6 Best Enterprise Cybersecurity Software [Antivirus & Backup]

Cybersecurity software include backup and data security tools

- Corporate environments are among the most vulnerable when it comes to cyber-attacks and data loss.

- That's why we decided to create a list of the best cybersecurity and backup software.

- The entries on our list are well-equipped for the corporate environment and are very effective.

Enterprise environments are places where data is created, modified, and circulated continuously, which makes securing it both in terms of cybersecurity and backups a mandatory process.

You as a user or as a company no longer have to deal with two separate programs, since there are plenty of enterprise cybersecurity software solutions that deal with both protection and data backup.

How can cybersecurity software help my business?

Any business is dealing with sensitive data. Server failures or ransomware attacks can turn everything into dust with huge losses.

That is why not only do you need to protect your network against intrusions but also back up your data at all times. That’s why you need to invest in enterprise cybersecurity software.

We’ve decided that a list of the best software of this kind would be appropriate, so we created one highlighting the best entries currently on the market.

These products were chosen based on their toolkit, reliability, price, and other important criteria.

Which is the best enterprise cybersecurity software?

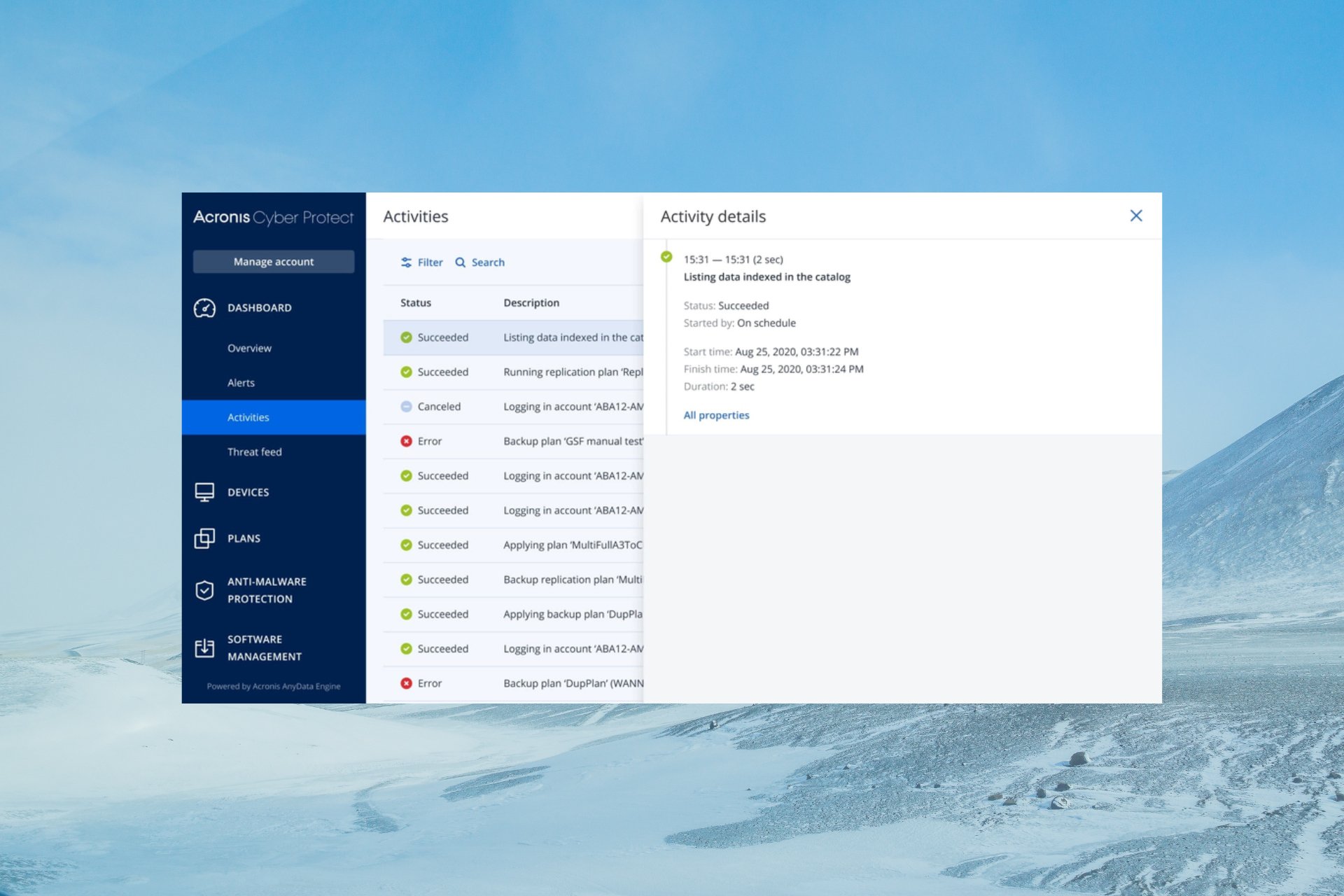

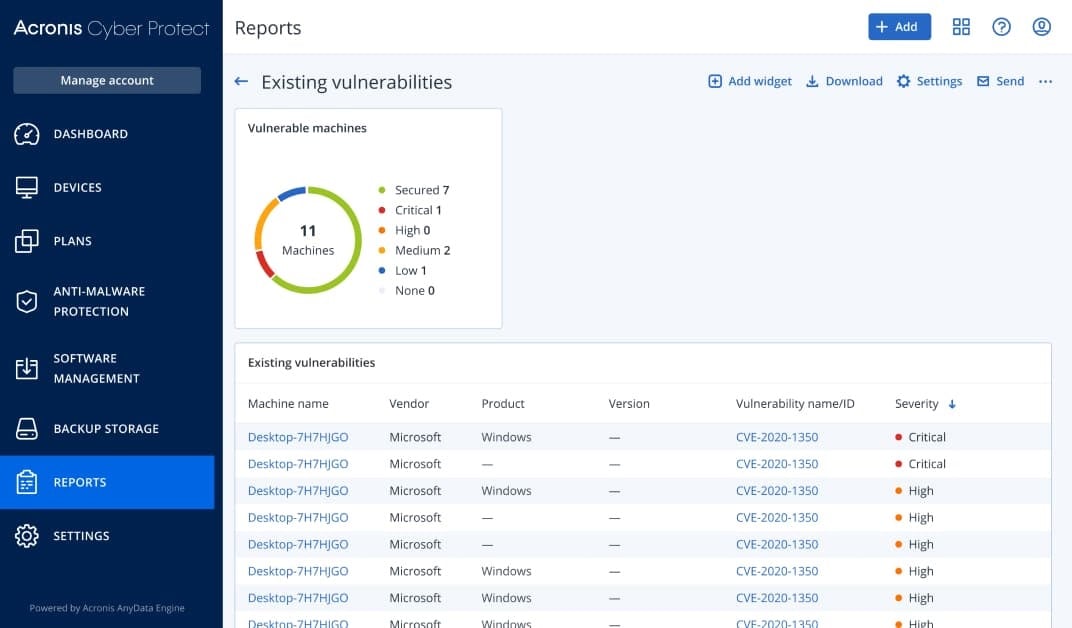

