EUR/USD, FTSE Forecast: Two trades to watch

EUR/USD holds steady ahead of tomorrow's ECB rate decision

- Eurozone PPI & Composite PMI data is up next

- Weak US data has raised Fed rate cut expectations

- EUR/USD holds steady below 1.09

EUR/USD is holding steady after losses yesterday, as investors show caution ahead of tomorrow's ECB interest rate decision.

The central bank is widely expected to cut interest rates by 25 basis points to 3.75%. However, given the uptick in inflation, the recovery of the economy, and record-low unemployment, they could do so with a hawkish tone.

Today, the focus is on eurozone PPI inflation data, which is expected to fall -0.5% Month over Month in April, down from 0.4% in March. On an annual basis, PPI is expected to be -5.1 % after falling -7.1% in the previous month. Cooling PPI bodes well for continued cooling in CPI inflation.

Eurozone business activity data as measured by the composite PMI will also be in focus. It's expected to confirm that business activity expanded at a faster pace in May, at 52.3, up from 51.7, supporting the view that the economy is recovering from its downturn.

USD is rising against its major peers in choppy trade as markets weigh weaker-than-expected data and investors look ahead to Friday's nonfarm payroll report.

Weak ISM manufacturing PMI figures on Monday sent the USD to a two-month low on concerns over the health of the US economy. Week-jolt job openings yesterday helped the dollar rise amid some safe-haven demand.

Equally, the US dollar index trades close to a two-month low amid rising expectations that the Federal Reserve will cut rates in September. The markets now price in a 65% probability of a September rate cut, up from under 50% last week.

Today, ISM services PMI and ADP payrolls will be in focus weaker than expected data could send the US dollar lower.

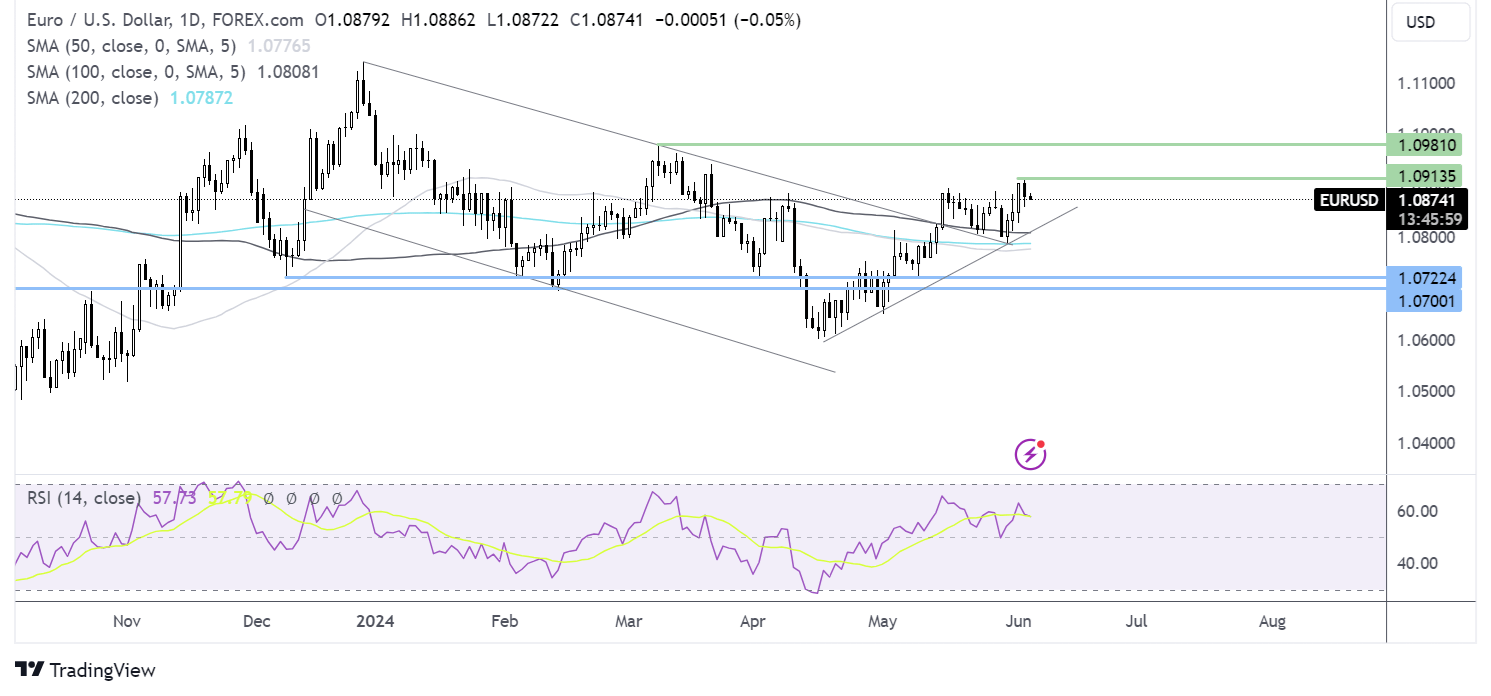

EUR/USD forecast – technical analysis

EUR/USD found support at the 200 SMA and the falling trendline support, and rebounded higher before running into resistance at 1.0915.

Buyers could look to extend this move above 1.0915 towards 1.0980 the March high.

On the flipside, support can be seen at 1.0780 the 200 SMA and last week’s low. A break below here opens the door to 1.0725 and 1.07.

FTSE rises as rate cut optimism & strong China data lifts the index

- China services PMI beat forecasts & UK services PMI is up next7

- BoC and ECB could cut rates this week

- FTSE consolidates above 8250

The FTSE is rising after a positive close on Wall Street. Weaker-than-expected job openings added to expectations that the Federal Reserve will start to cut interest rates soon.

Central Banks are very much in focus this week, with the Bank of Canada expected to cut rates today and the ECB tomorrow fueling optimism surrounding looser monetary conditions.

The mood is also upbeat after stronger-than-expected Chinese services PMI data. The data experienced a notable surge in May, marking its fastest pace of growth in 10 months thanks to persistent stimulus measures from Beijing.

The FTSE will now look towards UK services PMI figures, which are expected to show that the dominant sector expanded at a slower pace in May. The services PMI was 52.9 in May, down from 55. This is the second reading, so it's unlikely to be as market-moving as the preliminary.

In the US session, the ISM services PMI and ADP jobs report will be of interest, particularly after the weaker-than-expected manufacturing ISM and the softer Jolts job openings yesterday. The differing market reactions to the weak data indicate that the market is struggling to find a narrative. On the one hand, weak data raises concerns over the health of the US economy, while on the other hand, soft data brings market rate cut expectations forward.

FTSE Forecast – technical analysis

The FTSE has recovered from the 50 SMA, rising above the rising trendline and is holding steady around 8250. The RSI is neutral, giving away few clues.

Buyers will look to rise above 8350 to extend gains towards the 8400 round number and 8480 to fresh ATHs.

Sellers would need to take out 8200, the weekly low and the rising trendline support to test the 50 SMA at 8150. A break below here creates a lower low and brings 8000 into focus.

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

FOREX.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.

FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

GAIN Global Markets Inc. has its principal place of business at 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA., and is a wholly-owned subsidiary of StoneX Group Inc.

© FOREX.COM 2024