Fix: Avast Antivirus is Slowing Down Internet

Reducing Avast's scan frequency should do the trick

- If Avast antivirus is slowing down your internet, it might be because the software is outdated.

- You can fix this issue quickly by disabling unnecessary Avast background processes.

- Another effective solution is to update your browser.

Modern security software now protects users online and offline, and Avast is one of the leading ones. However, some users are complaining that Avast antivirus is slowing down their internet connection.

While this can be caused by several factors, it is not the most difficult issue to fix, requiring minor tweaks in most cases. In this guide, we will show you to fix the issue for good and restore normal service.

Does Avast antivirus slow down internet speed?

The Avast antivirus software can sometimes slow down your internet speed due to features like Web Shield. This is due to protective options that scan your HTTPS connections, stream downloads, and other internet resources.

So, usually, during the Avast antivirus scan active period, your internet will slow down a bit. Aside from this, below are some factors that can slow down your internet while using Avast:

- Outdated browser – In some cases, this issue might occur because your current version of your browser does not work well with Avast. You need to update your browser to the latest version to fix this.

- Wrong router configuration – If you did not configure your router properly to permit the activities of Avast, you might face this problem. The solution to this is to make the necessary changes to your router settings.

- Outdated app – Avast Antivirus itself might be outdated, leading to a slow internet connection. You need to update the security software to improve your internet speed.

What can I do if Avast Antivirus is slowing down my internet?

Before exploring the sophisticated solutions in this section, try the following basic troubleshooting steps:

How we test, review and rate?

We have worked for the past 6 months on building a new review system on how we produce content. Using it, we have subsequently redone most of our articles to provide actual hands-on expertise on the guides we made.

For more details you can read how we test, review, and rate at WindowsReport.

- Update Avast Antivirus

- Check and modify your router configuration

If the issue persists, you can now proceed to the fixes below.

1. Tweak the Scan Frequency settings

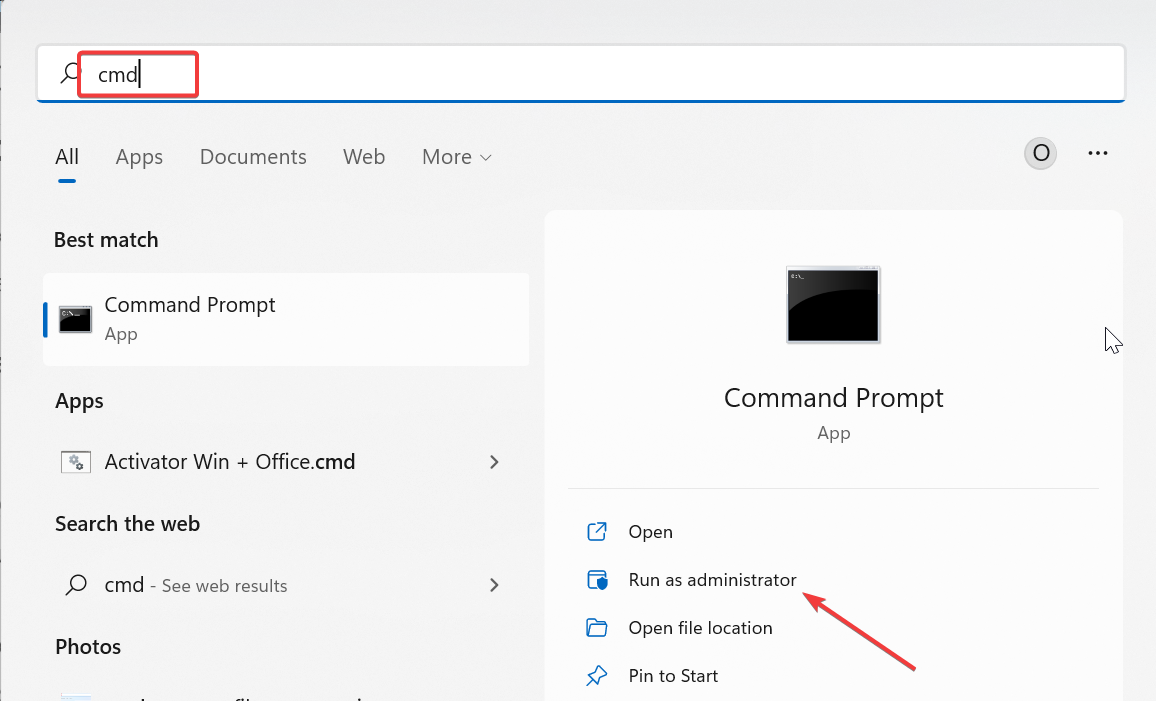

- Press the Windows key, type cmd, and select Run as administrator under Command Prompt.