Acronis Cyber Protect – Best backup and security protection

Acronis Cyber Protect is a fully functioning solid cyber protection solution that includes full antivirus and antimalware protection with AI-based ransomware protection, integrated patch management, and backup, a real-time threat feed, vulnerability assessment, remote desktop capabilities, and many more including monitoring and additional management capabilities.

Whether you are concerned about preventing cyberattacks, ensuring business continuity, or system integrity, Acronis’ real-time cyber protection, and data monitoring features will ensure threats are prevented, detected, and managed so you can keep your business moving forward.

All in all, it doesn’t matter whether you fear cyber threats, or simply hardware or software failure, Acronis Cyber Protect has you covered.

Here are just some of the best features of Acronis Cyber Protect:

- Flexible reporting and monitoring

- Full antivirus and antimalware protection with AI-based ransomware protection

- Blockchain-based notarization

- Real-time threat feed and notifications from Acronis’ Global Cyber Protection Operations Center

- Integrated patch management and backup

- Intuitive web-based interface

- Multi-tenant administration

- Remote desktop

- Thorough systems support

- Acronis Universal Restore

- Multi-level encryption

- Acronis Instant Restore

Acronis Cyber Protect

Acronis Cyber Protect will ensure that all of your company data is safe from both internal and external threats!Vembu BDR Suite – Complete backup & recovery solution

