March, down from 85% late last year.

With no high-impacting economic data in focus today, all eyes are on corporate earnings with several big names due to report including Johnson and Johnson Procter and Gamble, 3M and Netflix and chipmaker Texas Instruments after the close.

Corporate news

United Airlines is flying around 6% higher after the airline posted 4Q results that beat estimates and despite the airline saying it expects a wider than forecast loss in the current quarter owing to the grounding of the Boeing 737 Max 9 jets. United Airlines posted EPS of $2.00 on revenue of $13.63 billion thanks to its busiest-ever travel period in the last two weeks of December.

Netflix is set to report after the close, and expectations are upbeat as the streaming giant continues to crack down on password sharing and thanks to the ad-supported tier. Expectations are for another quarter of surging subscriber numbers, which is set to rise by another 9 million, whilst EPS is expected to come in at $2.20 on revenue of $8.71 billion.

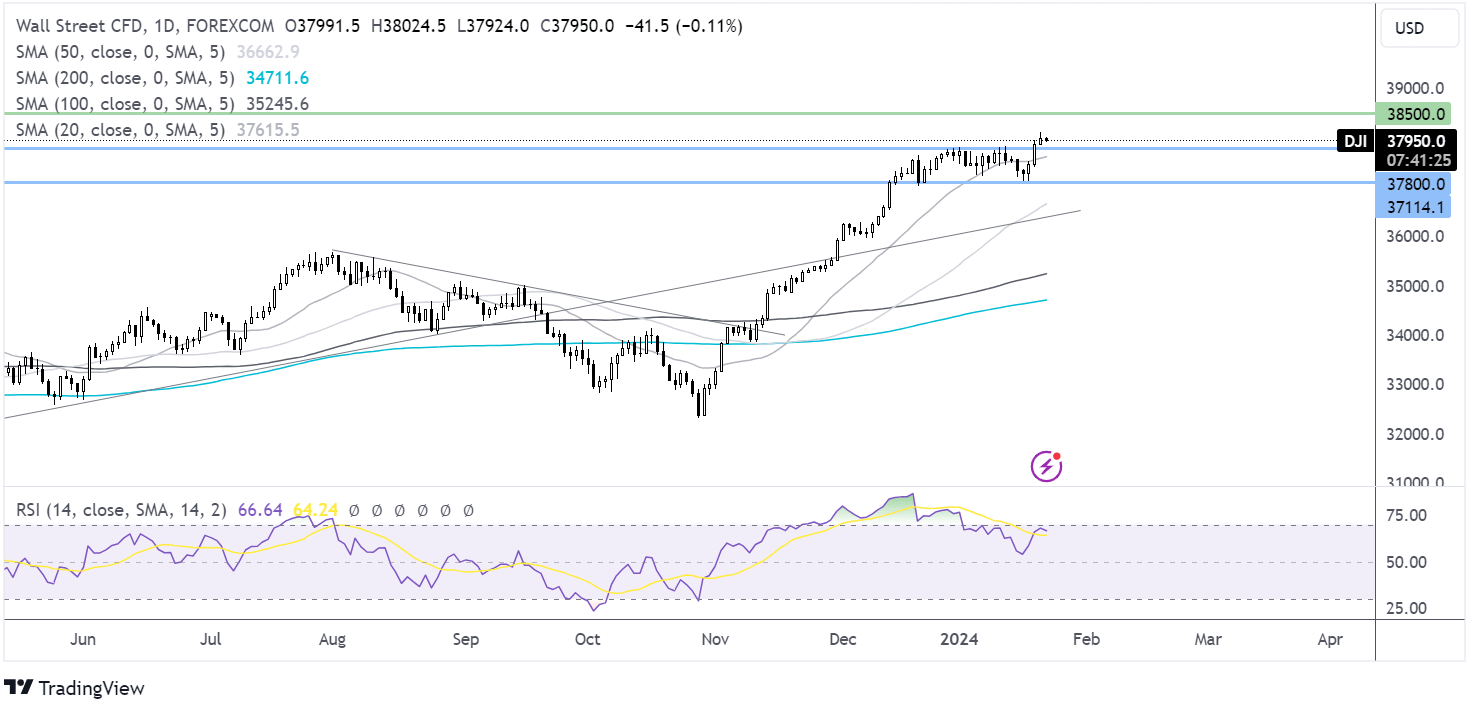

Dow Jones forecast – technical analysis

After a period of consolidation, the Dow Jones rose to a record high of over 38,000. The upside remains intact whilst buyers keep the price above 37,800, the previous high. A break below here could bring 37130, last week’s low, into focus.

FX markets – USD rises EUR/USD rises

The USD is rising after a weaker start as investors look ahead to key U.S. data at the end of the week. US GDP and core PCE Could provide further cues over the timing of the first-rate cut from the Fed.

EUR/USD is struggling against the stronger U.S. dollar as investors look cautiously ahead to the ECB interest rate decision later in the week. Consumer confidence is due to be released today and is expected to improve slightly. While this won't directly impact the ECB interest rate decision, it could be a signal or a sign that the economic slowdown in the eurozone has started to bottom out.

GBP/USD is showing resilience against the stronger U.S. dollar after UK government borrowing was significantly lower than expected at £7.77 billion, down from £13.2 billion a year earlier. This gives the government some wiggle room to cut taxes in the March budget should inflation continue falling towards 2%

Oil gives back yesterday’s gains.

Oil prices are falling after a 2% rally on Monday as investors continue to assess supply and demand factors.

An escalation in tensions in the Middle East supports the price as US and UK forces conducted further strikes on Houthi targets in Yemen.

Meanwhile, severe cold weather in the US is hitting supply. North Dakota's oil output remained impacted by the extreme weather conditions.

On the demand side, concerns over the health of the Chinese economy continue hurt the demand outlook for oil.

Crude inventories are due later and are expected to decline with the API report anticipated show fall of roughly 3,000,000 barrels.

.