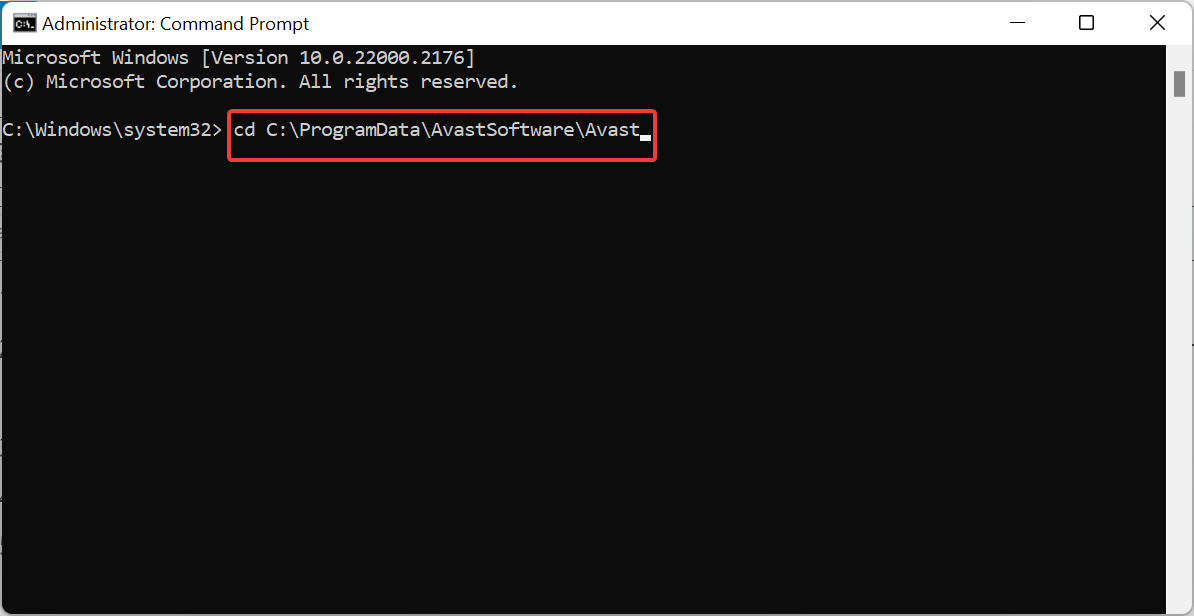

- Type the path (change the path if it is different for you) below and hit Enter to open the Avast folder:

cd C:\ProgramData\AvastSoftware\Avast - Now, open the ini file (usually avast.ini) in the Avast folder using Notepad.

- Next, type the command below:

[GrimeFighter]: ScanFrequency=999 - Finally, save the ini file and restart your PC.

If the Avast antivirus software scans your PC frequently, it uses your resources and slows down your internet. Hence, you need to reduce the scan frequency, as shown above.

2. Disable unnecessary background processes

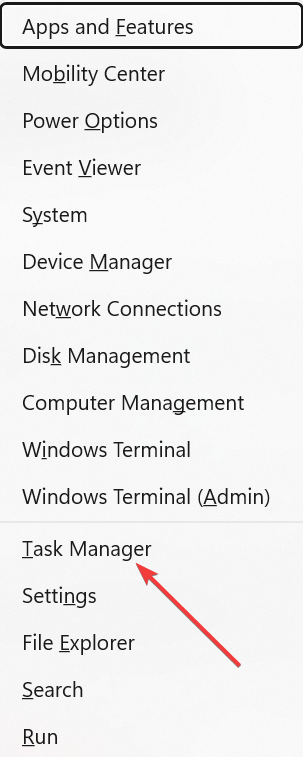

- Press the Windows key + X and choose Task Manager.