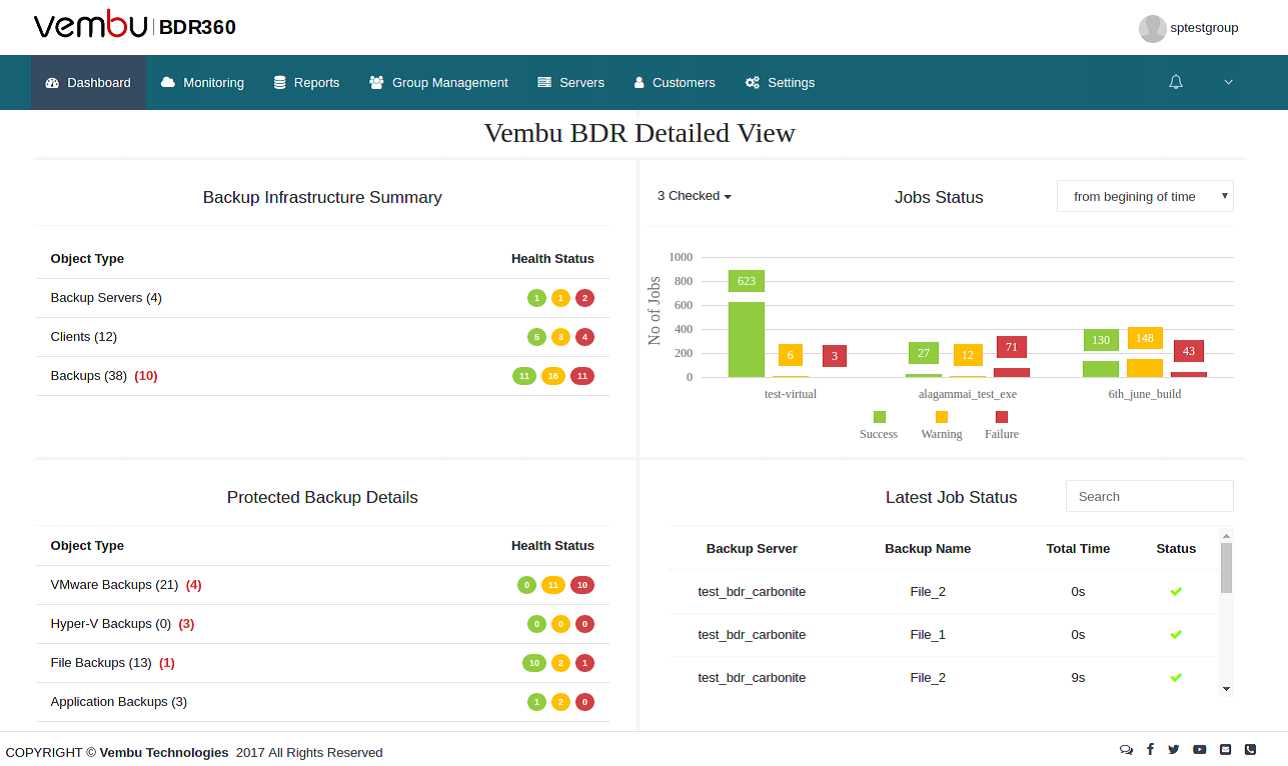

Backup is the most important form of data protection, and Vembu BDR Suite covers every single aspect of server and endpoint backup possible.

We’re talking about virtual, physical, cloud workloads, and even SaaS applications, this suite all the solutions you need.

Whether there are VMware, Hyper-V, Windows, Linux, Mac, AWS, Microsoft 365, and Google Workspace, Vembu BDR Suite can back it up.

How we test, review and rate?

We have worked for the past 6 months on building a new review system on how we produce content. Using it, we have subsequently redone most of our articles to provide actual hands-on expertise on the guides we made.

For more details you can read how we test, review, and rate at WindowsReport.

And if something happens to the original data, this solution promises an RTO and RPO in less than 15 mins.

Everything is secure because the data is encrypted with an industry-grade AES 265-bit algorithm during transfer and on-site.

Once you’ve created a backup, Vembu BDR Suite will make continuous incremental backups using Vembu Changed Block Tracking driver.

That means it will only back up the data that were changed or added, not the whole system.

Lastly, with Vembu, the plans and configurations may be tailored to the size of your business and needs.

You don’t have to take our word for it. You may request a demo or even get a 30-day trial of the software to make sure it covers your requirements.

