Teams will let customers use AI to generate custom backgrounds

The feature is coming to Teams this month.

- Teams users will be able to generate custom backgrounds for channel announcements with AI, in just a few clicks.

- The feature is coming to all platforms, including Android, Web, and iOS.

It has been a good week for Microsoft Teams, as the Redmond-based tech giant released the new version of the platform on Windows and Mac devices, effectively becoming the new default Teams client for desktop devices.

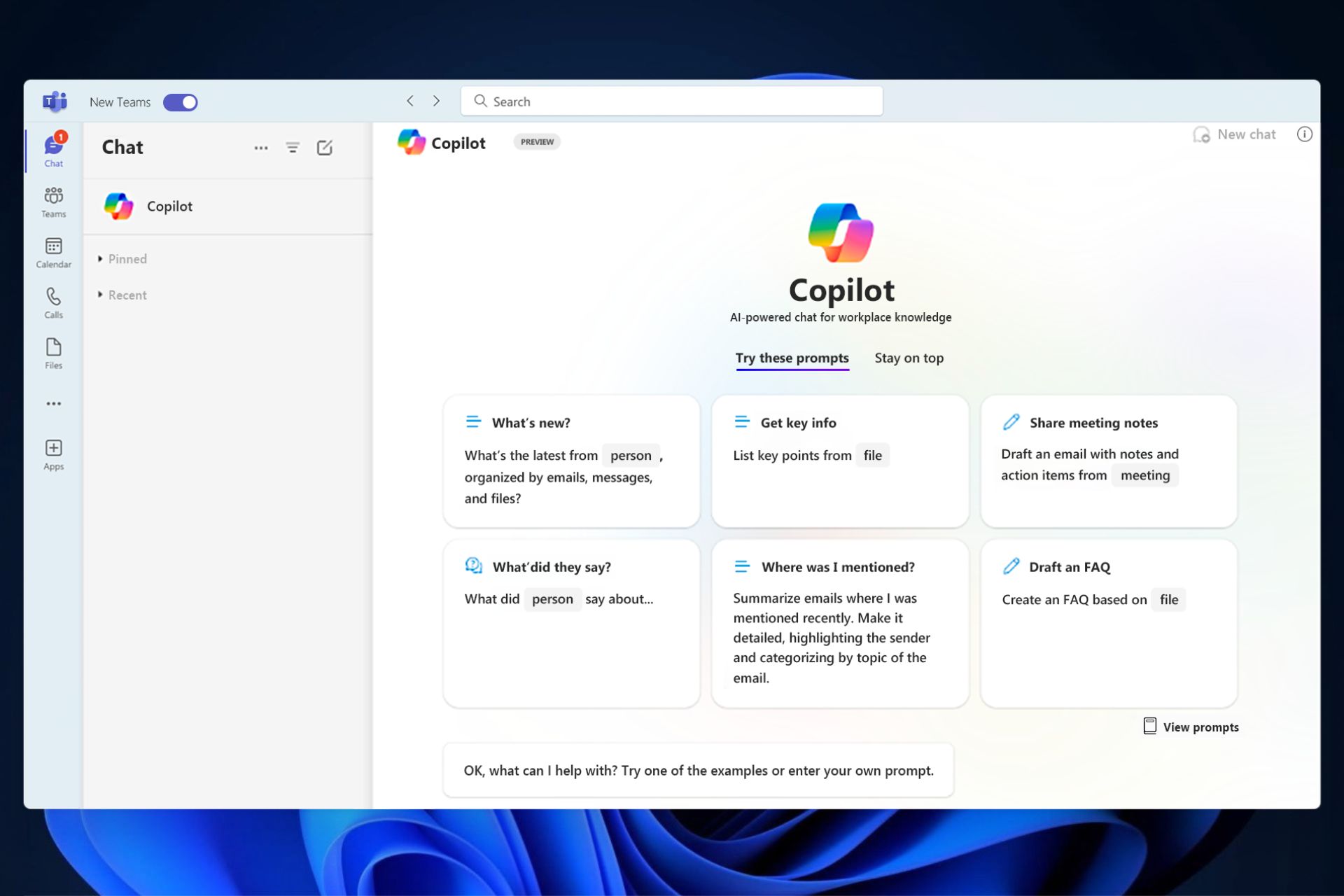

Among a plethora of new features, including a new design, a new Teams for Education version, and many other improvements that greatly make Teams faster, Microsoft is also bringing Copilot to Teams, starting in November.

Teams users will be able to work with the AI tool to organize their files, compose emails, summarize Teams meetings, and even get task recommendations from Copilot.

However, Teams users will get a taste of AI on the platform sooner. According to the latest entry in the Microsoft 365 Roadmap, Teams will let customers use AI to generate custom backgrounds for channel announcements.

Gone are the days when managers needed graphic designers for the job. Now they can easily generate these backgrounds with just a few clicks.

Teams users will be able to create engaging custom backgrounds for channel announcements in just a few clicks. Powered by Microsoft Designer, use generative AI to create expressive images.

Microsoft

The feature is coming on Teams later this month, mid to late October, and it will generally be available everywhere on every platform: Windows, Desktop, iOS, Android, Mac, and Web.