How to Block Outlook Emails Received With no Sender

If you don't see anything in the sender box, don't open the email

- If you see an email with nothing in the sender box, it's highly probable that it's not a legitimate message.

- Attackers may spoof their addresses to disguise their phishing attempts.

We receive multiple email messages in our inboxes, and almost all of them come with a sender’s email address. However, there are times when a few unwanted emails arrive with no sender.

You can get a bit confused as there is a high chance that they are spam or unwanted emails, or someone is trying to lure you into phishing.

In this guide, we have explained how to block no sender emails for users who use email services regularly, particularly those who have experienced receiving emails with no sender information.

What are no sender emails?

When you come across an email with no sender, it could raise multiple questions in your mind.

Most of the time, these are unwanted emails or spam emails that are just there to get you to share your personal data or perform other fraudulent activities.

Since there is no legitimate way of concealing your sender address, this is clearly a sign of illegal activity.

How we test, review and rate?

We have worked for the past 6 months on building a new review system on how we produce content. Using it, we have subsequently redone most of our articles to provide actual hands-on expertise on the guides we made.

For more details you can read how we test, review, and rate at WindowsReport.

It is not advised to interact with such emails, and they should be treated as junk emails as there are very high chances of them being spam messages.

How do I stop emails from sending with no sender address?

If you are looking for ways to stop emails from sending with no sender address, then we would like to highlight again the fact that there is no legitimate way to send a message without a sender’s address.

The procedure is called spoofing and wrongdoers are doing that to make the unwanted emails appear as if it does not include any sender’s information.

How do I block emails with no sender in Outlook?