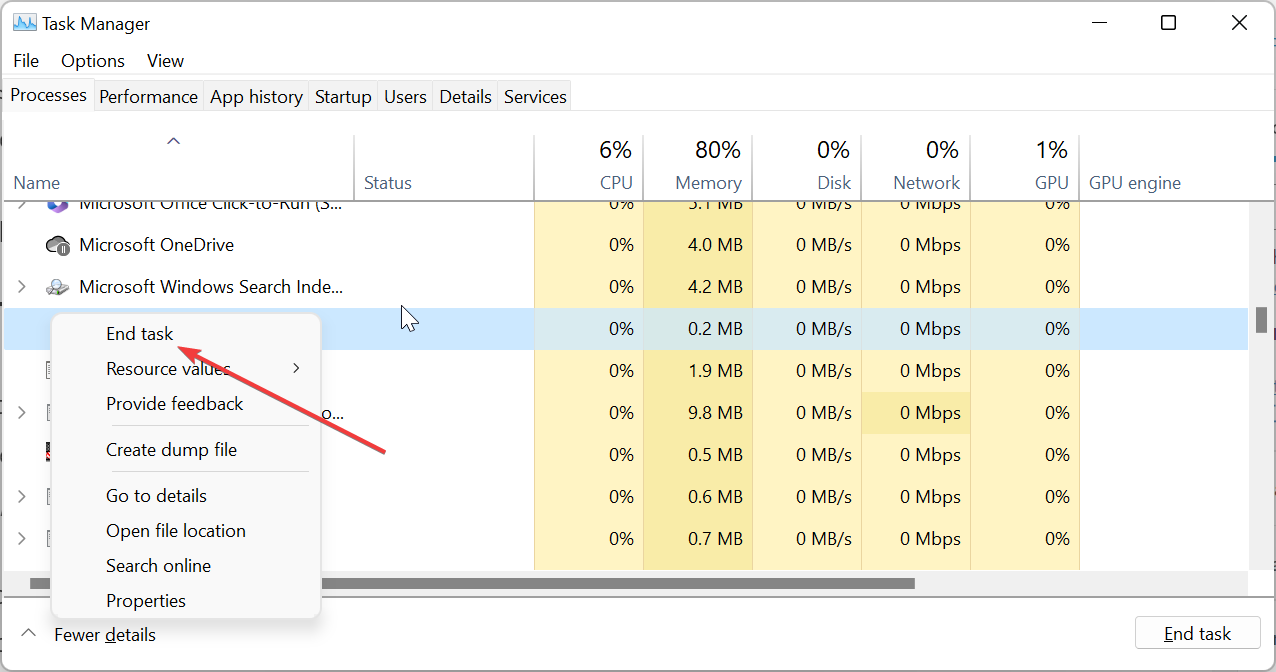

- Now, right-click any unnecessary process like Avast Cleanup.

- Finally, choose the End task option.

When you install Avast, it comes with a lot of other packages. Some of these processes do not add anything to your security.

Instead, they use your resources and can slow down your internet when active. So, you need to disable them.

