US futures

Dow future -0.15% at 41160

S&P futures -0.25% at 5602

Nasdaq futures -0.4% at 19430

In Europe

FTSE 0.24% at 8354

Dax 0.47% at 18700

- Dow steadies below ATH

- The mood is cautious ahead of Nvidia earnings, US core PCE this week

- US consumer confidence data due

- Oil steadies after solid gains

Dow steadies below ATH

U.S. stocks are pointing to a muted open ahead of the keenly awaited Nvidia results on Wednesday and crucial economic data later in the week.

The S&P500 and the NASDAQ100 paused for breath in the previous session, weighed down by the tech sector, while the Dow Jones rose to a fresh all-time high.

Nvidia, which has been partly responsible for the recent bull market rally, is due to report after the close on Wednesday and is expected to show that quarterly revenue more than doubled; however, given its lofty valuation, even a slight miss could hurt the share price and more broadly risk sentiment.

Today, attention is on U.S. consumer confidence data, which is expected to tick higher, tracking Michigan consumer confidence northwards. However, the main focus on the economic calendar will be Friday's core PCE inflation print, which comes as the market is fully pricing in a Fed rate cut in September. While a rate cut is fully expected, the market is undecided on the size of that rate cut, pricing in a 28.5% chance of a 50 basis points cut compared to 71.5% chance of a 25 basis point cut.

Corporate news

Apple is edging lower on news that long-time CFO Luca Maestri will be stepping down from his role at the start of 2025.

Eli Lilly is falling over 1% ahead of the open after the drug giant announced it has released a new form of its weight loss drug Zepbound for roughly half its usual monthly list price.

JD.com rose 3.9% after the Chinese online retailer announced a new $5 billion share buyback programme across the next 36 months.

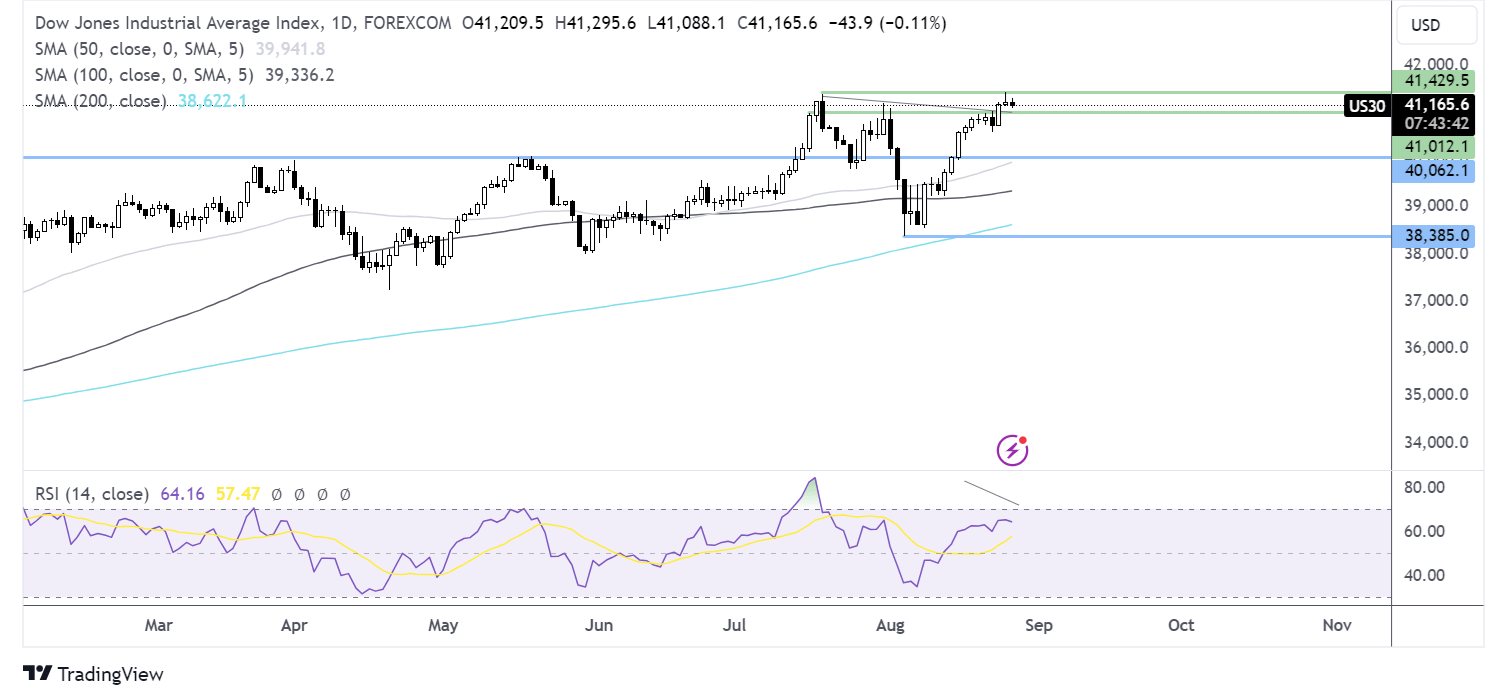

Dow Jones forecast – technical analysis.

Dow Jones is hovering above 41k after rising to a new ATH of 41,427 in the previous session. Buyers, supported by the RSI above 50, could look to rise above 41,427 towards 42k, the next logical step for bulls. Immediate support sits at 41k, the round number ahead of 40k, which is the May high.

FX markets – USD flat, GBP/USD rises

The USD is holding steady around a 13-month low compared to its major peers, pressured by expectations that the Federal Reserve will start cutting interest rates next month.

EUR/USD is holding steady below 1.1175 after a slew of data raised concerns over the health of the German economy. German GDP for Q2 confirmed a 0.1% contraction, and German consumer confidence plunged to -22 from -18.6 amid concerns over the labor market outlook. The data comes after the German Ifo business climate deteriorated for a fourth month as economic conditions worsened in the eurozone's largest economy.

GBP/USD has risen to a multi-year high after UK PM Keir Starmer warned the autumn budget will be painful. This is his strongest hint yet of tax rises, likely aimed at the highest earners to improve public finances. The pound also benefits from expectations that the Bank of England will unlikely cut interest rates further until November.

Oil steadies after steep gains on supply concerns

Oil prices are inching lower after rallying over 7% across the previous three sessions on supply concerns. Worries over supply have been prompted by fears of a broadening Middle Eastern conflict and a potential shutdown of Libya's oil fields.

A clash between Libya's leadership and the country's central banks resulted in authorities threatening to halt oil production and exports. However, there has been no confirmation from the national oil corporation or the recognized government in Tripoli that controls the countries or resources.

Meanwhile, an escalation in the conflict between Israel and the Iran-backed Hezbollah over the weekend also highlighted the fragility of the situation in the Middle East. The conflict threatens to broaden out lifting the risk premium on oil prices.