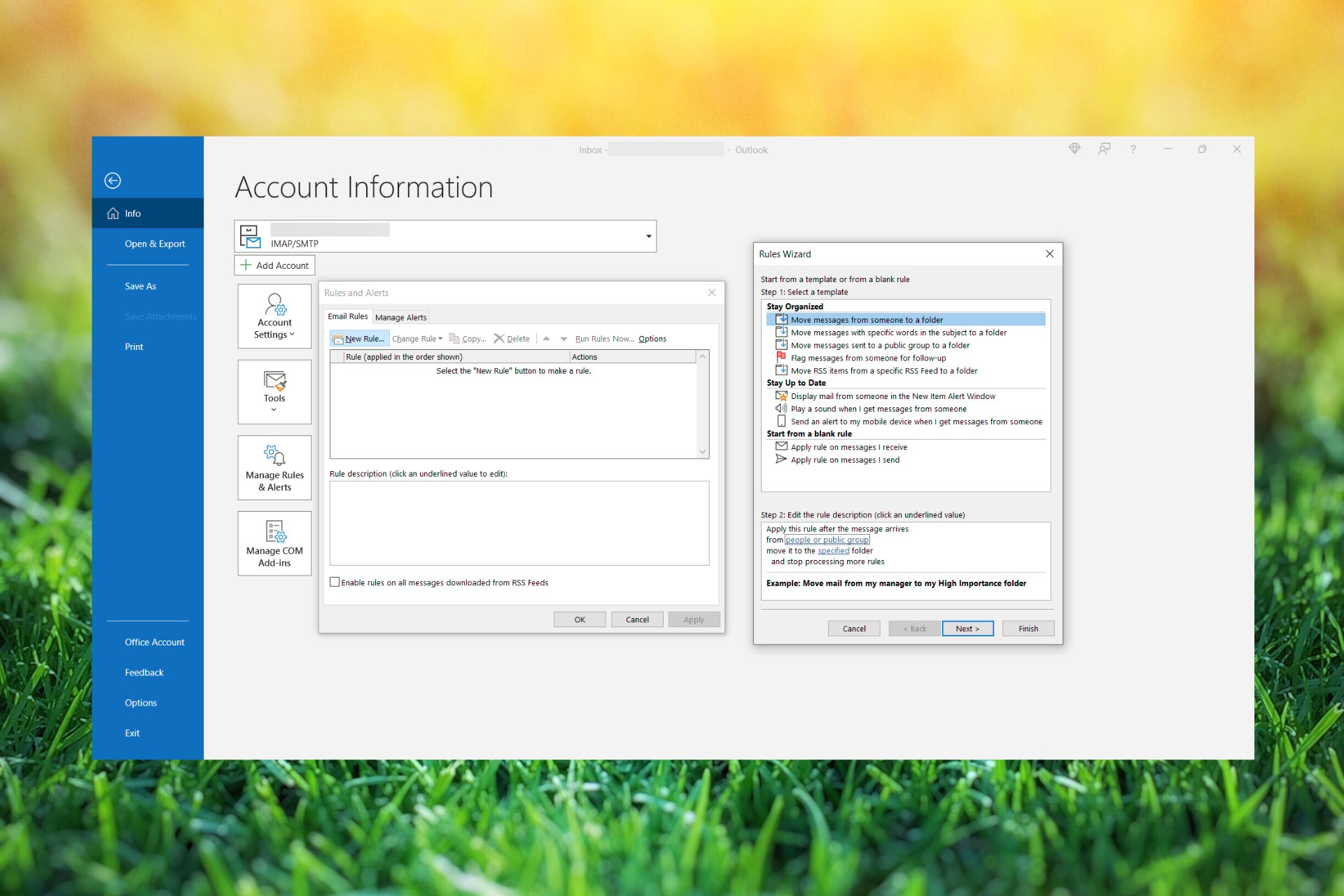

1. Creating email rules to filter out no sender emails

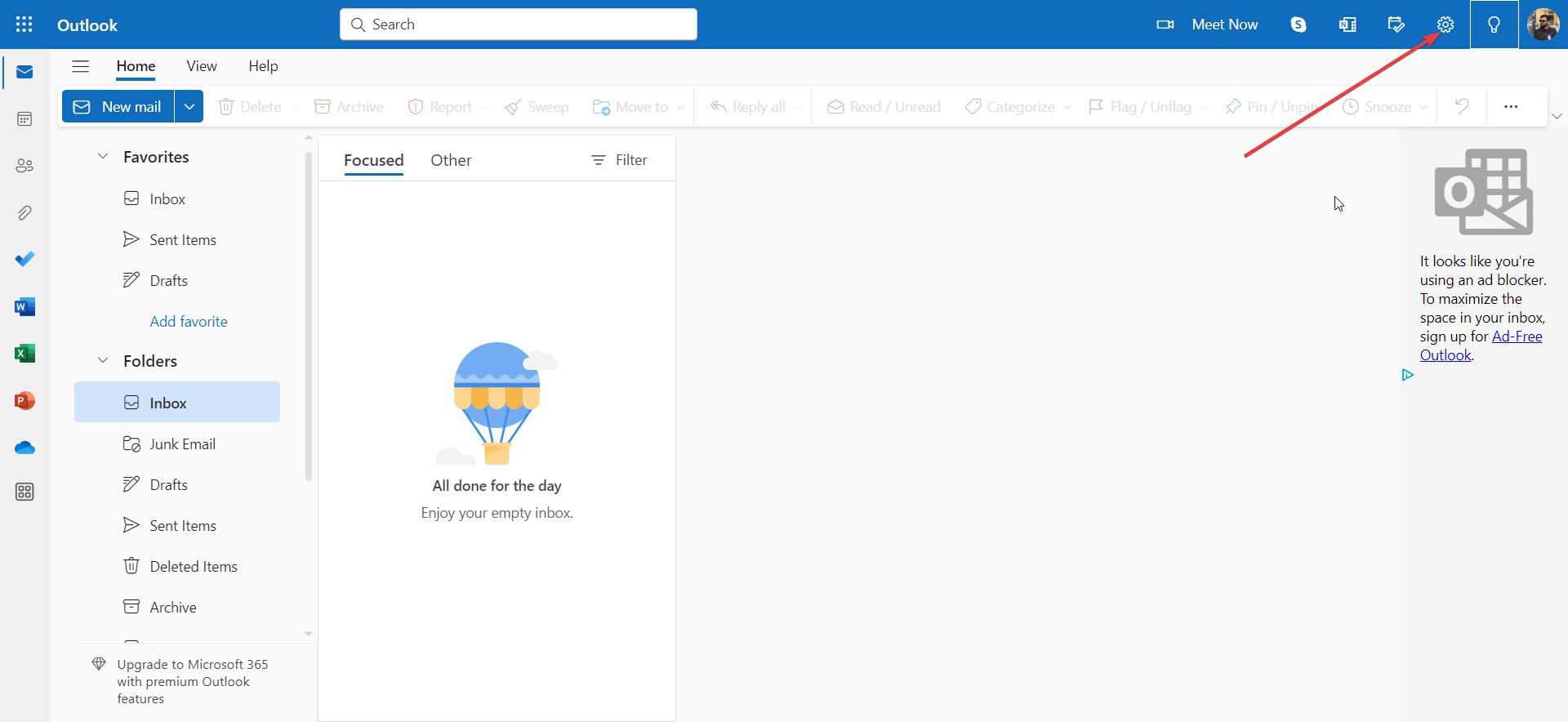

- Open the Outlook webpage and log in with your account.

- Click on the gear icon to open Settings.

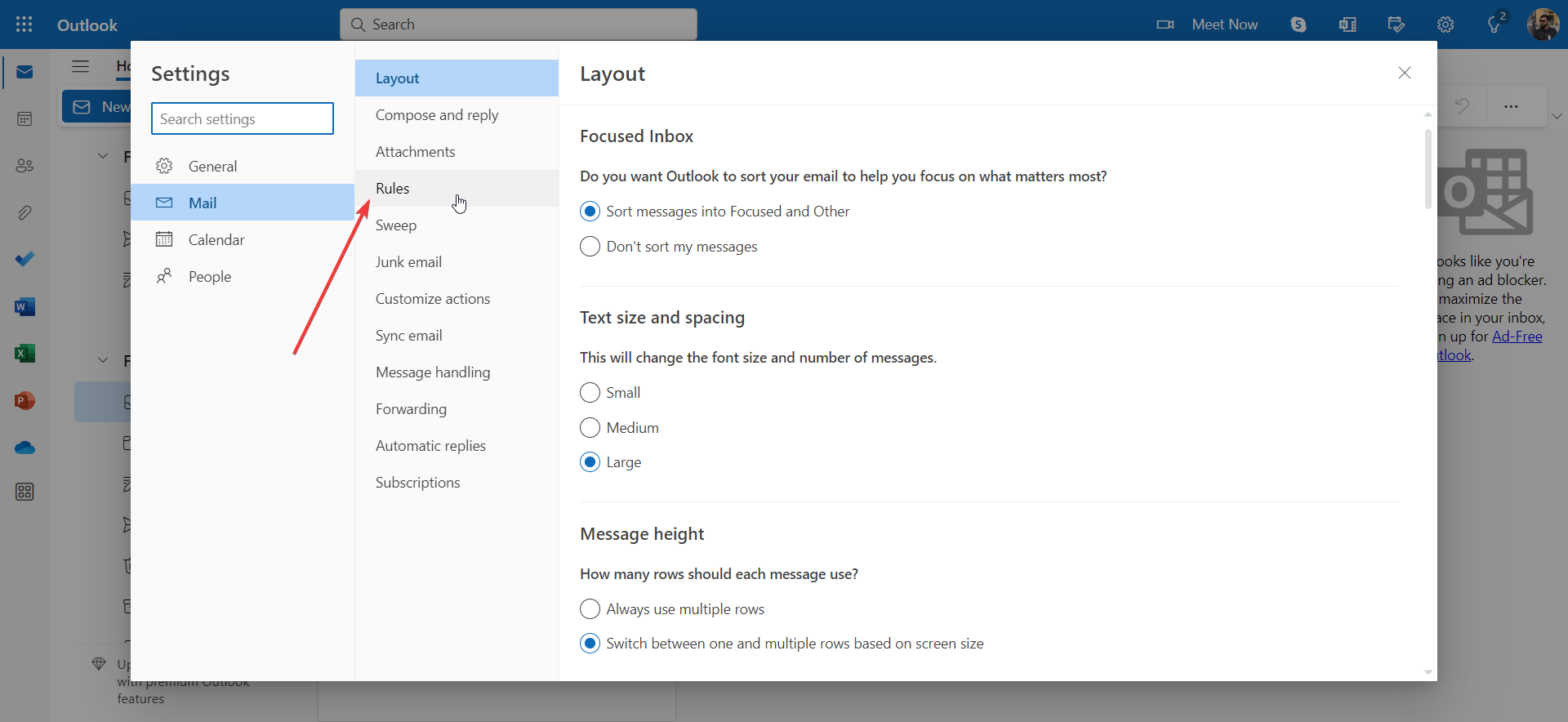

- Select the Rules option.