Take a look at its key features below:

- RTO and RPO in less than 15 mins

- Supports VMware, Hyper-V, Windows, Linux, Mac, AWS, Microsoft 365, and Google Workspace backups

- AES 265-bit encryption during flight and on-site

- Priced per CPU-Socket or per VM or per server basis

- Centralized monitoring & management with multi-tenancy

Vembu BDR Suite

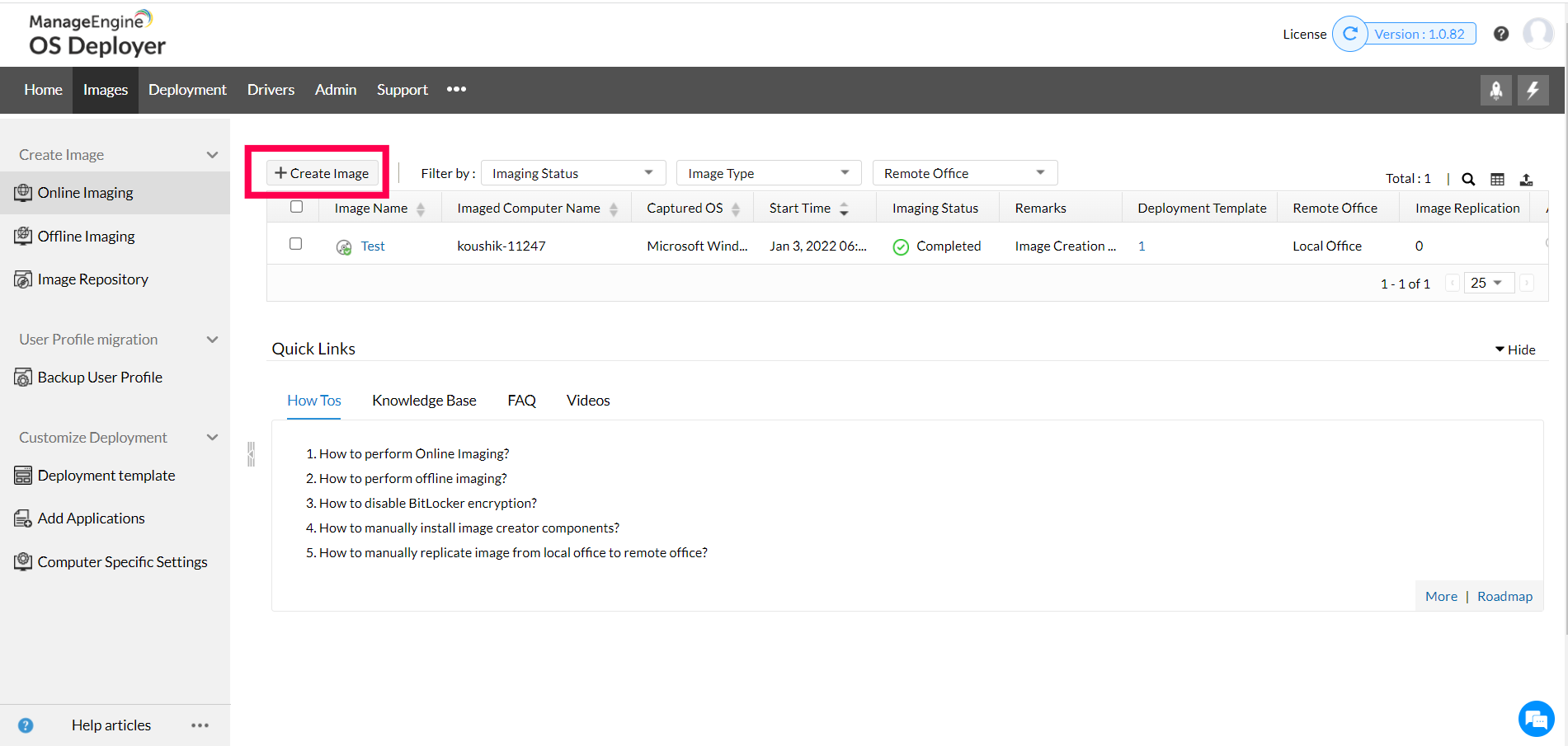

Cover all your enterprise needs with a complete solution to back up all your servers and endpoints!ManageEngine OS Deployer – Effortless Disk Imaging and Backup

One of the important features of the ManageEngine OS Deployer is imaging, which allows you to create an image of an entire disk or partitions.

These backups can be then deployed as standardized system configurations across multiple computers.

