US Dollar rips higher as simmering inflation fears crush Fed rate cut hopes

- US inflation risks curtail Fed rate cut expectations, boosting US dollar

- Strong US CPI report today may amplify dollar strength

- EUR/USD hits multi-year lows, with further downside in sight

- USD/JPY rallies as Treasury yields climb and momentum shifts higher

Overview

Wednesday’s US consumer price inflation report could be the catalyst to spark an extended Fed pause, likely fuelling further gains in the US dollar against other major currencies.

With the economy powering ahead, even before the prospect of highly expansionary fiscal policy from the Trump administration, further signs of sticky inflationary pressures could push markets to flirt with the idea that the next Fed move may be a hike. As unlikely as that sounds, it’s something traders need to be prepared for as they double down on Trump trades, underpinned by expectations for a string of rate cuts ahead.

US inflation fight may not be over

The US economy simply won’t quit, defying expectations that higher interest rates would slow it down meaningfully. Instead, growth is running well above perceived potential, pointing to the risk of lower unemployment and higher inflation.

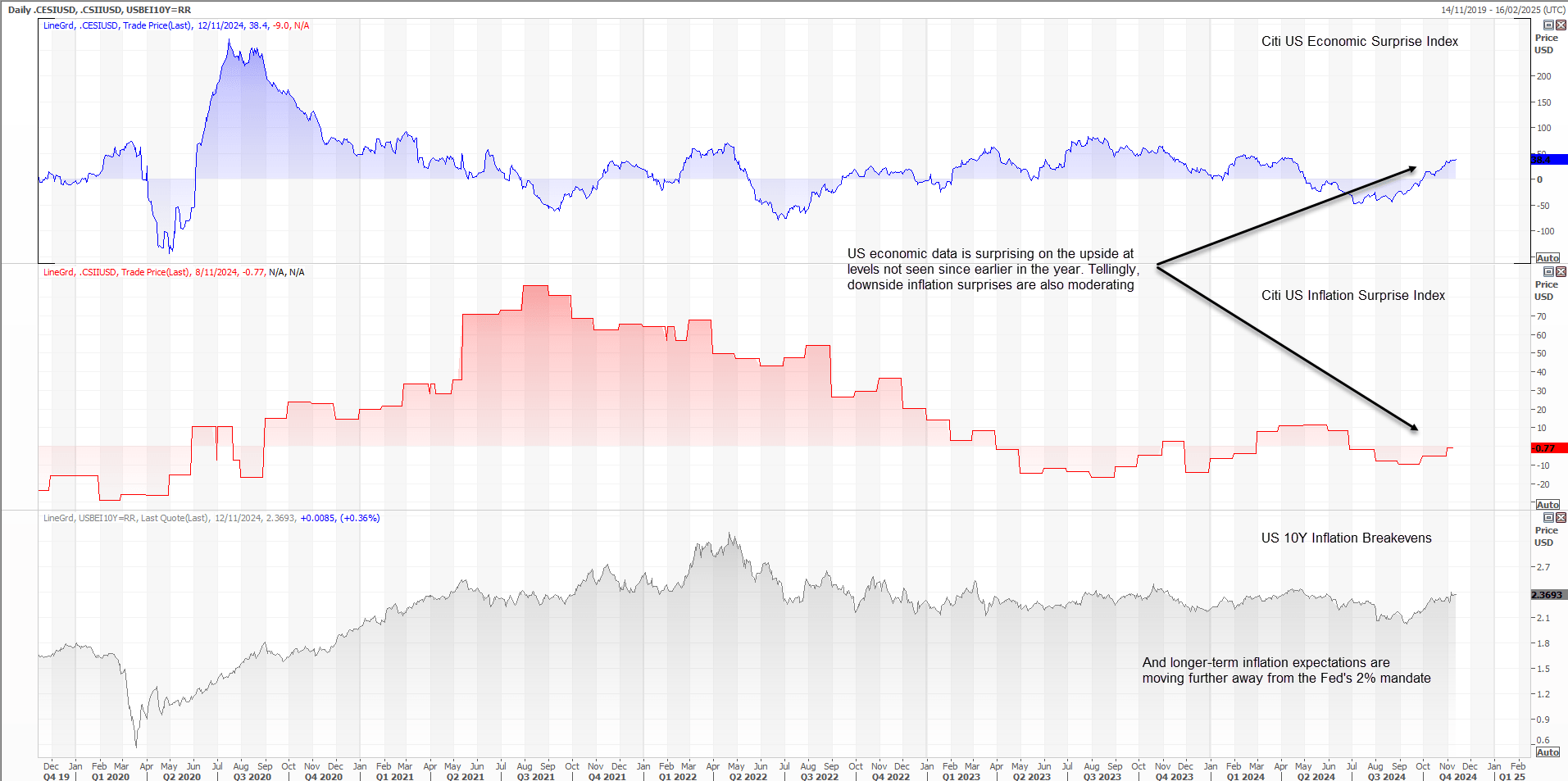

The Citi Economic Surprise Index has surged to multi-month highs, as shown below, with most data releases now topping forecasts despite much higher market expectations. Tellingly, US inflation surprises are now moderating after undershooting earlier this year. Longer-term market-based inflation expectations are also at multi-month highs, reflecting concerns the Fed may not be able—or willing—to bring inflation back to its mandated 2% target.

Source: Refinitiv

US core consumer price inflation has risen 0.3% in each of the past two months, with another 0.3% print forecast later today. Annualized on a one- and three-month basis, that's nearly double the Fed’s 2% target. While it’s not the Fed's preferred measure, 0.3% gains simply don’t get the job done.