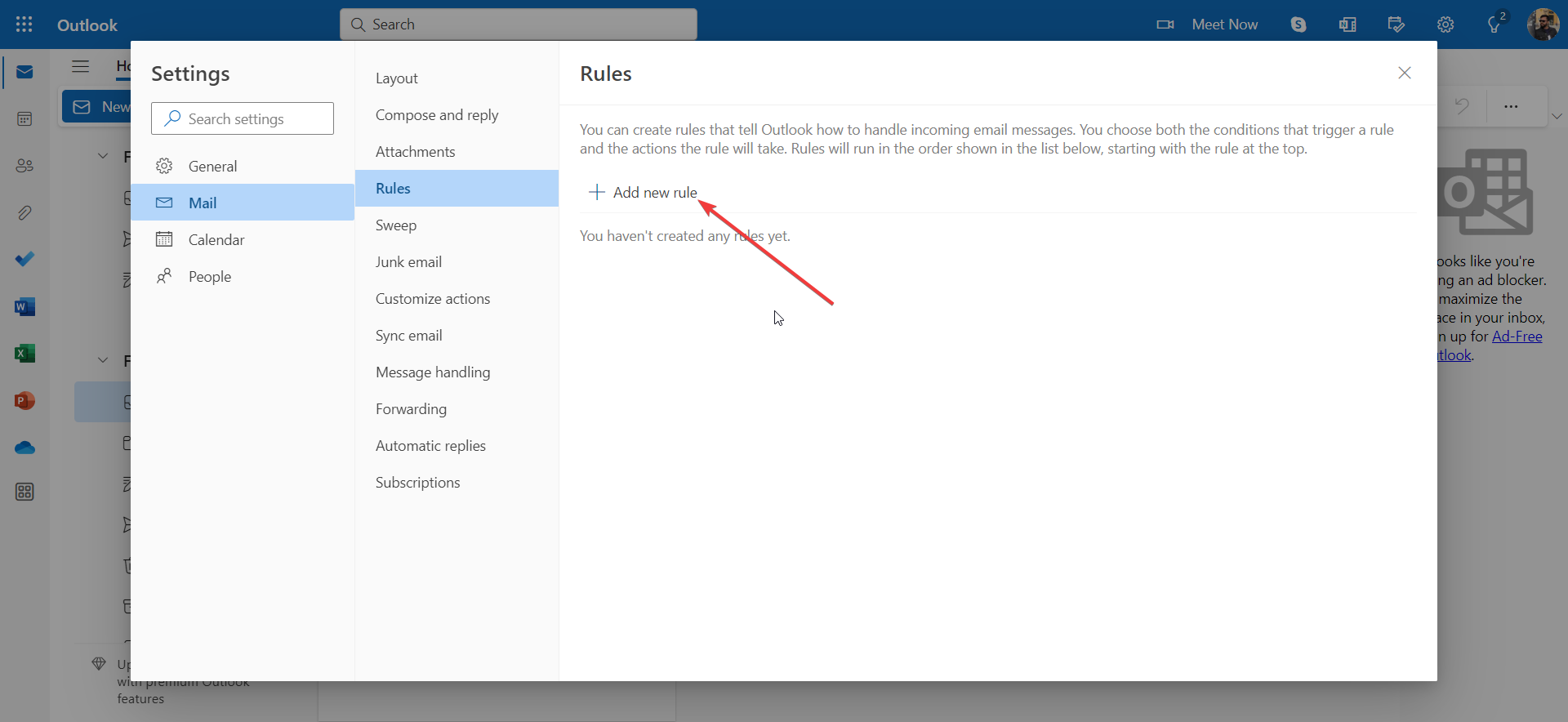

- Click on Add new rule.

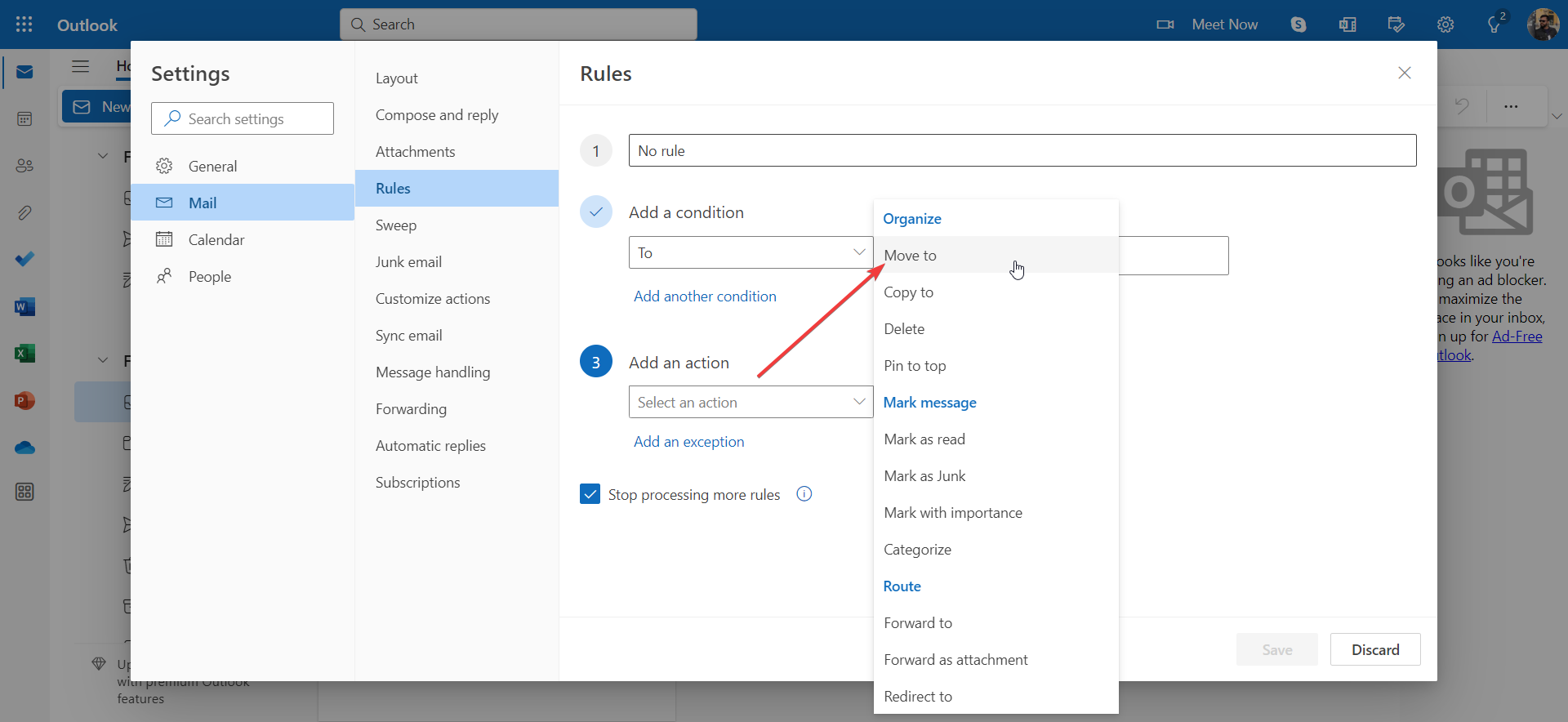

- In Line 1, you need to add the name of the new rule that you want to set. We have named the new rule No sender.

- Line 2, requires you to select a condition. Select to in the first drop-down menu and then add your email address as the recipient.