This image can be of great use when a machine is infected or damaged, as it can restore the data and apps in no time without any data loss.

It enables you to either the entire disk or only specific partitions, depending on your requirements, and you can store it locally or remotely.

You can add or remove drivers, apps, and configurations, thereby creating a custom image tailored to your specific needs.

The software supports image compression, which reduces the size of the image and speeds up the deployment process.

Here are just some of the best features of ManageEngine OS Deployer:

- Seamlessly migrates user profiles

- Acquires image of a machine when it’s live

- Comes with an image verification feature

- Creates a bootable USB or CD/DVD with an encrypted image

- Provides centralized management

ManageEngine OS Deployer

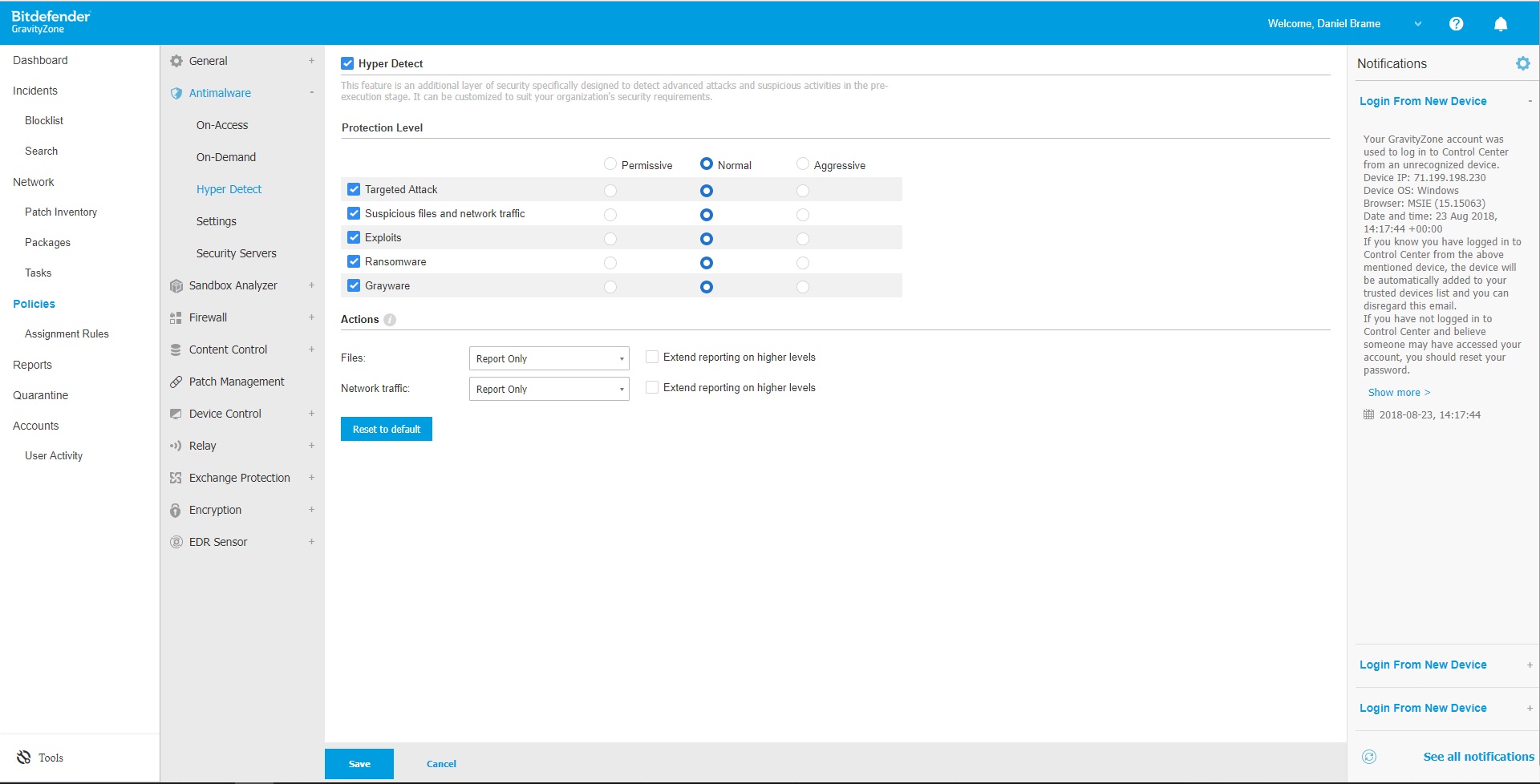

Create an image of the entire OS, including data & applications, and deploy it on any machine.Bitdefender GravityZone Business Security – Complete security

This next entry is a software solution bought by a leader in terms of antimalware solutions, and it is a complete software Suite for businesses to keep their data safe.