3. Update your browser

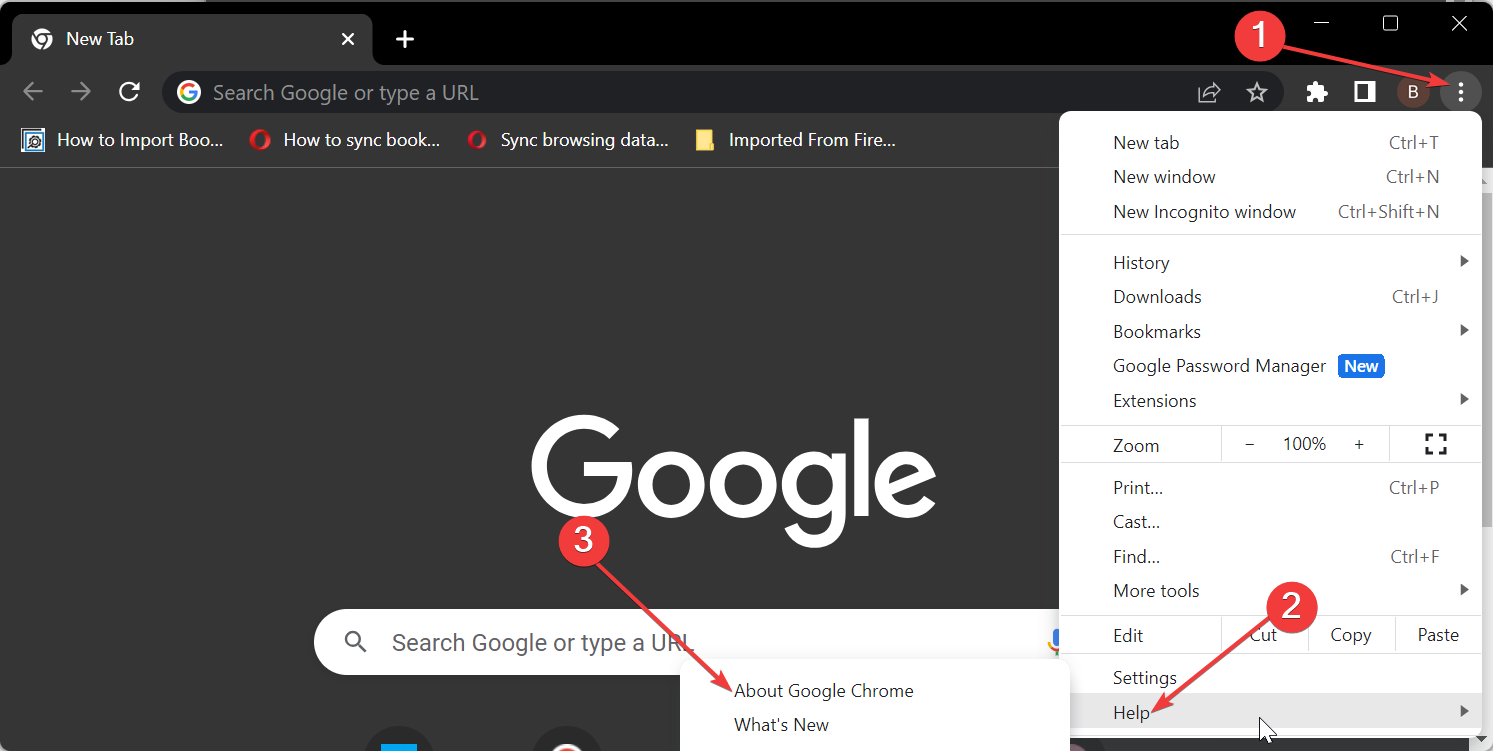

- Launch your browser (we use Chrome as an example here) and click the Menu button in the top right corner.

- Select Help and click About Google Chrome.