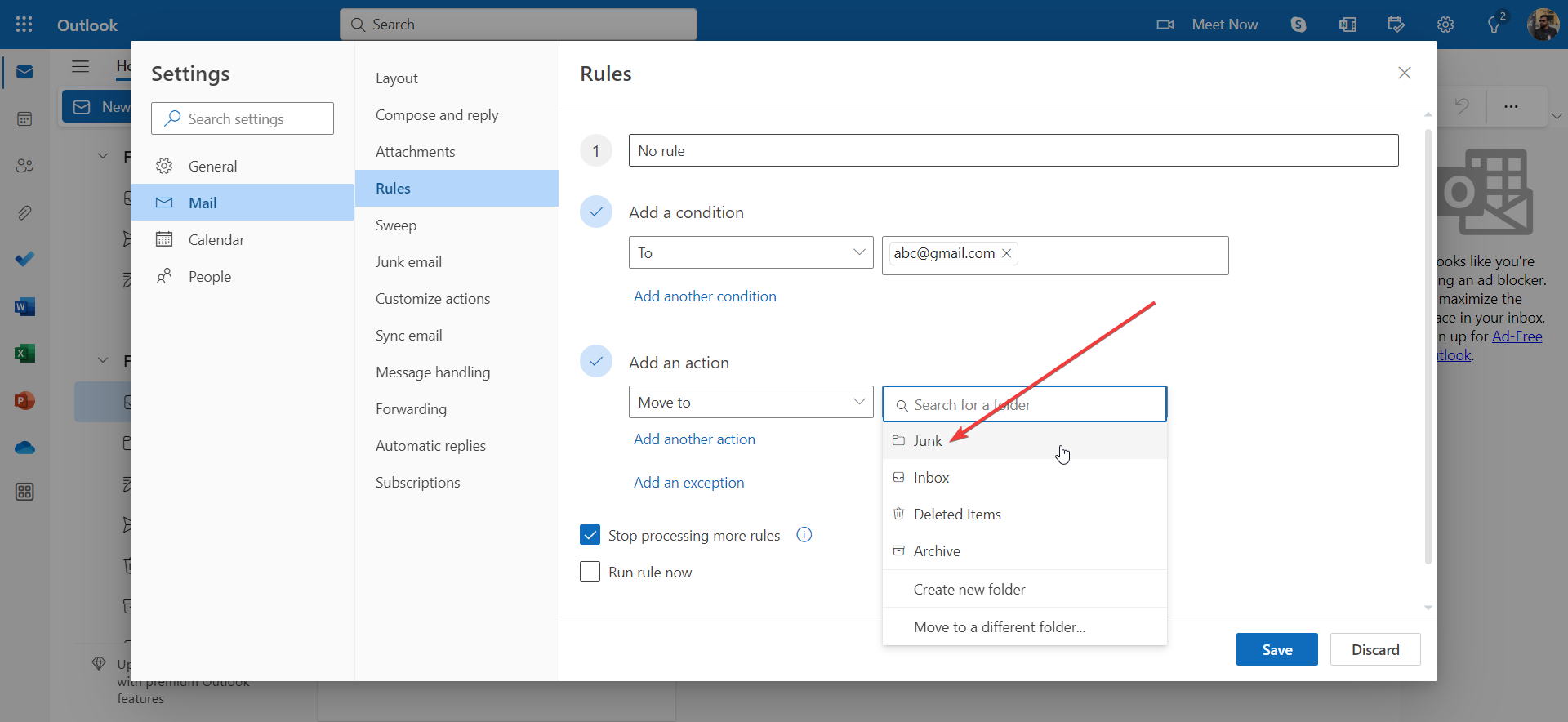

- Line 3 requires you to select an action such as deleting unwanted emails or annoying emails or moving them to a specified folder. Select Move to in the first drop-down.

- Select the Junk folder in the next drop-down. If there is no Junk folder, then create a new folder and name it Junk. You can also create a Spam folder.

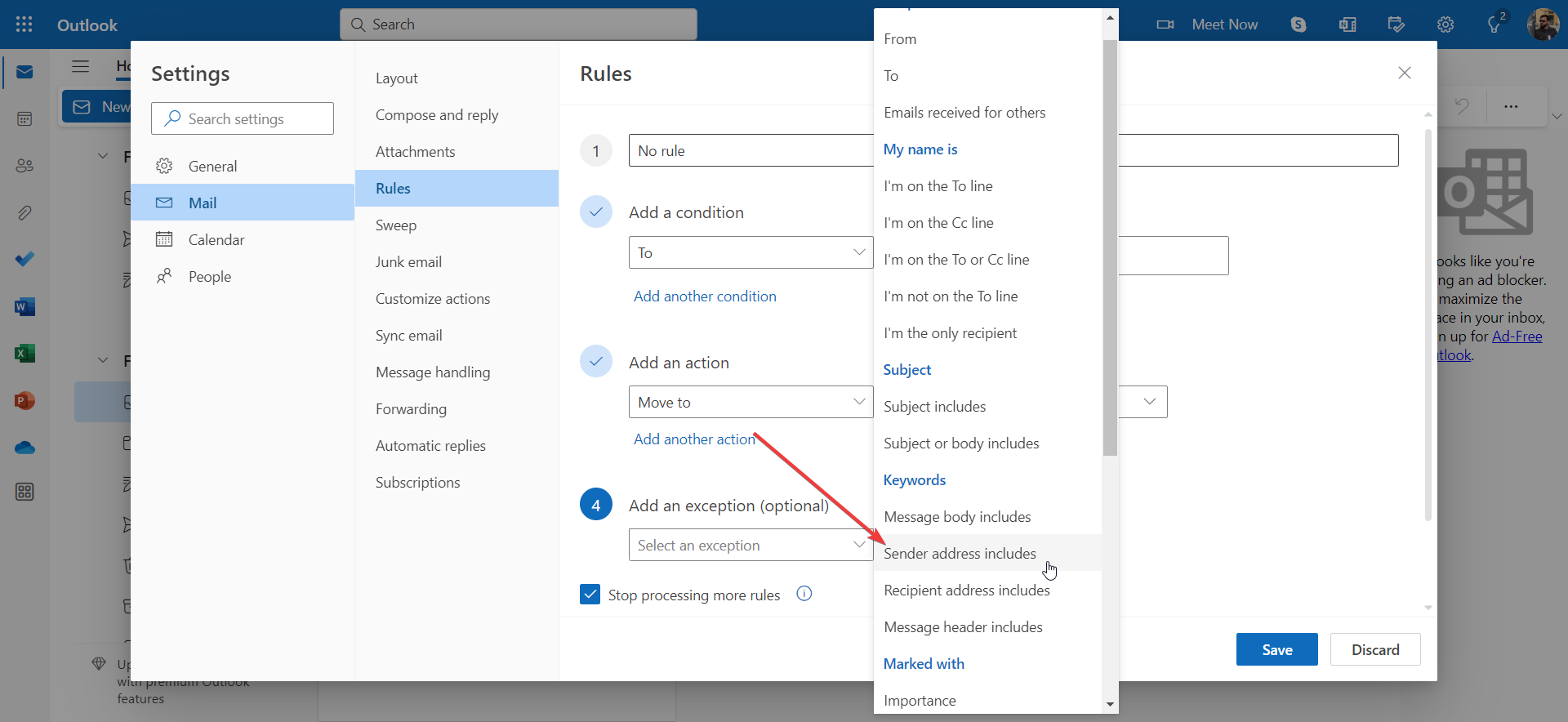

- Click on Add an exception.

- Select Sender’s address includes from the first drop-down.

