EUR/USD, GBP/AUD analysis: European open – Jan 24, 2024

Asian Indices:

- Australia's ASX 200 index rose by 4.3 points (0.06%) and currently trades at 7,519.20

- Japan's Nikkei 225 index has fallen by -282.34 points (-0.77%) and currently trades at 36,235.23

- Hong Kong's Hang Seng index has risen by 231.67 points (1.51%) and currently trades at 15,585.65

- China's A50 Index has risen by 39.2 points (0.36%) and currently trades at 11,009.26

UK and European indices:

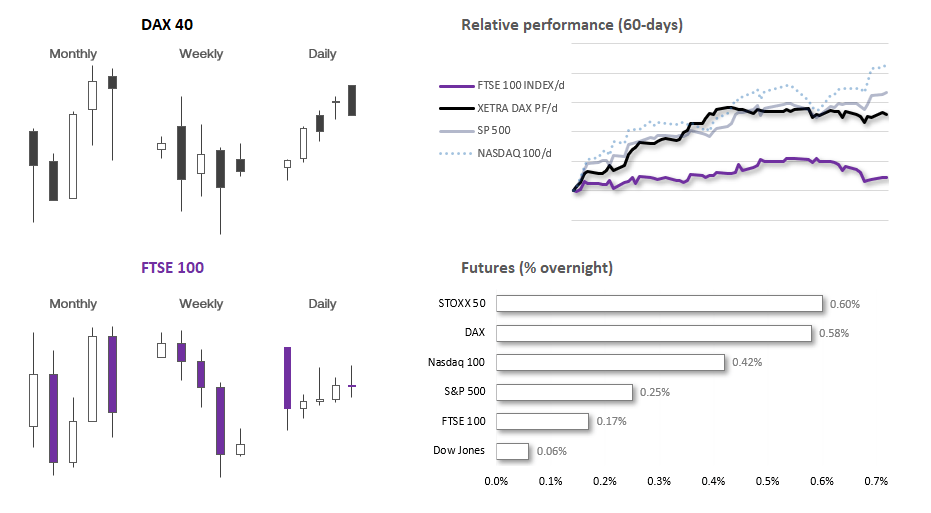

- UK's FTSE 100 futures are currently up 14 points (0.19%), the cash market is currently estimated to open at 7,499.73

- Euro STOXX 50 futures are currently up 27 points (0.6%), the cash market is currently estimated to open at 4,492.91

- Germany's DAX futures are currently up 100 points (0.6%), the cash market is currently estimated to open at 16,727.09

US index futures:

- DJI futures are currently up 24 points (0.06%)

- S&P 500 futures are currently up 12.5 points (0.26%)

- Nasdaq 100 futures are currently up 74.25 points (0.42%)

Events in focus (GMT):

- 08:15 – French flash PMIs (manufacturing, services, composite)

- 08:30 – Germany flash PMIs (manufacturing, services, composite)

- 09:00 – Eurozone flash PMIs (manufacturing, services, composite)

- 09:30 – UK flash PMIs (manufacturing, services, composite)

- 14:45 – US flash PMIs (manufacturing, services, composite)

- 15:00 – BOC interest rate decision (looking for dovish clues)

S&P global release their flash PMI reports for the major regions today. So far we have seen quite a mix amongst PMI reports in Asia, with New Zealand manufacturing souring, manufacturing for Australia expand and above expectations, yet contract in Japan whilst their services surprised to the upside with an expansion. With no clear pattern from Asia, we’re hoping for some cleaner data sets from Europe and the US. Currency traders will like to see a divergence between regions; such as weak PMI data for Europe and strong from the US for bearish EUR/USD bets (or bullish on the US dollar). And if UK data were to disappoint, it could see GBP/JPY pull back further from its highs after failing to break the December 2015 high yesterday.

The Bank of Canada are highly likely to hold their rates at 5% for a fourth consecutive meeting, with no immediate case for any hikes and a growing case for their first cut. Their last statement noted that there is “growing evidence that past interest rate increases are dampening economic activity and relieving price pressures”, so focus will shift straight to the statement to see if it delivers a similar tone. However, also note that their quarterly monetary policy report will be released which includes their updated forecasts for growth an inflation, which itself can provide guidance on if or when they may begin easing rates.

EUR/USD technical analysis (1-hour chart):

The euro if suffering from the same chart noise as the US dollar index; current price action on the daily chart is surrounded by 50 and 200-day averages and EMAs. Still, EUR/USD has retraced around 50% of Tuesday’s decline, and prices are now meandering around the weekly pivot point and prior cycle lows. There’s also a high-volume node (HVN) just above the 50% retracement level which could well attract prices, so I’m on guard for a spike or two higher before momentum turns lower.

Ultimately, I am bullish on the US dollar so seeking short opportunities on EUR/USD. A weak PMI report form Europe and strong data from the US could do wonders for that bias. Bears could seek to fade into resistance levels with a stop above. In anticipation of an eventual leg lower.

GBP/AUD technical analysis (daily chart):

Relatively hawkish expectations of the BOE over the RBA and positive interest rate differentials have helped GBP/USD rise over 4.4% this past three weeks. Price action on the weekly chart remains firmly bullish, although we’ve seen three bullish weeks in a row (and potentially on track for a fourth), so we may need a new catalyst for it to notch up another few consecutive weeks. Still, a potential bullish reversal pattern is forming on the daily chart, so I’m keeping a lookout for a break above 1.94 to signal trend continuation.

A pullback to the 2021 high could provide an area for dip buyers to consider loading up, whereas a strong break beneath it suggests a retracement is underway and invalidates the bullish bias.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

FOREX.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.

FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

GAIN Global Markets Inc. has its principal place of business at 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA., and is a wholly-owned subsidiary of StoneX Group Inc.

© FOREX.COM 2024