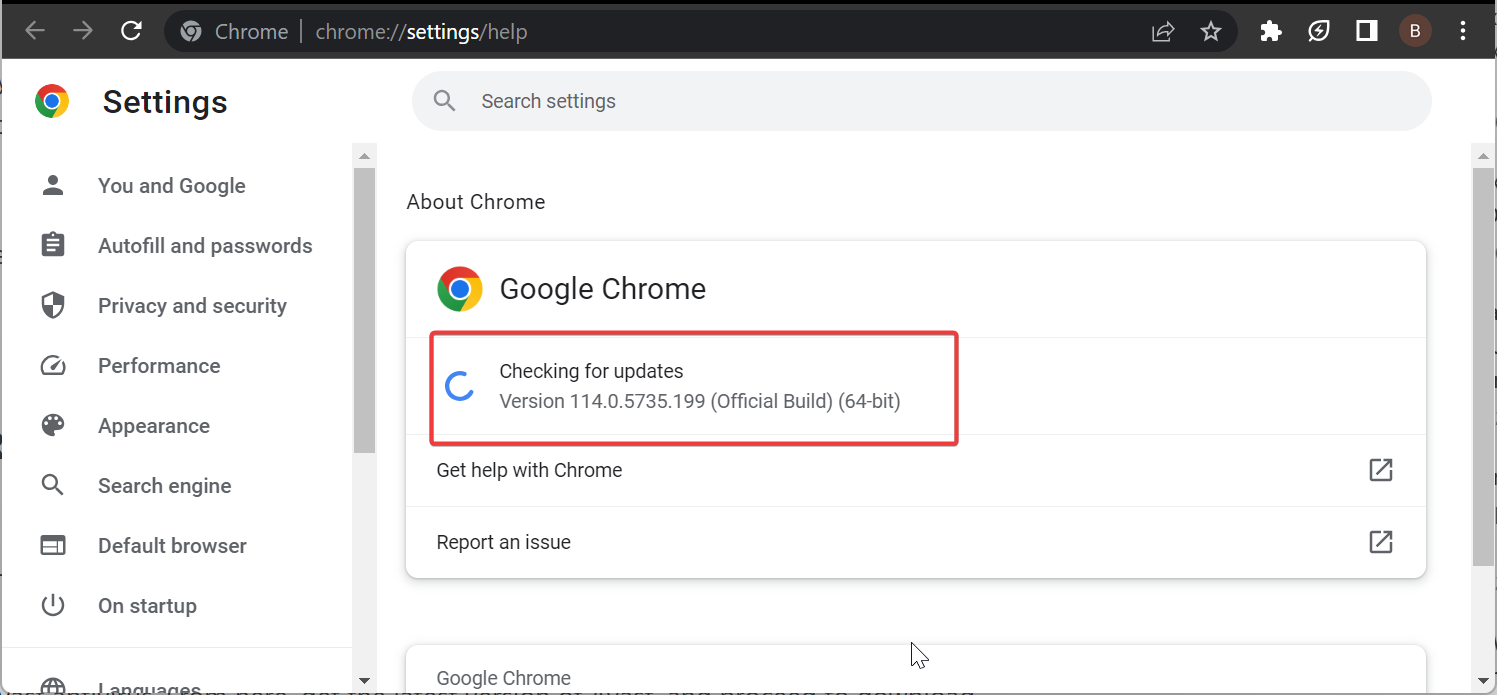

- Now, wait for your browser to automatically check and install any available updates.

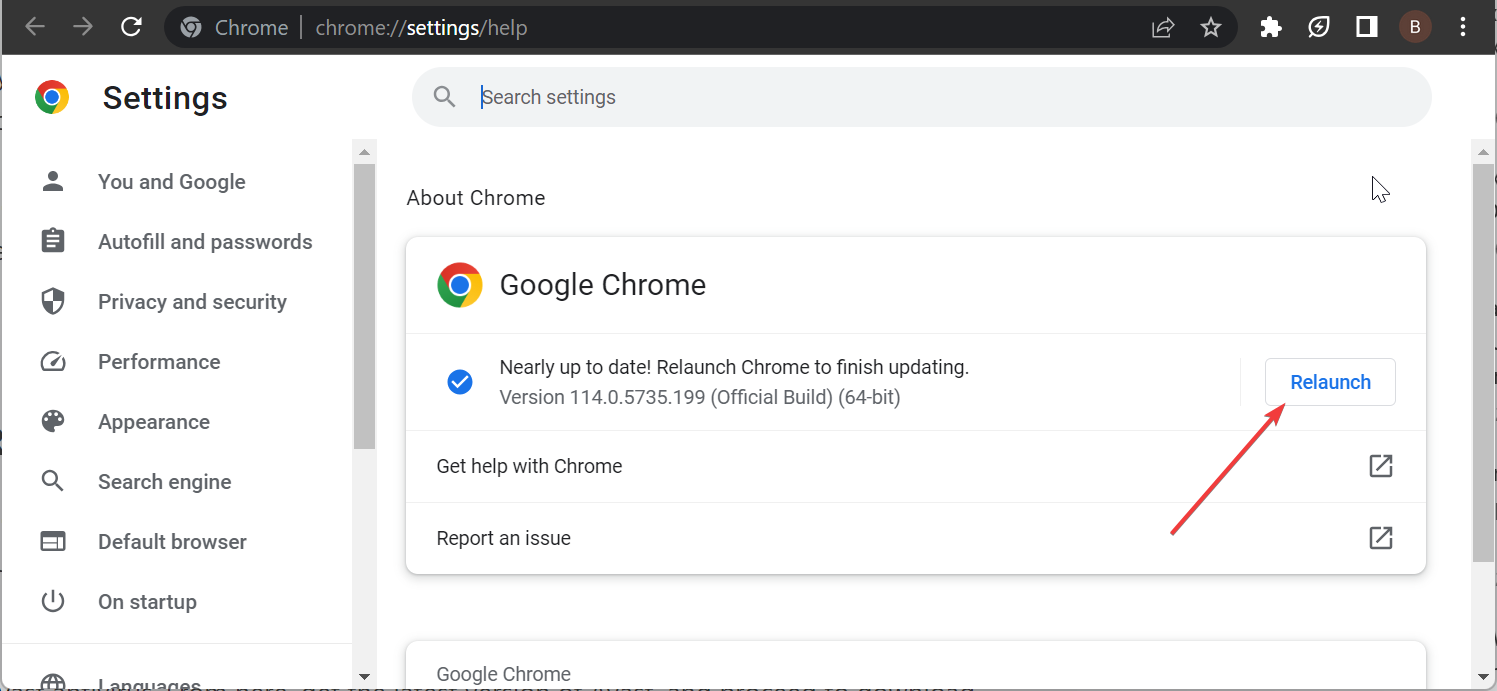

- Finally, click the Relaunch button.

