US futures

Dow future 0.07% at 40900

S&P futures 0.17% at 5626

Nasdaq futures 0.27% at 19870

In Europe

FTSE 0.01% at 8281

Dax 0.17% at 18483

- Stocks quiet ahead of Fed Powell’s speech tomorrow

- FOMC minutes point to a September rate cut

- US payrolls were revised 818k lower

- Oil steadies after 4-days of losses

Stocks quiet post-Fed minutes & with Jackson Hole in focus

U.S. stocks are heading for a quiet start after gains in the previous session and amid a cautious mood as central bankers gather at Jackson Hole for the start of the Federal Reserve’s annual economic symposium.

The markets gained in the previous session and remain supported amid expectations that the Federal Reserve will cut rates in September. The FOMC minutes of the August meeting, released yesterday as good as confirmed the rate cut in September, while some policymakers even supported cutting rates in the July meeting.

With the Federal Reserve comfortable that inflation is cooling towards the 2% target attention is also turning towards the employment component of the Fed’s dual mandate.

Yesterday, US payrolls were revised downward by a chunky 818k, a sign that the US labour market is weaker than previously reported. The data supports the view that the Fed will be cutting interest rates in September, which means the market will be laser-focused on August NFP data in early September.

The markets will now look ahead to Federal Reserve chair Jerome Powell's speech on Friday at the Jackson Hole economic symposium for clues over the Fed’s outlook for interest rates and to see if Powell references yesterday’s downward revision.

Corporate news

Snowflake is set to open almost 10% lower after the software maker beat expectations for Q2 earnings and revenue but disappointed with guidance that failed to impress investors.

Urban Outfitters is set to open 12% lower after the retailer's Q2 same-store sales growth came in below forecasts, highlighting the pressure on consumers.

Peloton is set to open almost 10% higher after the fitness equipment maker returned to sales growth for the first time in nine quarters as its turnaround plan bears fruit. Losses were also narrower than expected, with a loss per share of $0.08

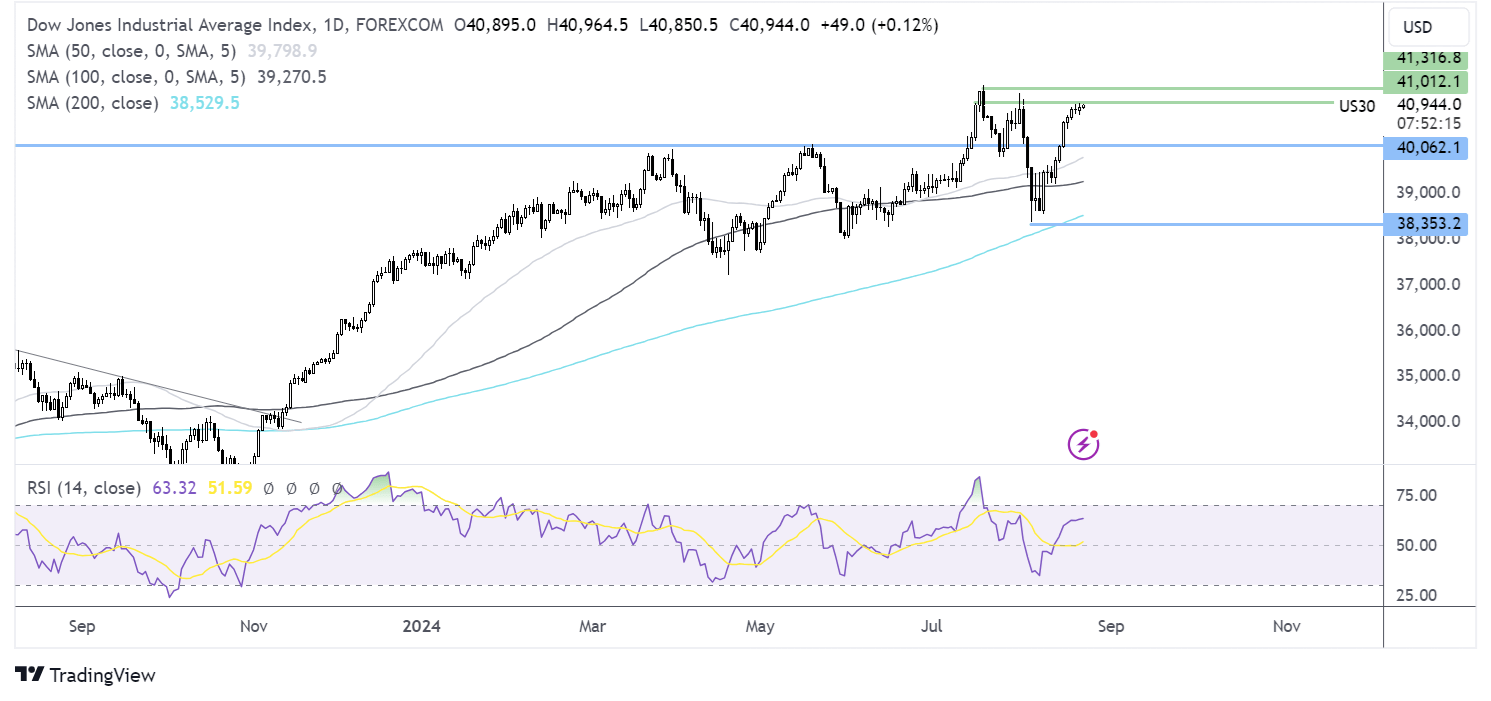

Dow Jones forecast – technical analysis.

The Dow Jones has extended its recovery towards 41k resistance. A rise above here brings 41,380 and fresh all-time highs into focus. On the downside, minor support can be seen at 40601, the weekly low ahead of 40k.

FX markets – USD rises, EUR/USD falls

The USD is edging higher, up from a year-to-date low. Gains will likely be limited amid rising expectations that the Fed will cut rates next month. The downward revision in US payrolls and the FOMC minutes supports the view the Fed will cut in September.

EUR/USD is falling after the ECB minutes guided towards a September rate cut. Data from the region was stronger than expected—business activity in the euro area rose to 51.2, up from 50.2 in July, well ahead of the 50.1 forecast, as services growth overshadowed a weaker manufacturing sector.

GBP/USD is rising and continues to trade around a year-to-date high. Stronger-than-expected PMI data are boosting the pound. Both the service sector and manufacturing sector activity expanded at a faster pace, causing the markets to further rein in September rate card expectations.

Oil steadies after 4-days of losses

Oil prices are inching higher after four days of losses. A decline in US fuel inventories steadied this week’s sell-off, caused by concerns over the global demand outlook and optimism of a ceasefire in Gaza.

Oil prices plunged yesterday following the downward revision to U.S. jobs data, which, combined with weak Chinese economic data, raised concerns over the demand outlook for oil prices.

However, the EIA oil inventory report underpinned prices, showing a larger-than-expected draw in U.S. stockpiles last week. Stockpiles fell by 4.6 million barrels, well above the 2.6 draws forecasted.

The recent fall in prices comes as OPEC is considering lifting voluntary output cuts as of October. This plan may be scrapped if downward pressure remains on prices.