Trump tariff threat roils markets: USD surges, CAD, AUD, NZD sink

- Trump vows 25% tariffs on Canada, Mexico exports, additional 10% on China

- USD surges, commodity currencies crunched

- USD/CAD clears 1.4105; AUD/USD nears key .6441 support

Overview

Donald Trump has doubled down on his threat to impose large tariffs on major trading partners, warning one of his first executive orders will be to introduce 25% taxes on goods entering the United States from Canada or Mexico, along with additional 10% tariffs on Chinese exports.

The US dollar has surged on the headlines, reflecting that it will increase the risk of managed depreciations in other currencies to counteract the tariff charges. It also raises serious questions regarding the narrative that Trump’s treasury secretary pick, Scott Bessent, will be able to act as a voice of reason to deliver market friendly policy outcomes, including regarding tariffs.

Currencies from small, open economies with large trade sectors have been among the hardest hit, with the Canadian and New Zealand dollars hitting fresh 2024 lows . AUD/USD is also not far off.

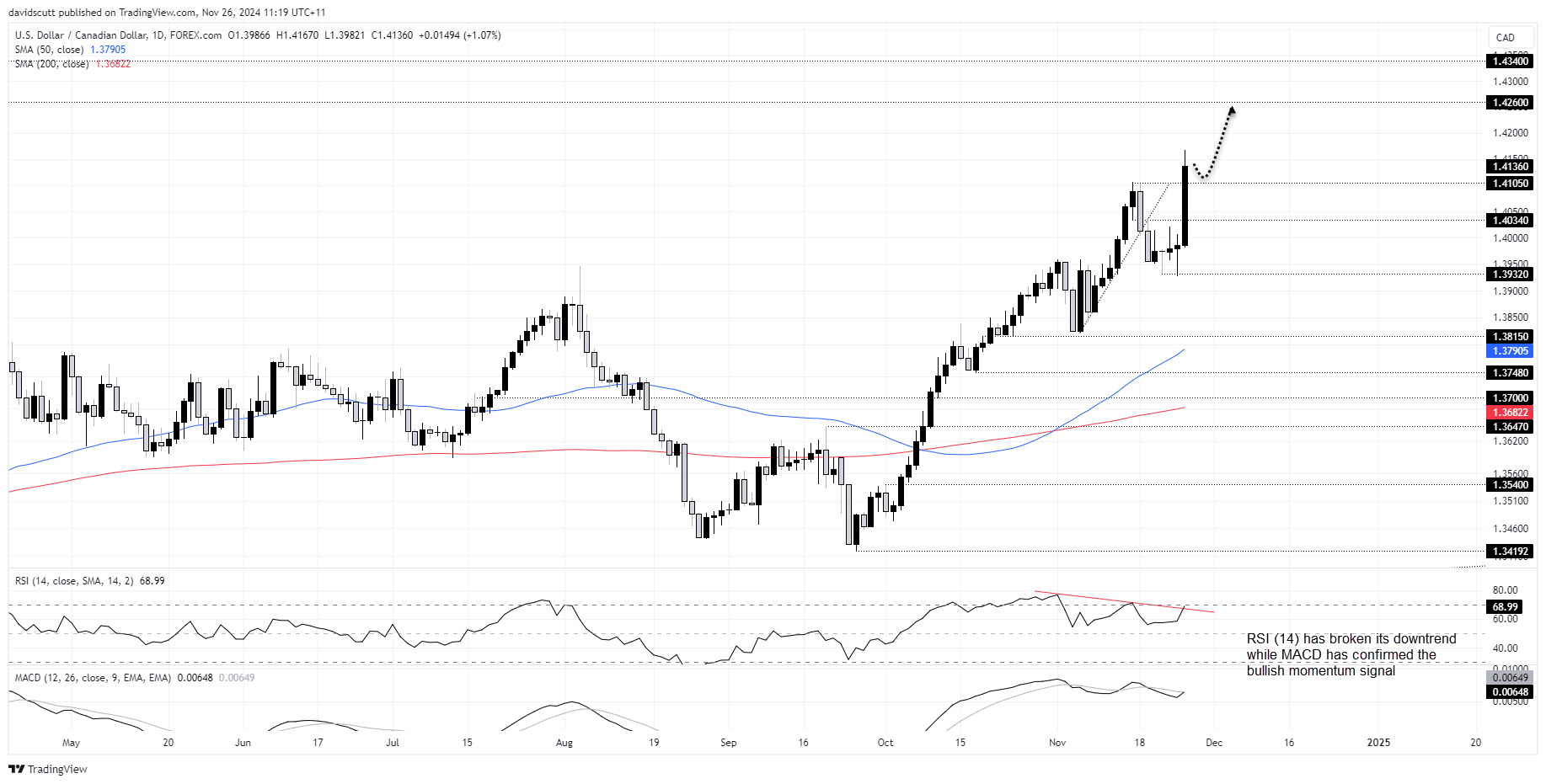

USD/CAD hits four-year high

Source: Trading View

USD/CAD has taken out 1.4105 with ease on the headlines, rising to levels not seen since the early stages of the pandemic. Having acted as resistance previously, the break may now see it revert to support, allowing for potential long setups to be established above with a tight stop beneath for protection.

There are only minor levels before we get to the pandemic highs of 1.4668, with only 1.4260 and 1.4340 in between. They loom as initial targets. Improving the probability of long trades, MACD and RSI (14) have generated fresh bullish signals on momentum, although the latter sitting in overbought territory is a reminder to ensure risk management is at the forefront of thinking.

AUD/USD teeters above 2024 low

Source: Trading View

Even though Trump did not specifically mention Australia, as a currency pair often used as a China proxy, AUD/USD has been hammered on the headlines, leaving it teetering just above the year-to-date low of .6441 after slicing through minor support at .6480.

The momentum picture has not turned outright bearish for the Aussie, although both RSI (14) and MACD look like they may soon rollover. Keep an eye on .6441 – if the price holds the level, consider buying ahead it with a very tight stop beneath for protection. It would be preferential to see the price interact with the level first before proceeding.

Alternatively, if .6441 is broken, shorts could be established below with a very tight stop above for risk management. .6380 – the location of key uptrend support – would be the initial trade target.

NZD/USD a sell-on-rallies play

Source: Trading View

NZD/USD is another name in a world of hurt, briefly touching 2024 lows before bouncing from below .5800. The Kiwi is stuck in a downtrend with momentum entirely with the bears, ensuring the bias remains to sell rallies until given an obvious signal to do otherwise. Shorts could be established on approaches towards the downtrend with a stop above for protection. Beyond the lows set earlier today, .5774 is one potential target.

While we may see positioning tweaks in the Kiwi ahead of the RBNZ rates decision on Wednesday, as covered in a separate post last week, it’s bee the US rates outlook that has been dictating NZD/USD movements recently.

-- Written by David Scutt

Follow David on Twitter @scutty

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

FOREX.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.

FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

GAIN Global Markets Inc. has its principal place of business at 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA., and is a wholly-owned subsidiary of StoneX Group Inc.

© FOREX.COM 2024