At times, the Avast antivirus might be slowing down your internet because the version of the browser you are using does not work well with it. Simply updating your browser should do the trick here.

If this does not work, you might need to switch to another browser.

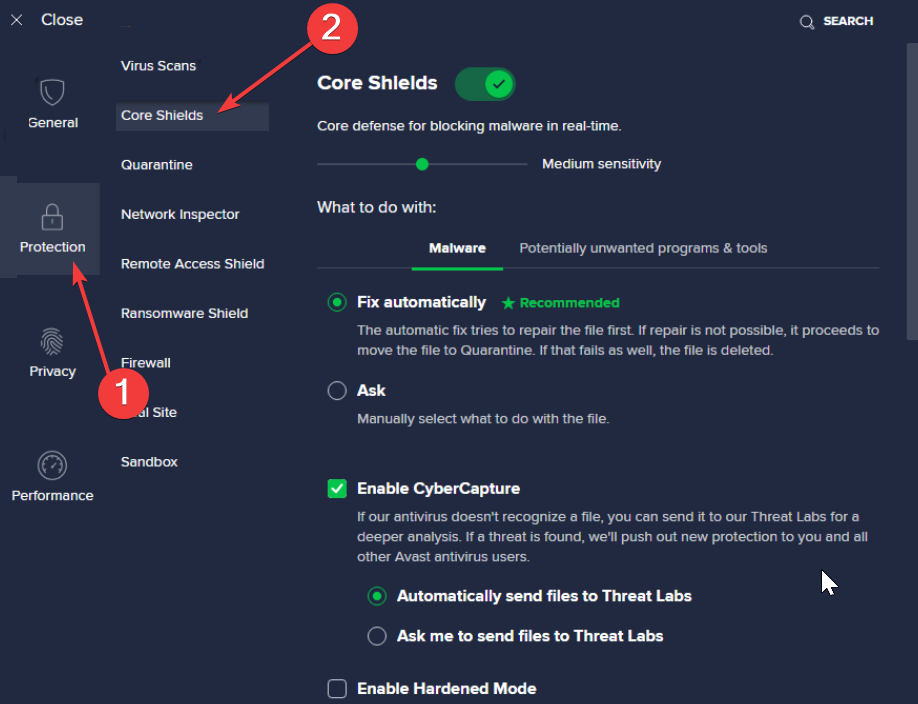

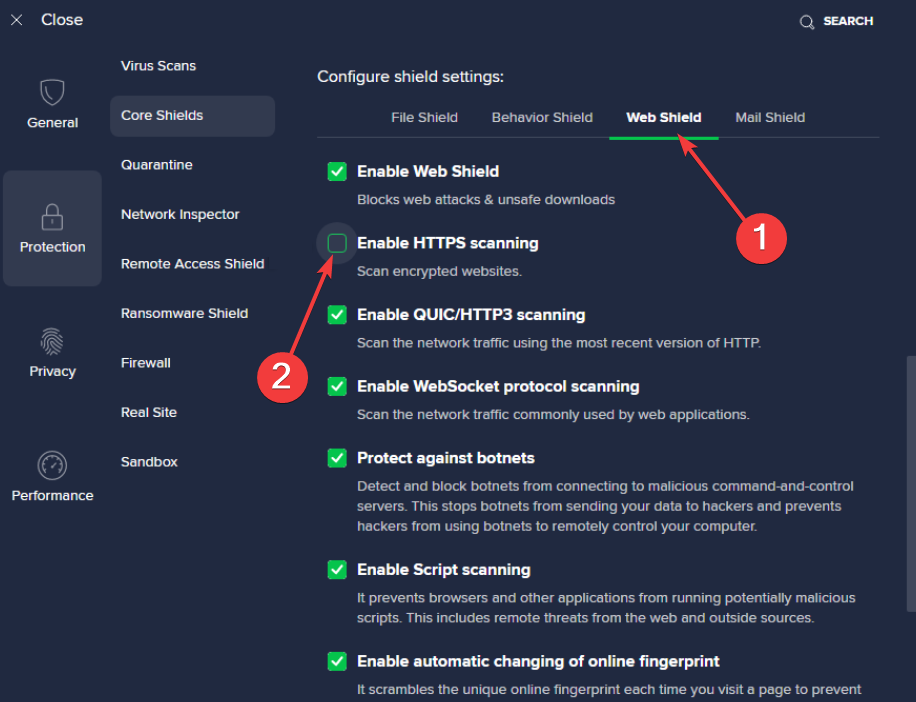

