What is Wins.exe & Should you Remove it?

Run SFC scan to remove the wins.exe if it's malicious

- Wins.exe is a software component that stands for Windows Internet Name Service by Microsoft.

- Removing wins.exe is not recommended unless it is causing issues with your PC.

- You can scan for malware and follow the security instructions to remove detected threats.

Several users in the Microsoft Community forum have recently requested to know what the wins.exe is after getting an error message with the executable file while trying to launch an application or boot up their Windows PC.

In case you have been wondering what the wins.exe is and whether to remove the executable file from your computer, we will explore it and how to remove it.

What is wins.exe?

The WINS software component, represented by the wins.exe file, was developed by Microsoft as an abbreviation for Windows Internet Name Service.

Initially, it functioned as a background process in early iterations of Microsoft Windows. The following are points to note about wins.exe:

- Initially served as an IP address – Its primary purpose was to enable the resolution of IP addresses for domain names. Although wins.exe served as the precursor to the current DNS system, it is no longer actively supported.

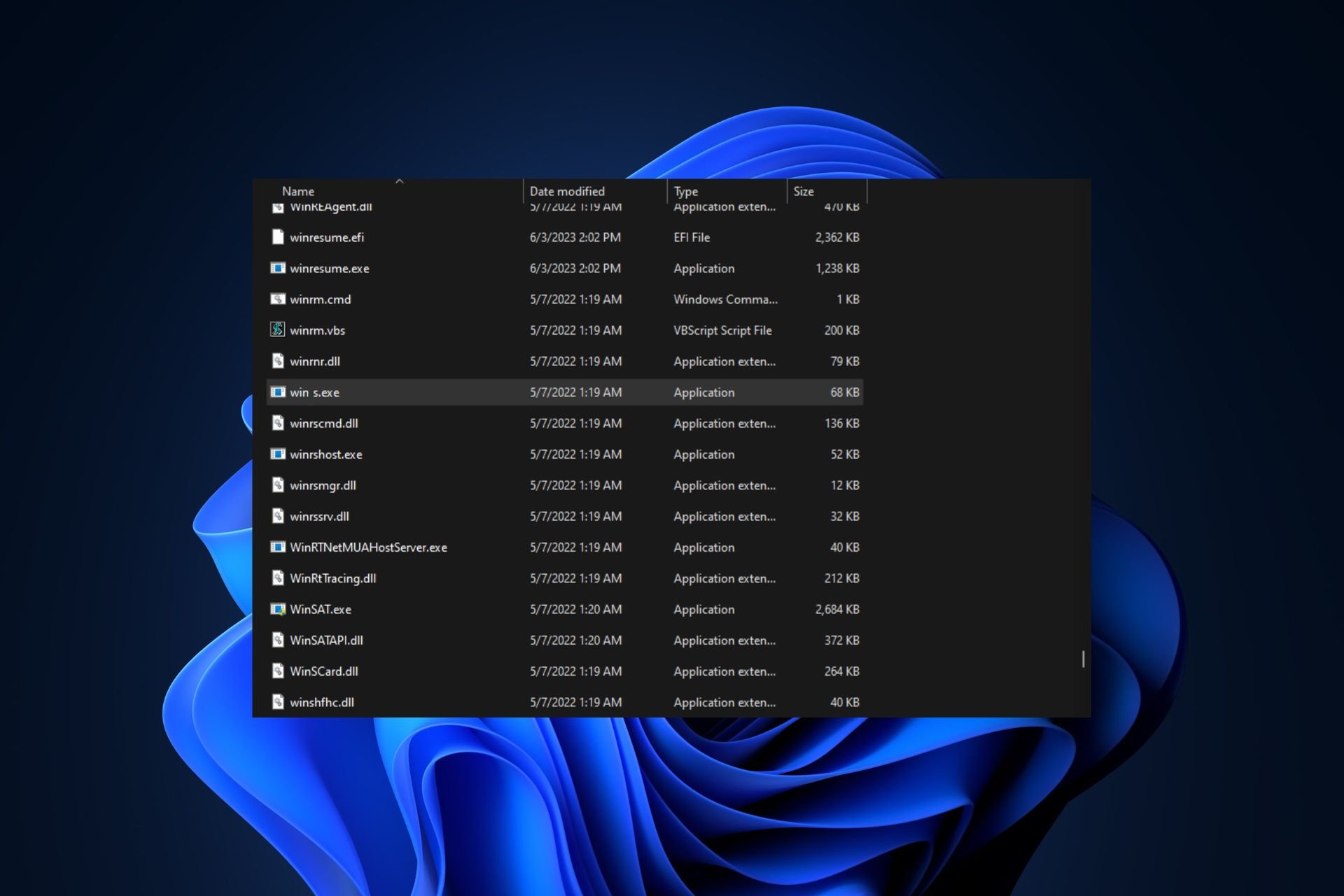

- Wins.exe is an unknown file in Windows – Due to its discontinued support and potential to cause issues, wins.exe is an unfamiliar file found within the Windows folder. Specifically, it can be located in a subdirectory of C:\Windows\System32.

- Wins.exe has no file description – This application lacks a file description and does not appear visibly to users. It operates by either sending or receiving data on open ports within a Local Area Network (LAN) or the Internet.