Fed rate cut pricing evaporating fast…

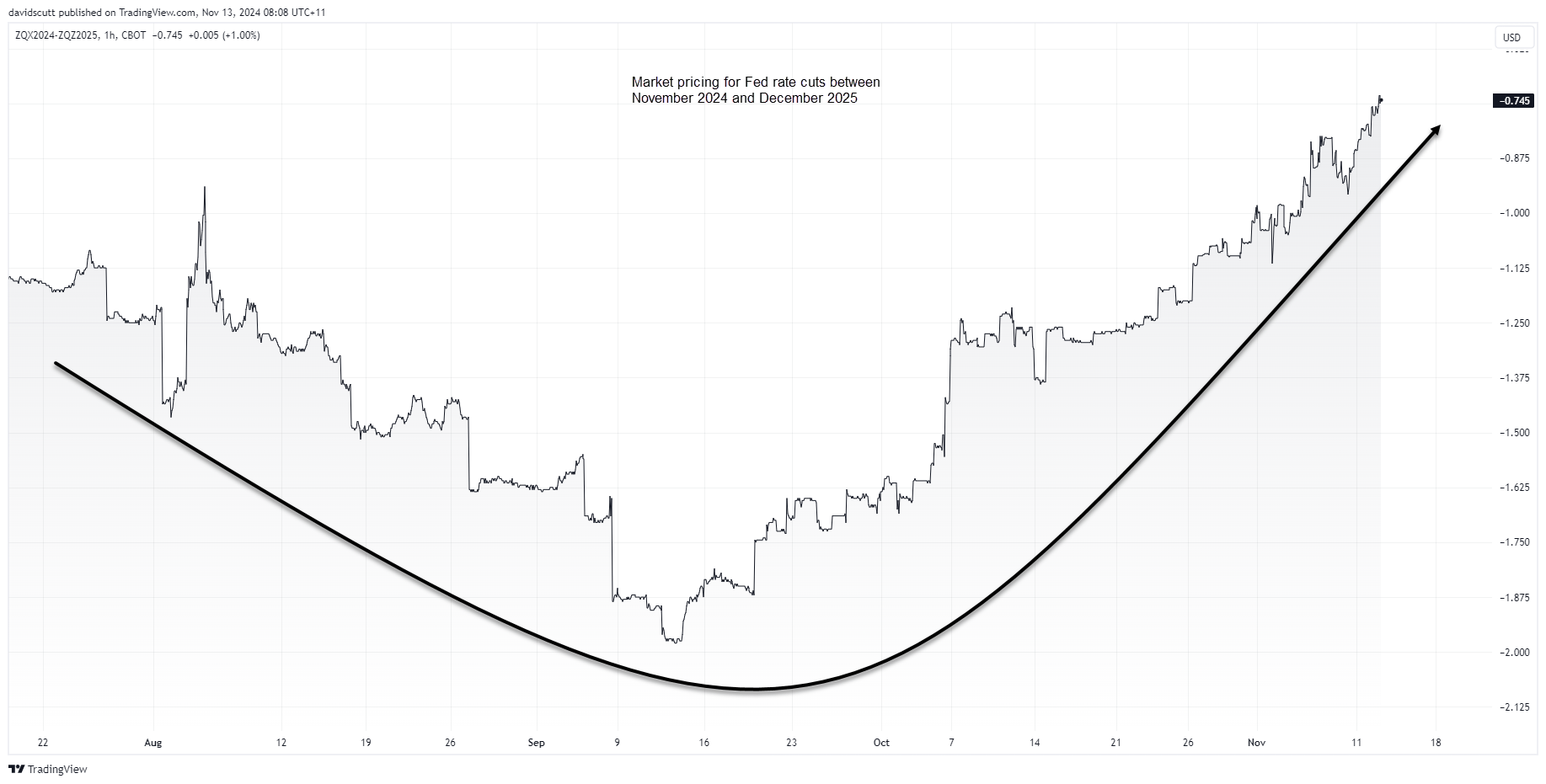

With inflation concerns rising, expectations for Fed rate cuts by the end of 2025 are evaporating faster than a puddle in Death Valley during summer. When the Fed started its easing cycle in September, markets anticipated nearly eight 25bps cuts between November 2024 and December 2025. Now, that’s down to three. The trend is obvious, and it's powering US dollar strength.

Source: TradingView

…and that’s fuelling US dollar strength

The next chart shows the rolling 10-day correlation between the US dollar index (DXY) and US interest rates across the yield curve. The strongest relationship has been with short-term rates, most influenced by monetary policy expectations.

So, it’s no surprise that on the same day US two-year Treasury yields hit fresh post-election highs, the DXY surged to multi-year highs.

Source: TradingView

DXY breaks nemesis downtrend

It’s not just fundamentals contributing to the bullish US dollar story. Technicals are also working in its favour with the DXY breaking above a long-running downtrend that has sparked multiple bearish reversals in the past. The weekly chart tells the story.

If we don’t see a meaningful reversal back below the trendline in the coming days, which would likely require a significant US inflation undershoot or retail sales data on Friday to unravel from a fundamental perspective, it may embolden traders to buy the break looking for a continuation of the bullish move. Momentum is to the upside, with common indicators such as RSI (14) not yet overbought on the weekly timeframe.

Source: TradingView

EUR/USD sick and unloved, understandably

EUR/USD looks like it's ready for last rites on the daily timeframe, briefly sinking to multi-year lows on Tuesday before bouncing into the close. With Europe’s largest economy in political turmoil and no obvious plan to boost activity other than cutting interest rates, only an undershoot in the US inflation report may prevent a deeper slide for the euro.