4. Change the Web Shield settings

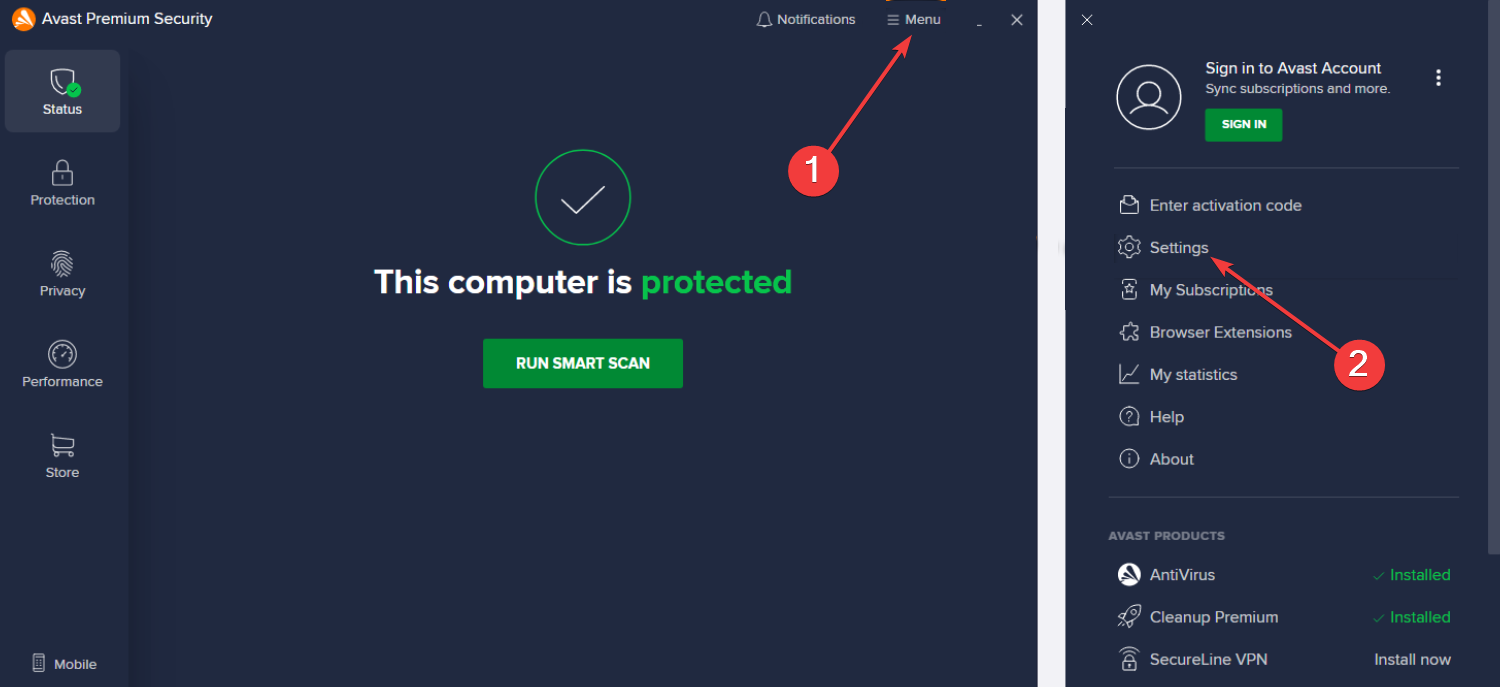

- Launch Avast, click the Menu button at the top and select Settings.

- Now, select Protection, followed by Core Shields.

- Next, click the Web Shield tab under the Configure shield settings section.

- Unmark the box next to Enable HTTPS scanning.