Furthermore, wins.exe possesses the capability to monitor applications. As a result, 73% of experts classify wins.exe as a potential threat, carrying a high likelihood of causing harm to a computer.

How we test, review and rate?

We have worked for the past 6 months on building a new review system on how we produce content. Using it, we have subsequently redone most of our articles to provide actual hands-on expertise on the guides we made.

For more details you can read how we test, review, and rate at WindowsReport.

Is it safe to remove wins.exe?

It is generally not recommended to remove or delete the wins.exe file. As aforementioned, in earlier versions of Windows, wins.exe is the Windows Internet Name Service (WINS), which provided IP address resolution for domain names.

However, with the evolution of technology, WINS has been largely replaced by the Domain Name System (DNS).

While wins.exe is no longer actively supported by Microsoft and may not be necessary for modern systems, it is still an integral part of the operating system. Removing wins.exe could potentially disrupt network services or cause compatibility issues with certain applications that rely on it.

If you suspect that the wins.exe file is causing problems or exhibiting suspicious behavior, we recommend you run a reputable antivirus or antimalware scan to ensure your system’s security.

How can I remove wins.exe?

Before anything else, try this step:

- Run a malware scanner – Before taking any action, run a thorough scan with a reputable antivirus or antimalware software to ensure that wins.exe is not a malicious file masquerading as a legitimate component.

If the scan detects any issues related to wins.exe, follow the steps below to remove them.

1. Disable the wins.exe service

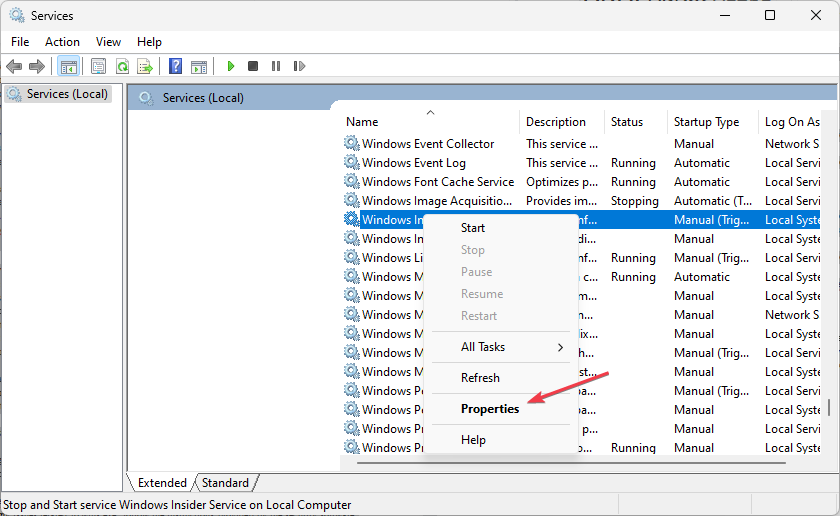

- Press the Windows + R keys to open the Run dialog box. Type services.msc in the dialog box and press Enter to open the Services window.