It ensures complete protection against all types of malware, including ransomware, phishing, zero-day attack, viruses, spyware, and more.

The solution uses machine learning techniques, behavioral analysis, and continuous monitoring of running processes to ensure that no stone is left unturned when it comes to security threats.

Bitdefender GravityZone Business Security comes with all sorts of tools that make it an excellent entry in our article, including device control, full disk encryption, and a lot more.

Here are some of its best features:

- Completely web-based security

- Layered protection for endpoints

- Network Attack defense features

- AI and machine-learning driven systems

- Access to the largest security intelligence cloud

- Protection integrated with endpoint risk management

Bitdefender GravityZone Business Security

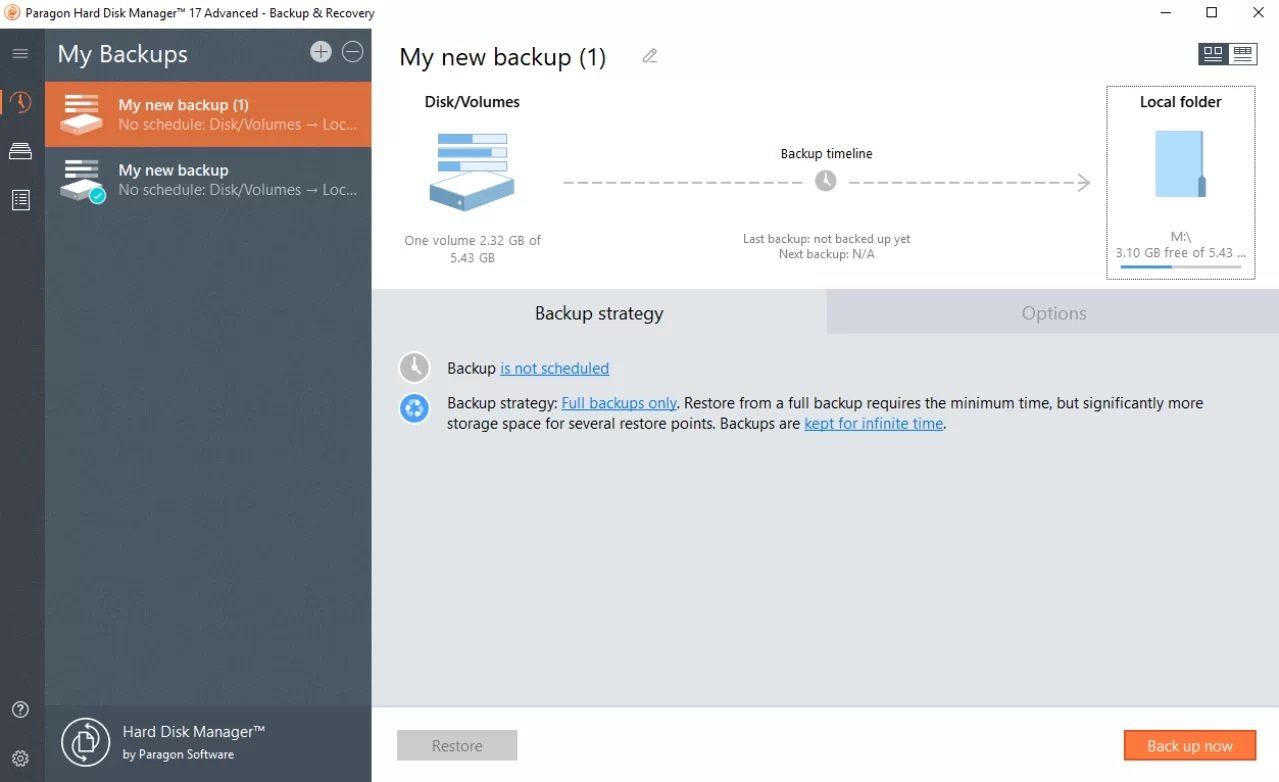

Keep your company data secured with the help of this incredibly useful tool.Paragon Backup & Recovery – Great for saving your data

Paragon Backup & Recovery has always been a staple of backup programs, having been one of the best on the market for a few years now.