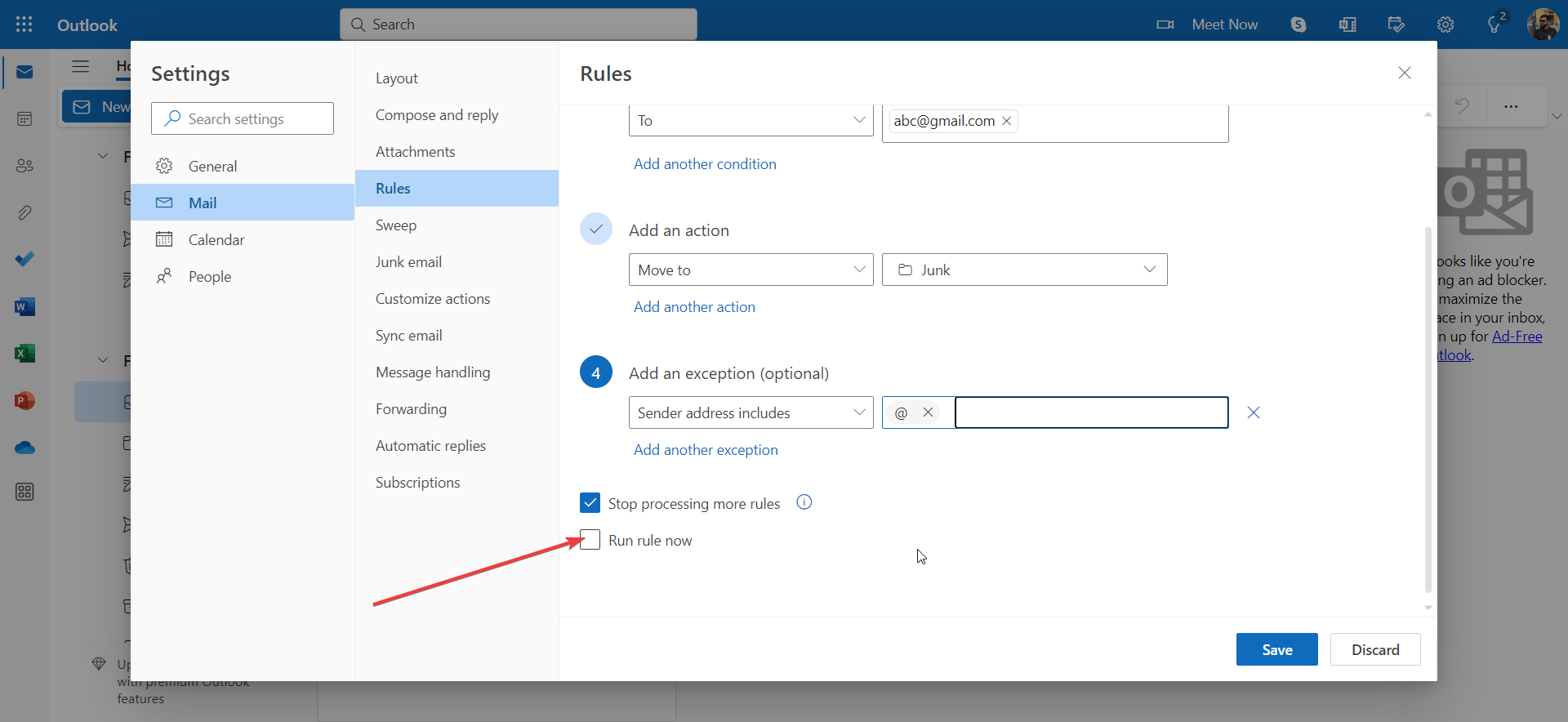

- In the Enter all or part of an address field, type @.

- In case you wish to run the rule immediately and clean your mailbox of unwanted emails or annoying emails, you can click the Run rule now checkbox.

- Hit the Save button to save this new rule in your MS Outlook.

- It will return to the Rule and Alerts interface, and the website will slow down and ask you to leave the website for the changes to take effect.

This is the official way of using the Outlook app to create a new rule and move the spoofed or unwanted emails with no sender address to the Junk folder. You can follow the same procedure to move such messages to other folders such as the Spam folder.

However, since it isn’t any legitimate way for someone to send an email without a sender’s address, you shouldn’t get them at all. For this reason, the rule that you have created above may or may not work.

2. Use third-party software

You can make use of third-party software to stop annoying emails to barge into your inbox and fill it with unwanted emails.

We have a guide that lists down some of the best email spam filters that you can use with any mail app including Apple Mail, Yahoo Mail, and MS Outlook mail app, and get rid of the spam messages.

If you wish to take things a bit forward, then you can check out our list that gives you some of the best antivirus software with anti-spam features.