- Scroll down to locate the Windows Internet Name Service (WINS) entry. Right-click on it and select Properties from the context menu.

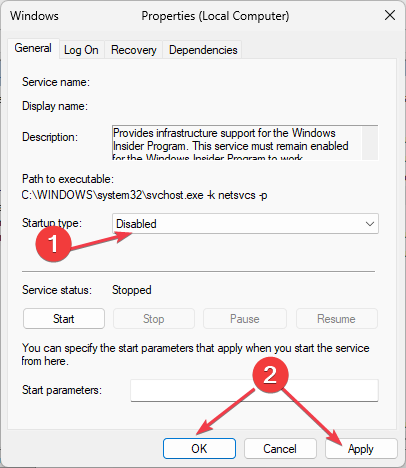

- In the Properties window, change the Startup type to Disabled.

- Click on the Apply button and then OK to save the changes.

Disabling the wins.exe service will prevent it from running and potentially resolve any associated problems. In case the dialog box does not have text, check here to fix it.

2. Run the SFC Scan

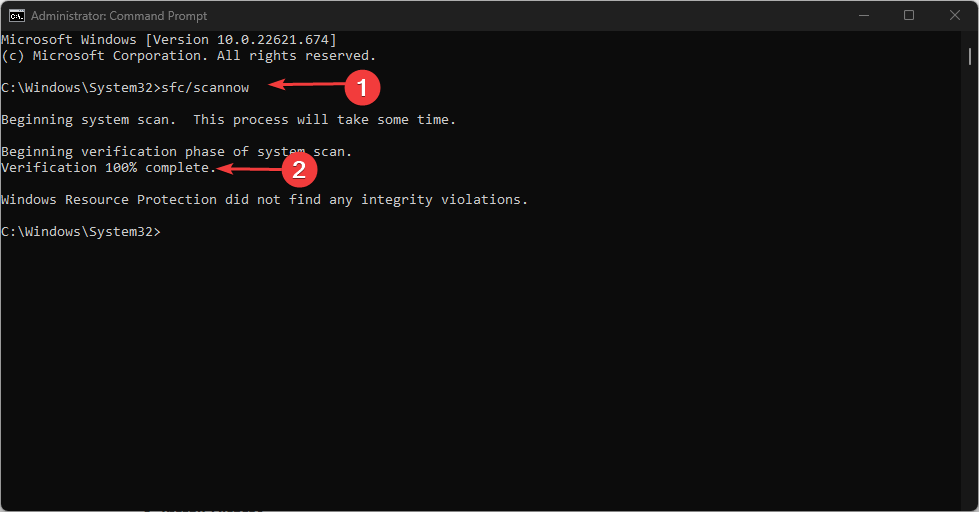

- Press the Windows key and type cmd in the Search box, and click Run as administrator.

- In the CMD window, type the following command in the text field and press Enter:

sfc /scannow - The scanning process may take up to 15 minutes, so wait till the verification reaches 100%.

- Restart your PC.

Running the System File Checker tool should repair the wins.exe file. However, this process may or may not work for this issue.

In order to ensure the file integrity and scan your Windows OS, we suggest you use multi-layered antivirus software to detect any kind of malware threats.

However, if after attempting the above methods, wins.exe remains, it is best to seek help from Microsoft support.

Wins.exe is not the only exe problem that users have reported. There have been several cases of other exe issues such as winword.exe application error, consent.exe, and so forth.

If you have any questions or know other workable methods to remove wins.exe, please let us know by using the comments section below.