Source: TradingView

Honestly, the only thing the euro has going for it right now is just how unloved it is, creating the potential for short-term squeezes. But without fundamentals underpinning them, these rallies are likely to be brief.

USD/JPY bulls regain ascendancy

When writing the USD/JPY week ahead report over the weekend, the reversal in US Treasury yields following the initial post-election surge had me thinking that risks were tilting lower, especially with momentum rolling over. How wrong I was!

Not only has USD/JPY gone in the opposite direction, but it’s also taken out last week’s high. With RSI (14) and MACD on the verge of generating fresh bullish signals, and the price remaining in an obvious uptrend, the path of least resistance is now skewing higher, barring a US inflation undershoot.

Source: TradingView

155.36 is a level on the radar, a minor level that acted as support and resistance briefly in early stages of the bearish USD/JPY unwind that began in July. A break of that could encourage traders to buy with a stop beneath for protection. A retest of the level—if broken—could improve the trade’s chances of success. Pullbacks towards the uptrend established in early October would also offer a setup, allowing longs to be established with a stop beneath for protection. Aside from 155.36, 160.23 and 161.95 loom as possible targets.

-- Written by David Scutt

Follow David on Twitter @scutty

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

FOREX.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.

FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

GAIN Global Markets Inc. has its principal place of business at 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA., and is a wholly-owned subsidiary of StoneX Group Inc.

© FOREX.COM 2024