3. Contact support

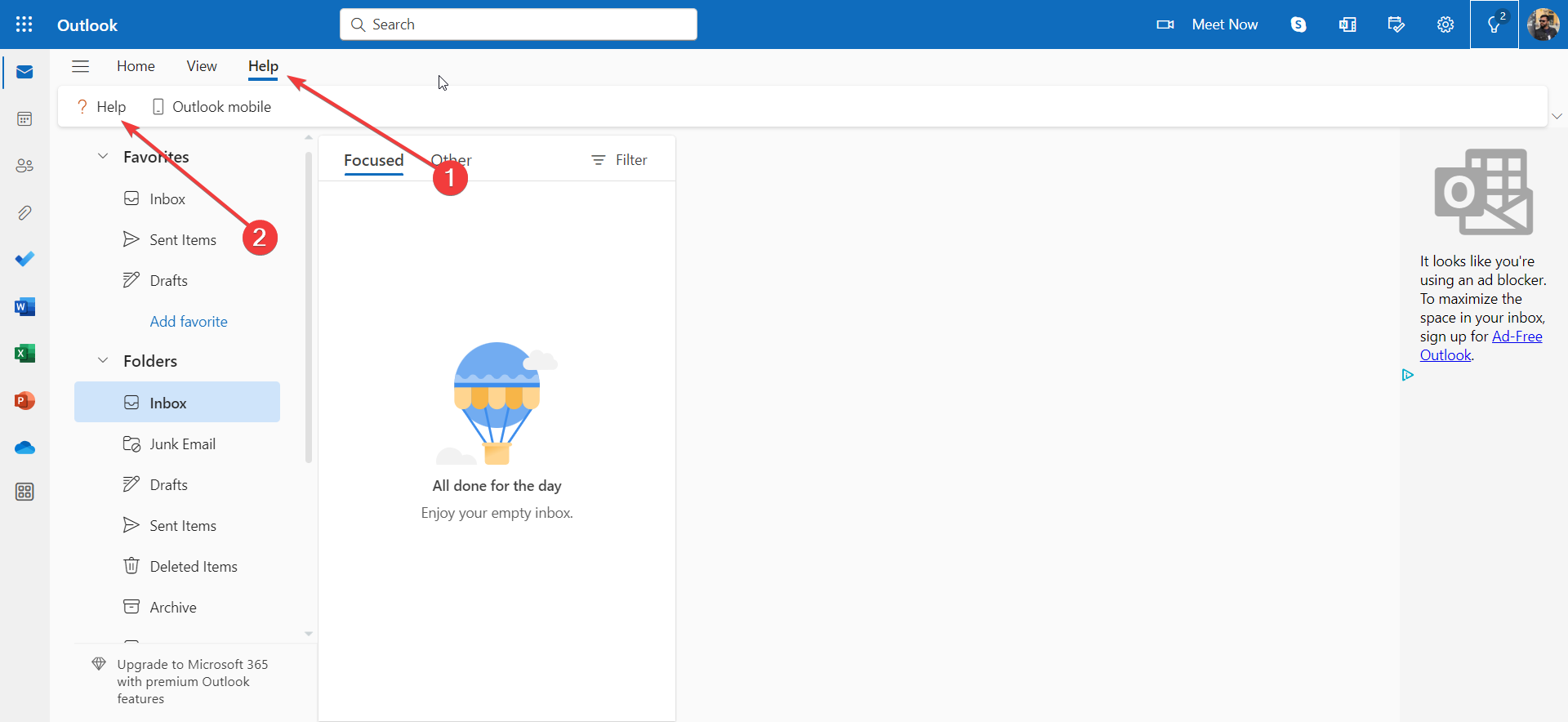

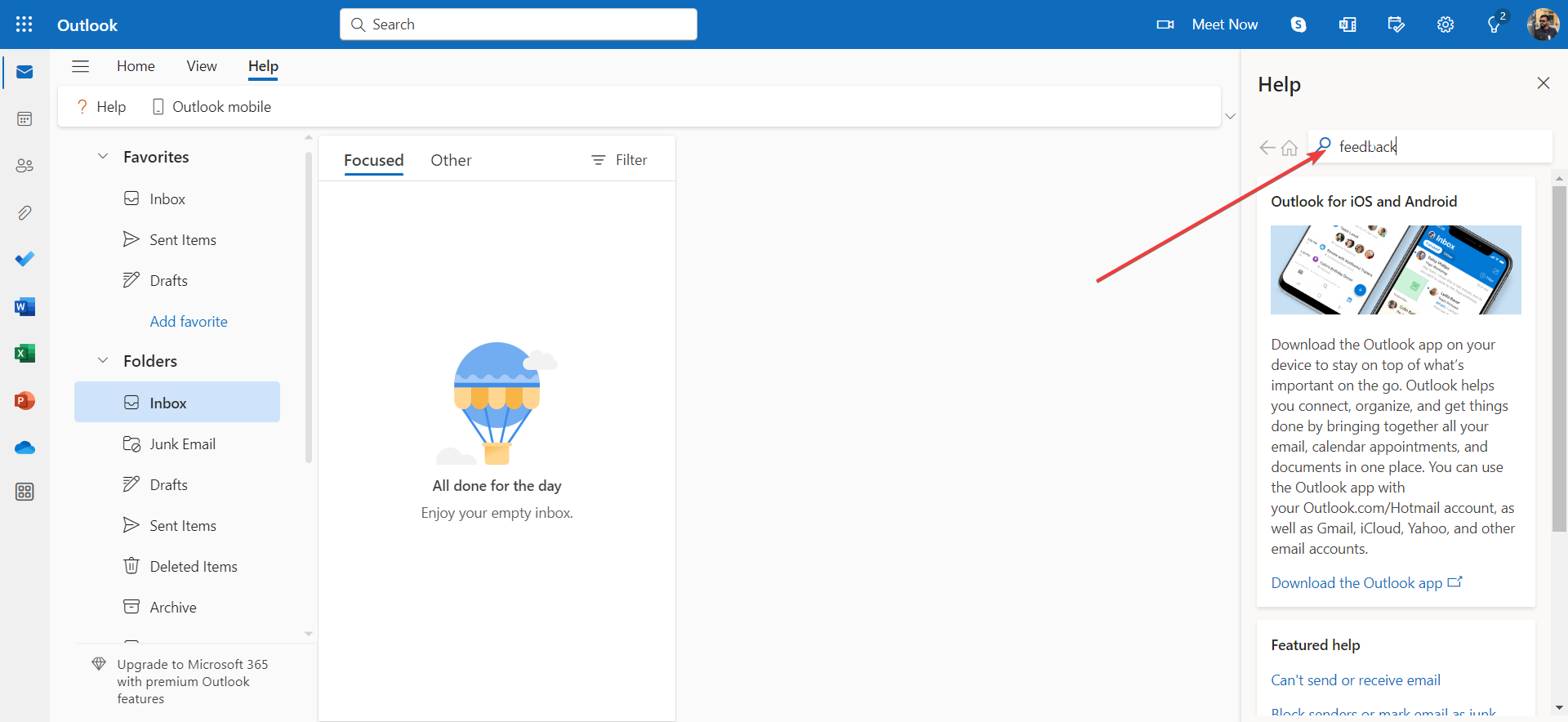

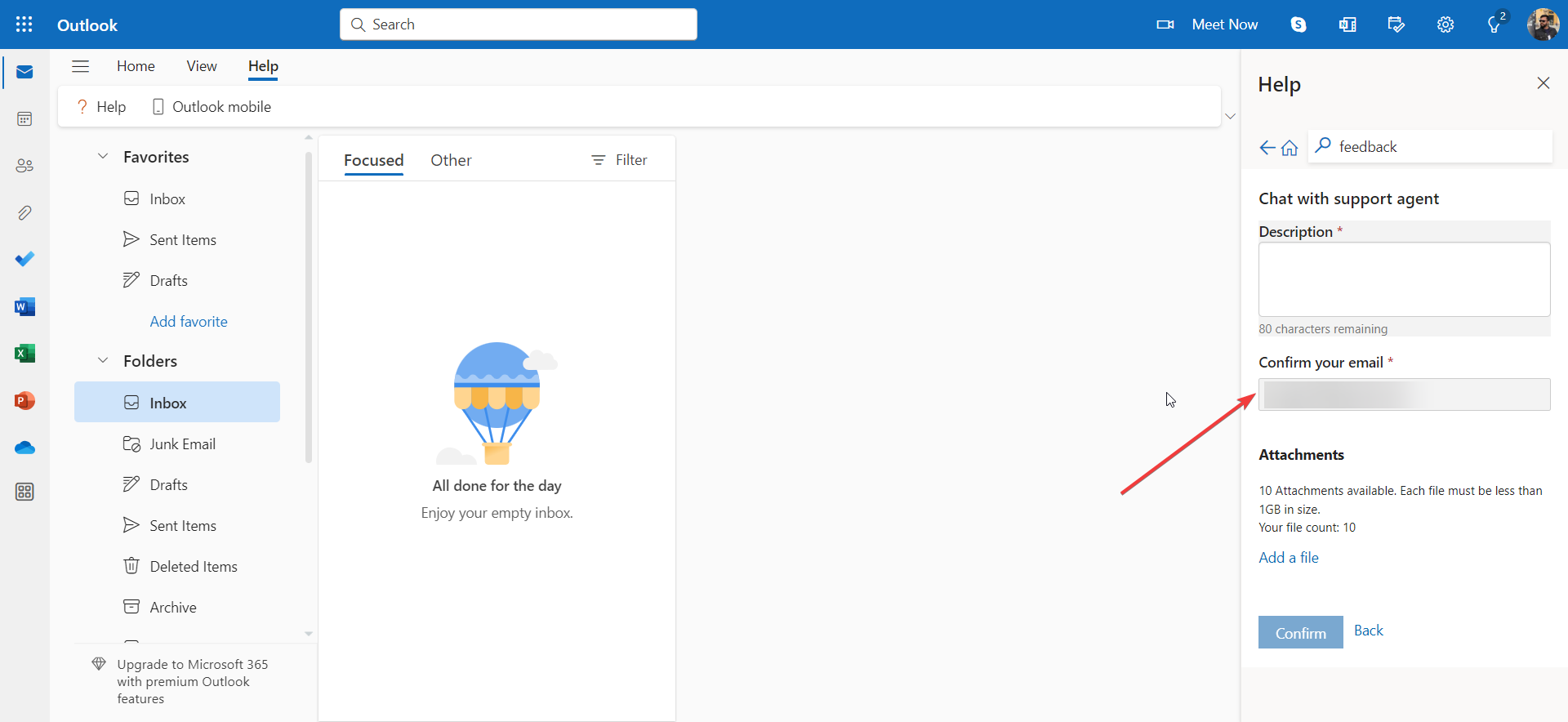

- Launch Outlook.

- Click on the Help tab on the top menu and select Help.

- In the search box, type Feedback.