Well, Paragon Back & Recovery can also be indirectly used to fight malware infections as well, although it doesn’t achieve this through conventional antivirus-like means.

It does this by using Paragon to simply reboot to a previous day, effectively kicking the malware from their system without any issues, and without losing any money, data, or time.

Basically, even if malware somehow gets on your system, you can simply reload a clean backup, since these are automatically created to contain the latest data relevant to your system.

Let’s review a few of its most important features:

- Very easy to implement and use

- Complete backup and recovery features

- Scheduled backup

- Incremental backup

- Hard drive management

Paragon Backup & Recovery

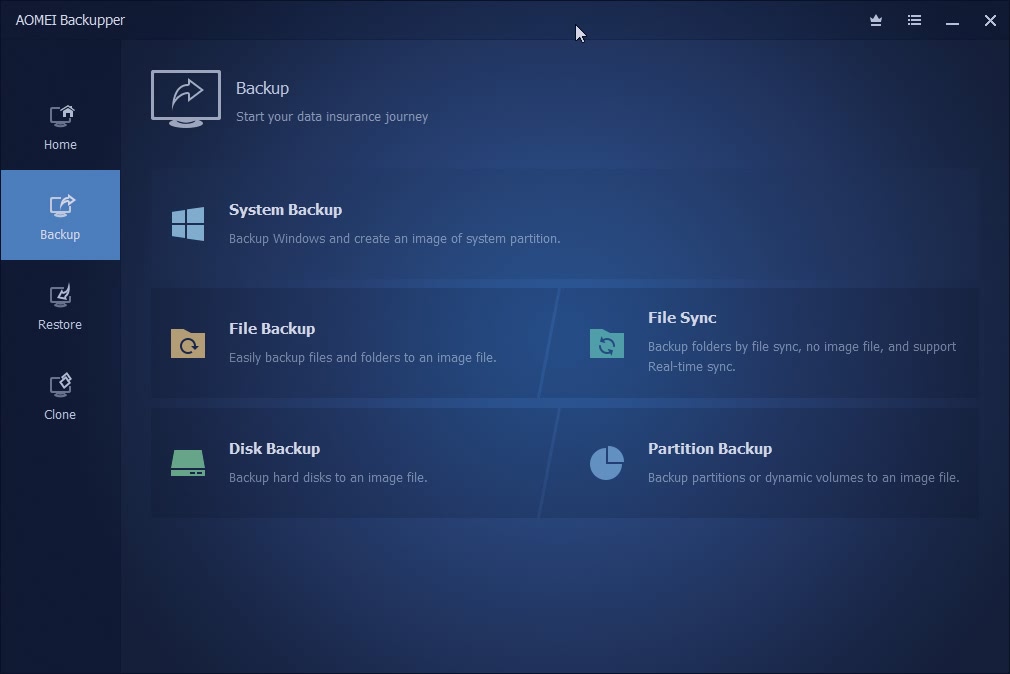

Perfect backups mean that you can always reboot from virus infection. Let Paragon create those backups today!AOMEI Backupper Workstation – Very easy to use

This last entry on our list is by no means inferior to the others, as AOMEi is too another big name in the backup software business.

Similar to Paragon, AOMEI has an extensive record of creating perfect copies of whatever data cluster you’re targeting, and it operates in the same way when it comes to dealing with malware.

This makes it an excellent tool when it comes to system crashes, hard drive failures, power outages, accidentally deleted overwritten files, viruses, and more.

Lastly, the price tag isn’t all that high either, and it even comes with a free trial for you to test out its full effectiveness, allowing you to make a more informed decision before commuting to buy it.

Here are some of its key features:

- Perfect for data security

- File syncing capabilities

- File, partition, or disk backup

- Very easy to use

- Extensive recovery features

AOMEI Backupper Workstation

AOMEI has been keeping your data safe for years now. continue keeping it safe with AOMEI Backupper Workstation!This concludes our list of the best software for enterprise cybersecurity and data backup.

We hope we included tools that would have made it to your own top list as well, and that we helped you decide which is the better tool to try out.

All in all, if you run a company, or are responsible for running one, then you will definitely need such tools to ensure data privacy and security.

In that respect, you may also check our list of the best network antiviruses for your business.

Is there any other tool that you consider that should have made it on our list? If so, let us know by leaving your suggestions in the comments section below.