Avast has a series of protection feature that protects you from malware attacks online. One of them is HTTPS scanning, which prevents your malware from getting into your PC from HTTPS connections.

However, this feature can make the Avast antivirus slow down your internet. It is important to mention that disabling this feature is risky, and you shouldn’t use it unless you only visit trusted websites.

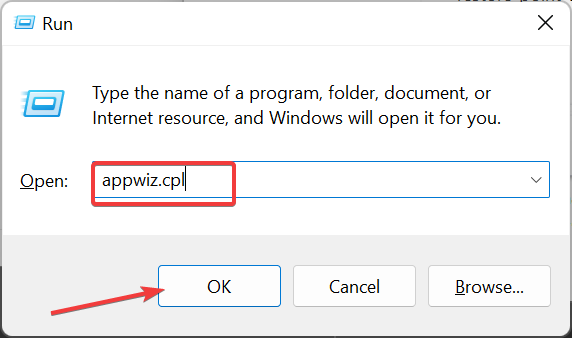

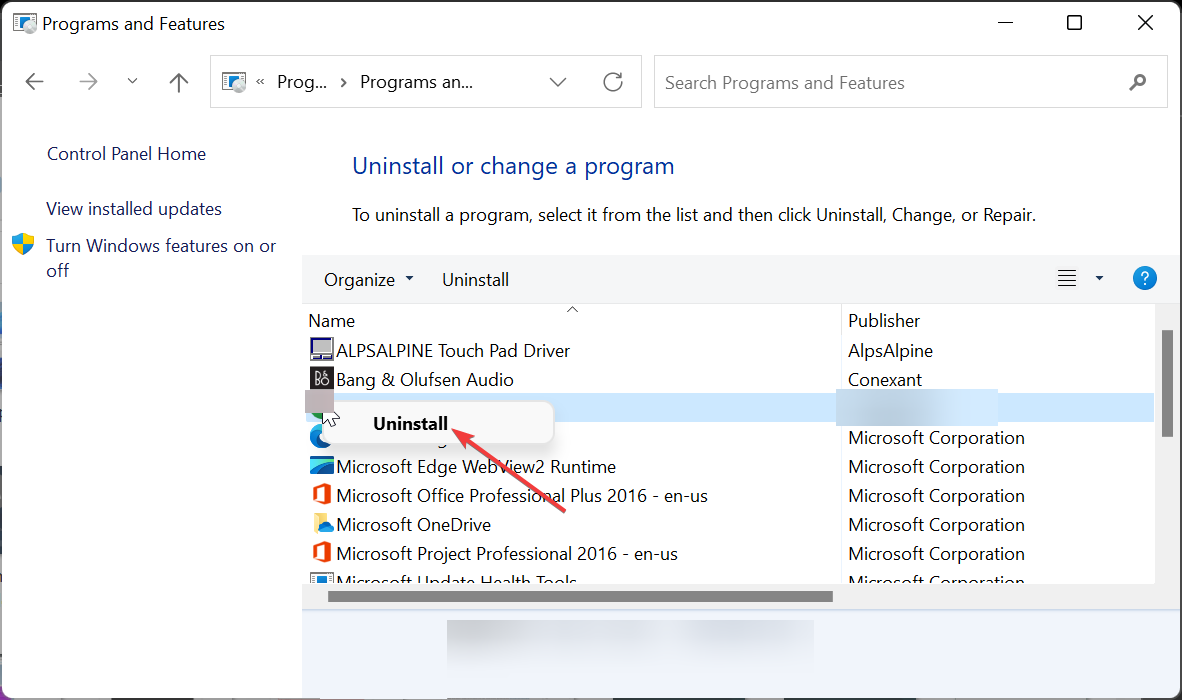

5. Reinstall Avast

- Press the Windows key + R, type appwiz.cpl, and click the OK button.

- Right-click the Avast antivirus and select Uninstall.

- Now, follow the onscreen instructions to remove it.

- Finally, visit the official website to download and install the app.

If, after trying the solutions above, Avast still slows down your internet, you might need to go for broke and reinstall the software. This is because the issue is likely with your installation.

If the Avast antivirus is slowing down your internet, it might be due to different factors. Fortunately, this can be fixed with the solutions in this guide.

In the same vein, if you are considering switching to another top antivirus software, we have selected the absolute best in our guide.

Feel free to let us know the solution that helped you fix this issue in the comments below.