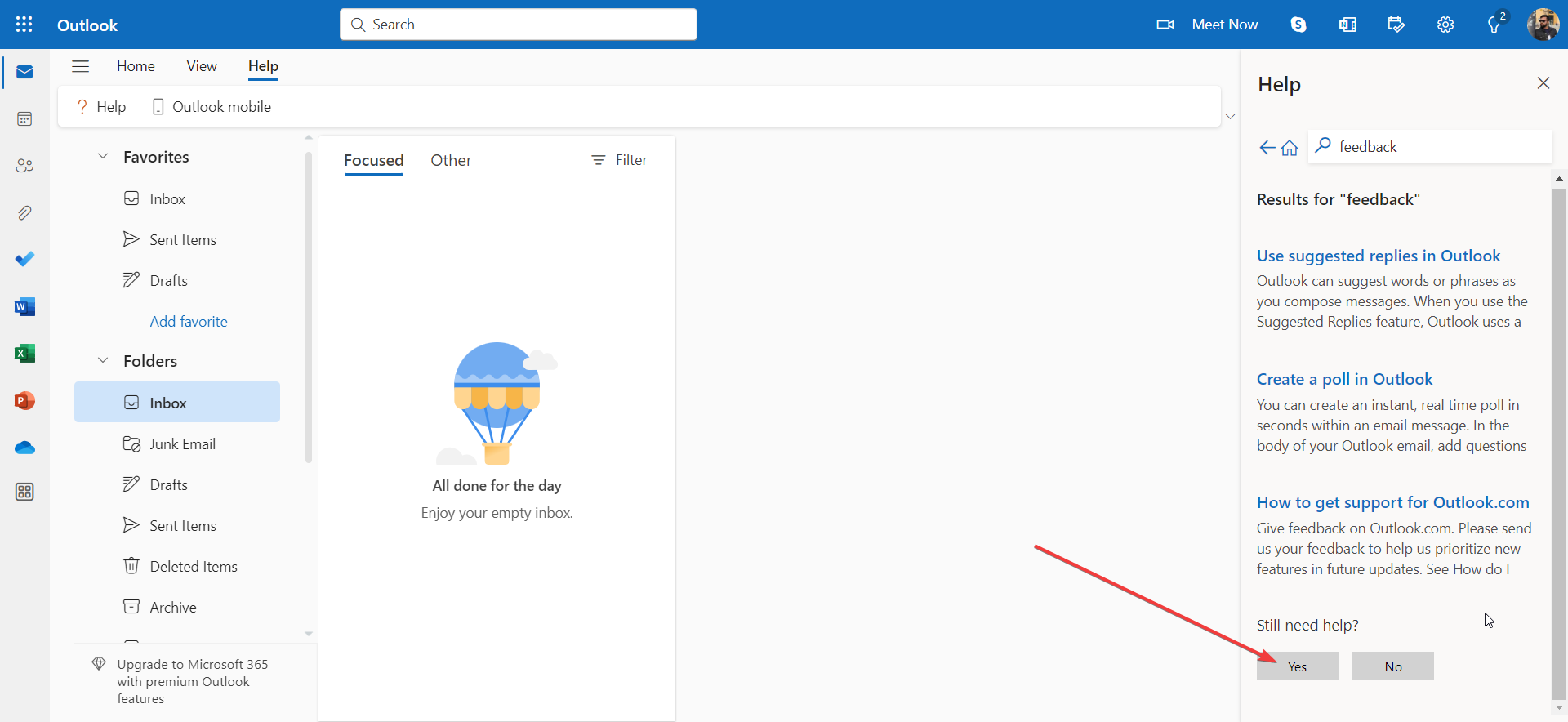

- Scroll down and click on the Yes button under Still need help? question.

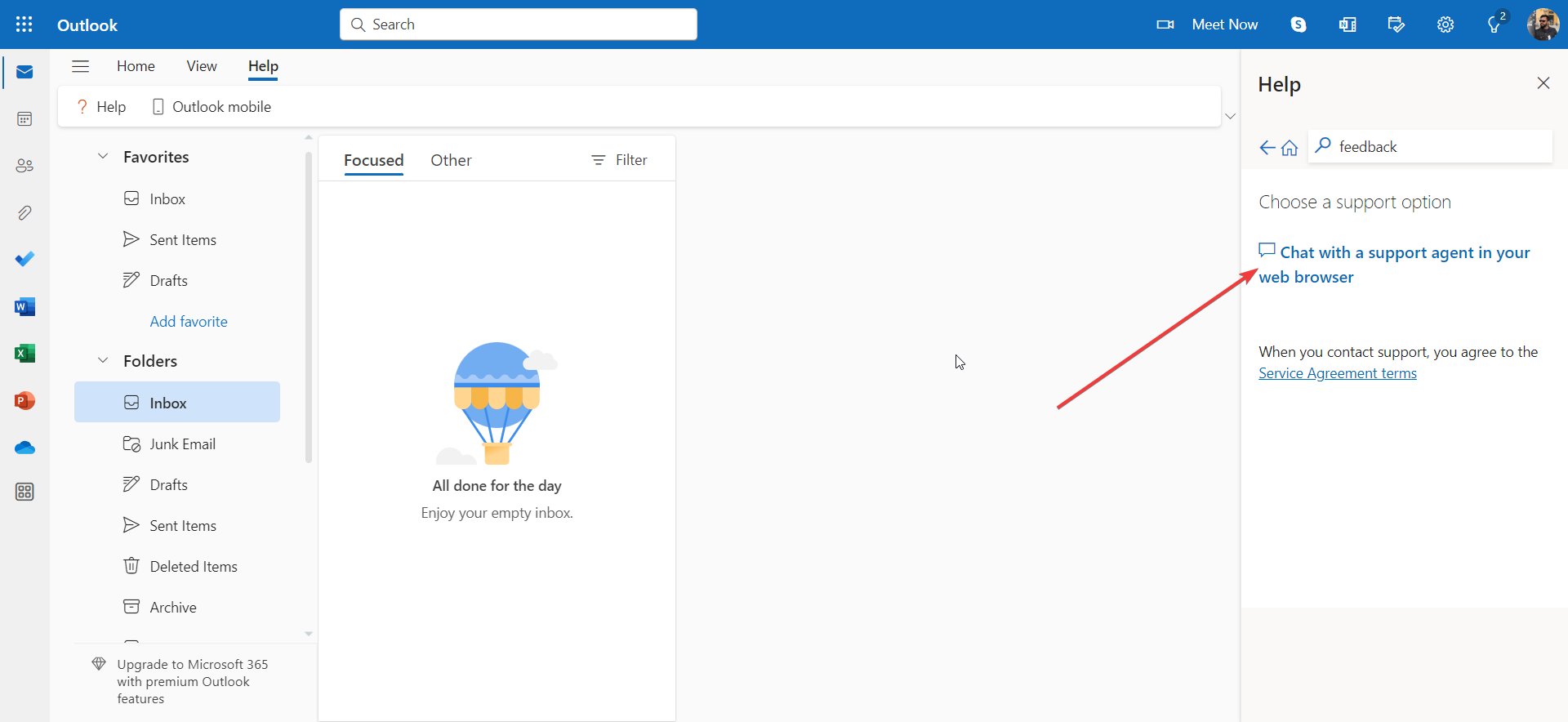

- Click on Chat with a support agent in your web browser option.

