US futures

Dow future 0.29% at 42326

S&P futures 0.05% at 5838

Nasdaq futures -0.28% at 20495

In Europe

FTSE -0.70% at 8235

Dax 0.14% at 19471

- Stocks slip after US GDP was slower than forecast

- ADP payrolls were stronger than expected ahead of Friday’s payrolls

- Alphabet soars after earnings

- Oil steadies around a monthly low

US GDP grew at a slower pace, Alphabet impressed

U.S. stocks are heading lower on Wednesday after disappointing growth data, although a surge in Alphabet is limiting losses after the technology giant posted strong quarterly results.

Data showed that the US economy grew at a slower pace than expected in Q3, with GDP rising by 2.8% in July and September—below the 3% pace expected and seen in Q2. Meanwhile, core PCE across the quarter was slightly hotter than forecast, which, combined with the resilient labour market, may make it more difficult for the Fed to cut rates aggressively.

ADP private sector employment grew by 233,000, up from a revised 159 thousand in the previous month. This was well ahead of forecasts and is a closely watched lead indicator for Friday's non-farm payroll data.

Data this week has been mixed ahead ahead of next week's Federal Reserve interest rate decision where the central bank is widely expected to cut rates by 25 basis points.

Attention is also on the US elections next week is stuck at stock market fidelity could pick up ahead of the voting on the 5th of November.

Corporate news

Alphabet is rising 7% premarket after the Google parent posted stronger-than-expected earnings for the September quarter, stating that its AI investments were now bearing fruit. Its cloud business, which is closely linked to AI, grew at its fastest pace in eight quarters, while election-related spending also boosted advertisement sales, particularly on YouTube.

Strong earnings from Alphabet are setting an upbeat tone for tech earnings this week. Meta Microsoft will report after the close today, and Amazon and Apple will report on Thursday.

AMD is opening over 10% lower after the chip company’s revenue failed to impress investors who were looking for a bigger boost from the AI boom.

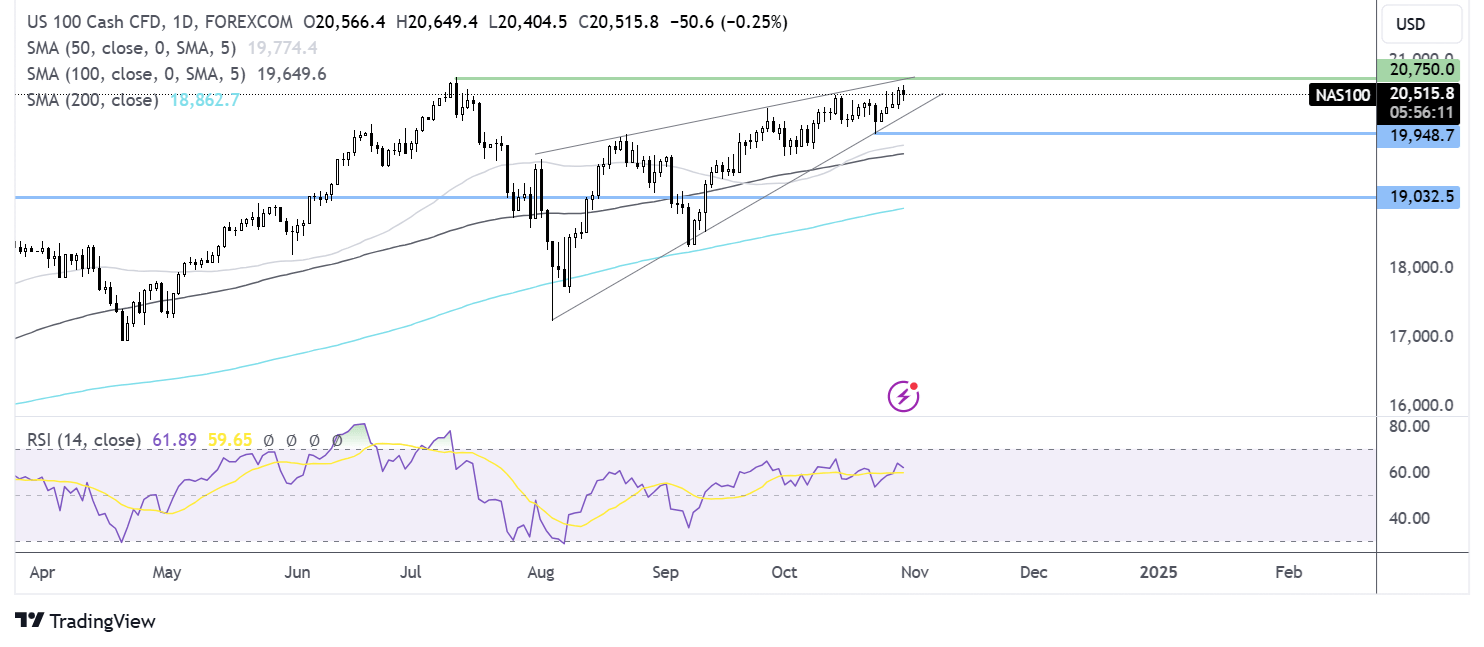

Nasdaq100 forecast – technical analysis.

The Nasdaq trades within a rising triangle. The price recovered from the 19930 low, rising above 20k, and, supported by the RSI above 50 is eyeing 20750, the record high. Support can ben seen at 20k and a fall below here creates a lower low.

FX markets – USD rises, EUR/USD falls

The USD is falling after data showed that the US economy grew at a slower pace than expected in Q3. Still, the USD remains near a three-month high on expectations the Fed will cut rates gradually and on the Trump trade.

EUR/USD is rising after Eurozone GDP was stronger than forecast in Q3 at 0.4%, double the 0.2% expected. German inflation was also stronger than expected. However, the ECB are still expected to cut rates in December.

GBP/USD recovered from daily lows after the Labour Chancellor Rachel Reeves delivered a budget where she managed to keep the markets happy with no outsized move in gilts or sterling. Bets on BoE rate cuts didn’t move much across the session.

Oil hovers around 1-month low

Oil prices continue to hover around a one-month low after falling for the past two days as investors weigh a possible ceasefire in the Middle East, rising OPEC+ crude supplies, a possible drop in US fuel inventories, and demand concerns.

Optimism is rising that Israel’s Prime Minister Benjamin Netanyahu would hold a meeting to consider talks on a diplomatic solution to the war in the Middle East.

Traders continue to be concerned about the prospect of OPEC+ reining in voluntary output cuts from December. This would exacerbate an already soft market.

API inventories fell last week by 573k in the week ending October 25, defying expectations of a 2.2 million barrel rise. EIA inventories are due later today.

On the demand side, concerns over China's demand outlook continue to weigh on the price despite the recently announced Chinese stimulus measures.