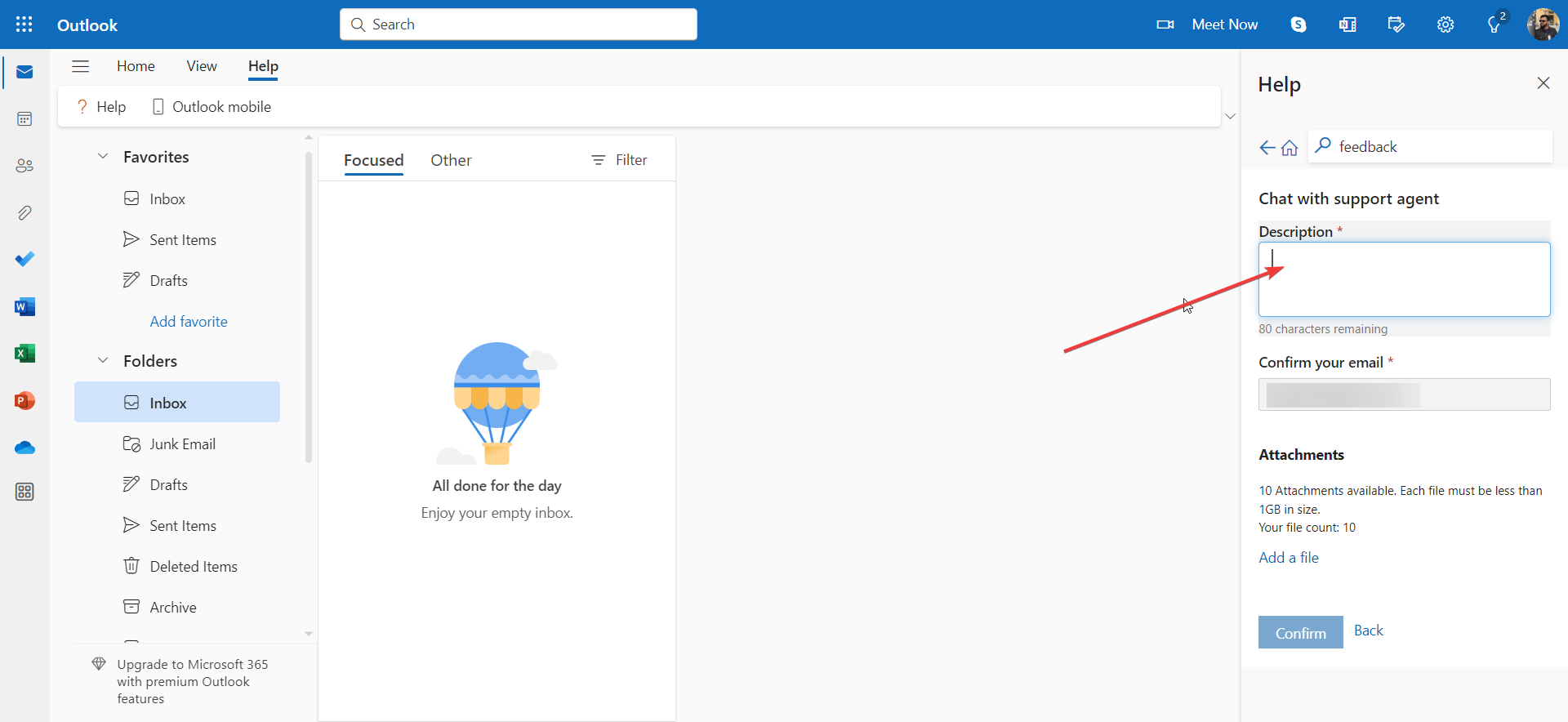

- Type your problem in the Description text field. Explain your issues clearly.

- Confirm your email address with which you are facing issues of unwanted messages with no sender.

- You can also attach any images that you have to give more credibility to your issue and make the support staff understand your situation better.

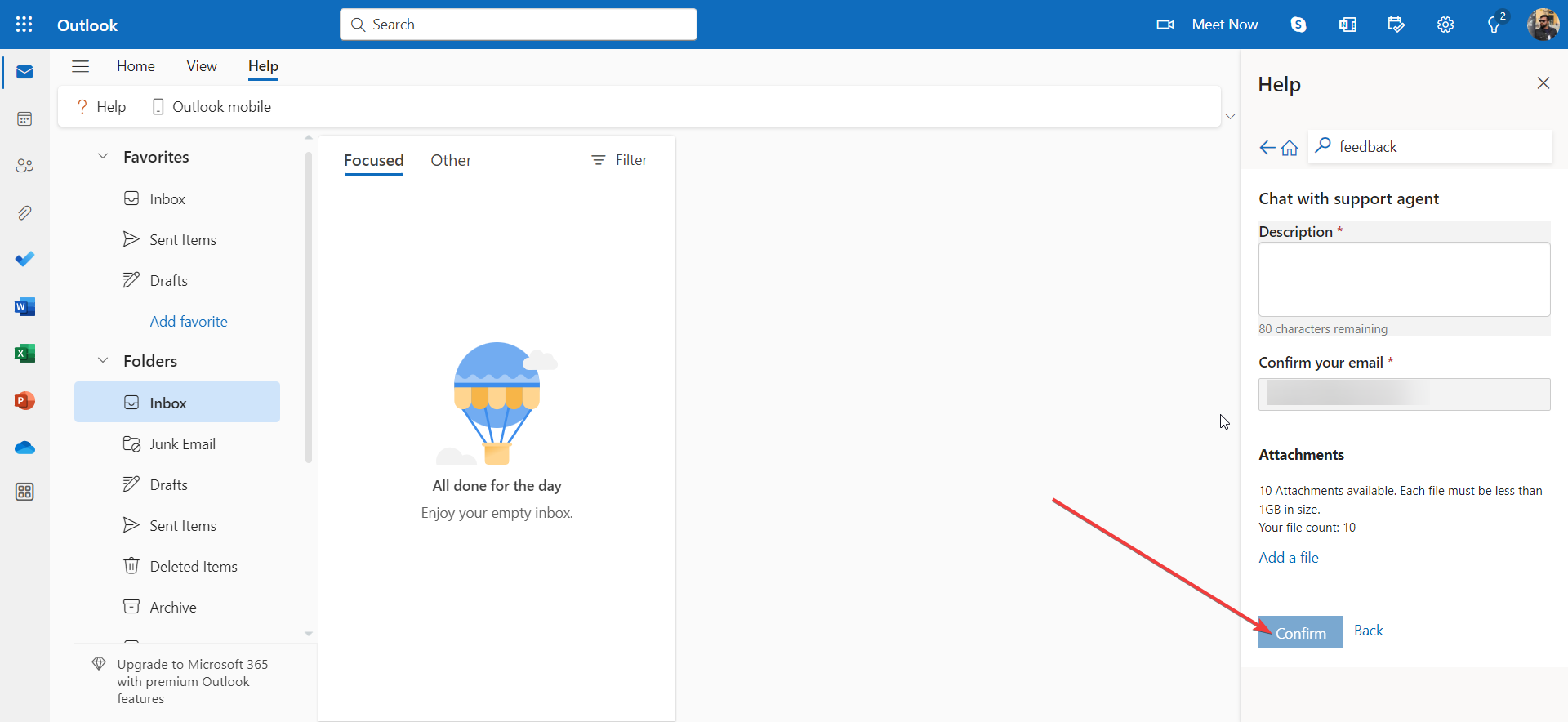

- Hit the Confirm button to send your query and start chatting with a support agent.

- The support team will come back with a response to your query. You need to then follow the advice that they give you to block no sender email on Outlook.

Several of our readers have reported that they were able to block unwanted messages with no sender addresses by contacting Outlook support. You can also do that and protect yourself from such future messages.

That is it from us in this guide and we hope that you now managed to block the no sender emails in Outlook successfully.

Many of our readers also reported that they get a The message cannot be sent right now error message in Outlook but if you have the same issue, the highlighted guide will help you fix it.

Another common problem that Outlook users come across is that the sender’s name does not show in the inbox. This can be fixed by applying the solutions mentioned in our dedicated guide.

Moreover, you can also apply the solutions that will help you resolve the Outlook not blocking junk mail problem in your PC.

Feel free to let us know in the comments below, which one of the above methods you followed to resolve your query on how to block no sender emails in Outlook.